Non-life Insurance 'Big 3' Dominate 70% of Non-face-to-face Channels

Preference for Large Firms Rises with Increased Comparison Enrollment

High Loss Ratios Push Small and Medium Firms Out of Price Competition

[Asia Economy Reporter Oh Hyung-gil] The direct auto insurance market, which has been steadily growing, is being reorganized around the 'Big 3' non-life insurance companies in response to the COVID-19 pandemic that triggered the rise of 'non-face-to-face' transactions.

Many non-life insurers have competed for market share in the direct market, but it is expected that the gap will widen further as large companies outcompete others in terms of price competitiveness.

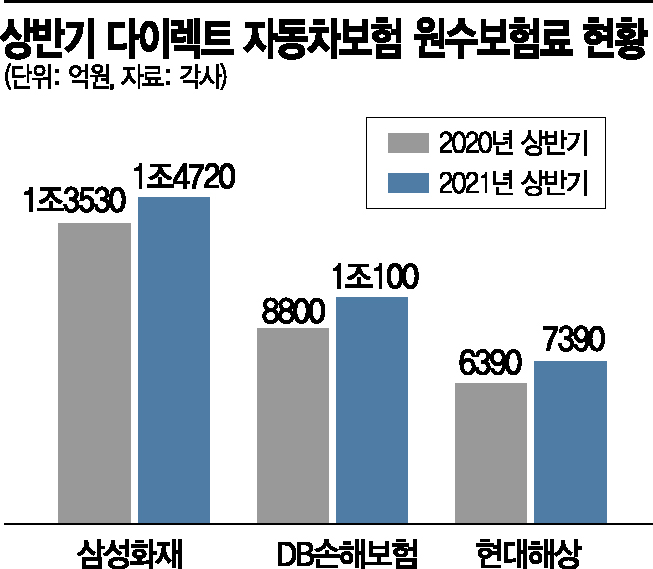

According to the insurance industry on the 17th, the combined market share of Samsung Fire & Marine Insurance, DB Insurance, and Hyundai Marine & Fire Insurance in the direct auto insurance market reached 69.8% in the first half of this year, up 0.5 percentage points from the end of last year. The 'Big 3' market share has jumped about 10 percentage points in four years since surpassing 60% in 2017.

Samsung Fire & Marine Insurance's direct auto insurance channel sales (gross written premiums) amounted to 1.472 trillion KRW in the first half, an 8.7% increase compared to the same period last year. This is nearly 49.8% of the total auto insurance gross written premiums of 2.953 trillion KRW. Additionally, the renewal rate in the direct channel increased from 93.2% to 93.6%.

DB Insurance's direct auto insurance sales exceeded 1 trillion KRW for the first time. The gross written premiums from telephone (TM) and online (CM) channels in the first half reached 1.01 trillion KRW, growing 14.7% from 880 billion KRW last year. The share of direct channel sales expanded by 3.0 percentage points from 44.7% to 47.4%.

Hyundai Marine & Fire Insurance also achieved a sharp 15.7% increase in direct gross written premiums compared to the same period last year, reaching 739 billion KRW. Although this accounts for only 35% of the total gross written premiums of 2.1124 trillion KRW, its share is steadily increasing.

The non-life insurance industry analyzes that the COVID-19 pandemic has served as a catalyst for reorganizing the direct auto insurance market around large companies. As more drivers subscribe to insurance non-face-to-face instead of through agents, they naturally compare and choose products from various insurers.

In particular, most consumers decide whether to subscribe to direct auto insurance based on price. Accordingly, large companies are believed to have secured price competitiveness by maintaining low prices based on stable loss ratios.

On the other hand, small and medium-sized non-life insurers have been unable to withstand rising loss ratios and have consecutively raised auto insurance premiums. This year, MG Insurance raised premiums in March, followed by Lotte Insurance and Carrot Insurance in April, and AXA Insurance in May. This is why the 'economies of scale' effect centered on large companies in the auto insurance market is expected to accelerate further.

They are also facing management emergencies in loss ratios. As of July, the cumulative loss ratios for MG Insurance (134.5%) and Lotte Insurance (85.5%) remain in deficit territory. AXA Insurance raised premiums for commercial vehicles such as rental cars, where the loss ratio exceeded 200% last year.

An insurance industry official said, "The more policies large companies underwrite, the more high-quality policyholders they attract, making loss ratio management easier," adding, "As long as large companies maintain low premiums, relatively expensive small and medium-sized insurers will inevitably fail to be chosen by consumers."

On the 2nd, during the summer vacation season, vehicles are moving in a line on the southbound lanes of the Gyeongbu Expressway near Jamwon IC in Seocho-gu, Seoul. / Photo by Mun Ho-nam munonam@

On the 2nd, during the summer vacation season, vehicles are moving in a line on the southbound lanes of the Gyeongbu Expressway near Jamwon IC in Seocho-gu, Seoul. / Photo by Mun Ho-nam munonam@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)