Server DRAM Price Increase Expected to Slow from 4Q This Year to 1Q Next Year

Server Shipment Pattern Changes to 'High in Early, Low in Late' Since COVID-19

Server Companies Have Sufficient DRAM Inventory, Making Price Hikes Difficult for Now

[Asia Economy Reporter Suyeon Woo] Amid recent controversies over peak prices centered on PC DRAM, dark clouds are also looming over the server DRAM market, where steady demand was expected. This is because server companies aggressively increased their inventories in the first half of this year, strengthening the analysis that server DRAM prices will not rise from the fourth quarter of this year through the first quarter of next year.

According to TrendForce on the 17th, server DRAM prices this year are expected to rise 5-10% in the third quarter compared to the previous quarter, but further increases in the fourth quarter are unlikely. Experts pointed out that the industry's server shipment pattern has changed from a "low-high" to a "high-low" trend after the COVID-19 pandemic, and that server companies' DRAM inventory levels are sufficient at over six weeks.

According to TrendForce, server shipments this year are projected to reach about 13.602 million units, a 5.4% increase from the previous year. Although the annual trend remains steady, shipments are expected to peak in the second and third quarters with 2.92 million units in Q1, 3.44 million units in Q2, 3.74 million units in Q3, and 3.49 million units in Q4, with growth slowing toward the fourth quarter.

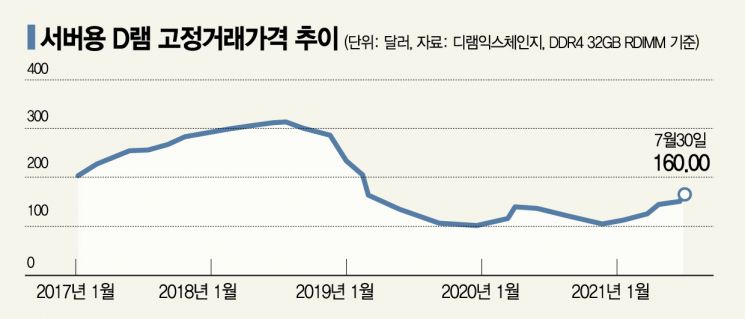

The price of server DRAM, a key component, is also linked to server shipment volumes. The fixed transaction price for server DRAM (DDR4 32GB RDIMM basis) surged 20-25% in Q2 compared to the previous quarter. The fixed price in July also rose 6% month-over-month to $160. As server shipments concentrated in Q2 and Q3, server companies aggressively built up DRAM inventories, leading to price increases.

Furthermore, experts warn that the typical formula of "increased server shipments = rising server DRAM prices" may break down after the fourth quarter of this year. Unlike the PC and mobile DRAM markets, where demand is predictable based on new product launches or product replacement cycles, the server DRAM market is relatively difficult to forecast demand for.

In the first half of this year, North American hyperscalers operating large-scale data centers such as Google, Facebook, and Amazon significantly increased their server DRAM inventories, causing prices to rise and supply shortages to appear. However, there is also a diagnosis that this is an "illusion of supply shortage" caused by server companies' strategies to secure price negotiation leverage with DRAM suppliers.

If server companies create a supply shortage situation for server DRAM through double or triple contracts, DRAM suppliers have no choice but to competitively increase capital investments to secure market share. When the market shifts to a supply surplus while server companies have sufficiently stocked inventories, server companies ultimately gain negotiation leverage, and suppliers follow. Moreover, North American hyperscalers have stable financial structures and sufficient funding, allowing them to freely employ such strategies at any time.

Kim Kyung-min, a researcher at Hana Financial Investment, said, "Since the server DRAM market is not in a supply shortage state, (for prices to rise) it will take a few months until the demand-side inventories are depleted. However, because supplier inventories are tight at 1-2 weeks, a soft landing is more likely than a sharp price drop."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)