[Asia Economy Reporter Jeong Hyunjin] Conflicting views are pouring in regarding the semiconductor market outlook for the second half of this year and next year. While some predict that prices of the representative memory semiconductor DRAM will peak and then decline, the industry counters that such concerns are excessive and that the demand for DRAM will continue to grow. The stock prices of major memory semiconductor companies Samsung Electronics, SK Hynix, and U.S.-based Micron have sharply fallen over the past week amid these mixed forecasts.

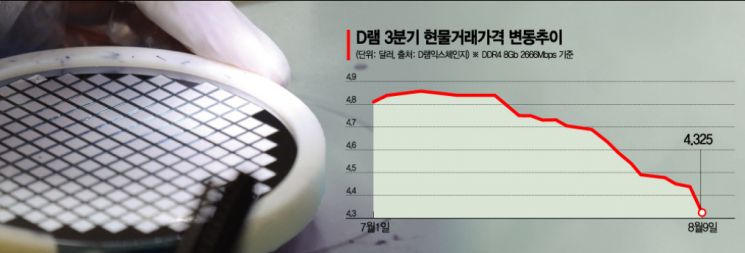

The decline in stock prices this week began with a report released on the 10th by Taiwanese market research firm TrendForce, which forecasted a drop in DRAM prices. TrendForce predicted that the fixed transaction price of PC DRAM would fall by up to 5% starting from the fourth quarter of this year. While PC DRAM, which showed a price increase of over 20% in the first half of this year, especially in the second quarter, was expected to maintain its price rise in the third quarter, it was anticipated to turn downward in the fourth quarter.

TrendForce based its forecast on the recent decline in spot prices of PC DRAM. In the third quarter of this year, the spot price of PC DRAM (DDR4 8Gb 2666Mbps) dropped by 10% within a month. Particularly, as COVID-19 related restrictions have been gradually lifted in Europe and the U.S., daily life has begun to return to normal, leading to a decrease in overall demand for laptops and consequently a reduction in DRAM demand.

Following TrendForce, global investment bank Morgan Stanley also released a report titled "The Winter of Semiconductors is Coming," stating that "the risks outweigh the rewards as we enter the late stage of the semiconductor cycle," and diagnosing that "although DRAM prices are still rising, the rate of increase has peaked as supply catches up with demand." The report added, "Earnings growth forecasts are expected to be reversed," noting that "cycle indicators have shifted from mid to late stage for the first time since 2019, and historically, it has been difficult to generate profits during such periods."

As reports predicting a decline in DRAM prices continued to emerge, the stock prices of Micron, Samsung Electronics, and SK Hynix fell sharply. Micron's stock price dropped 13.25% over the last five trading days on the New York Stock Exchange. Samsung Electronics fell nearly 9%, hitting its lowest point of the year, and SK Hynix's stock price also dropped more than 10%, breaking below the 100,000 KRW mark during trading.

However, there are also market voices arguing that these forecasts are excessive. The reason is that with the diversification of DRAM applications compared to the past, it is difficult to judge the overall DRAM market conditions based solely on PC DRAM prices. According to market research firm Omdia, as of the first quarter of this year, DRAM applications are weighted as follows: mobile at 38%, server at 30%, PC at 19%, and consumer at 5%.

In response, another global investment bank, Goldman Sachs, pointed out in a report that "even considering the price decline of PC DRAM, it can be offset by server DRAM," noting that "DRAM demand from PCs accounts for 15%, while demand from servers accounts for 30%." Goldman Sachs added, "Although PC DRAM prices may fall, the positive impact from servers will be greater."

Major semiconductor companies such as Samsung Electronics and SK Hynix also maintain the outlook that DRAM demand will remain solid in the second half of the year. Han Jinman, Vice President and Head of Strategy Marketing at the Memory Business Division, said during the second-quarter earnings conference call last month, "The fundamentals of market demand for memory semiconductors will remain solid," and expected steady demand in the server market as well as in mobile and PC markets. SK Hynix also forecasted strong memory semiconductor demand and good performance in the second half of this year.

Lee Jaeyoon, a researcher at Yuanta Securities, said, "Since major memory manufacturers such as Samsung Electronics, SK Hynix, and Micron have less than one week of inventory and production bottlenecks are intensifying, the possibility of a sharp price drop or prolonged down cycle is low," and predicted, "After a momentum slowdown from the fourth quarter of this year to the second quarter of next year, a rebound will occur no later than the third quarter of next year."

Meanwhile, the Philadelphia Semiconductor Index, which tracks the stock prices of the top 30 semiconductor-related companies listed on the U.S. stock market by market capitalization, recorded 3335.04, down 2.61% over the last five trading days. Influenced by the stock price declines of companies like Micron, the index had been on a downward trend since the 9th but showed a slight rebound on the 13th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)