[Asia Economy Reporter Lee Seon-ae] Amid mixed directions in profit forecasts across domestic sectors, investment advice has emerged emphasizing the need to focus on common traits among companies with high target price revision ratios.

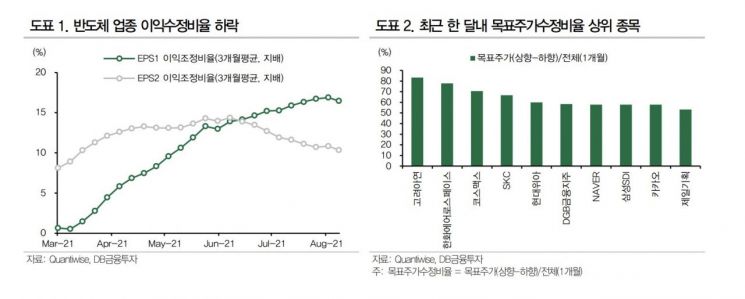

According to DB Financial Investment on the 14th, when limiting to KOSPI companies with more than 10 target price estimating institutions and compiling the companies with the highest target price revision ratios, the common traits identified were not concentrated in specific industries but rather included significant potential for profit growth through business expansion in the electric vehicle battery sector, benefits from economic recovery, and rebounds in subsidiary performance.

Unlike the U.S. stock market, where profit forecasts continue to rise across most sectors, the domestic stock market shows sectoral profit forecast directions changing rapidly in the short term depending on changes in earnings outlooks of representative companies in each sector due to various issues.

Last week, the KOSPI rebounded strongly, led by strength in the IT sector centered on semiconductors, but showed the opposite trend this week. Factors contributing to weakness in semiconductor-related stocks included declines in DRAM spot prices and concerns over weakening memory demand. Accordingly, a decline in the profit revision ratio for the semiconductor sector was also observed.

In the past month, the top stocks by target price revision ratio included Korea Zinc, Hanwha Aerospace, Cosmax, CJ CGV, Hyundai Wia, DGB Financial Group, Naver, Samsung SDI, Kakao, and Cheil Worldwide.

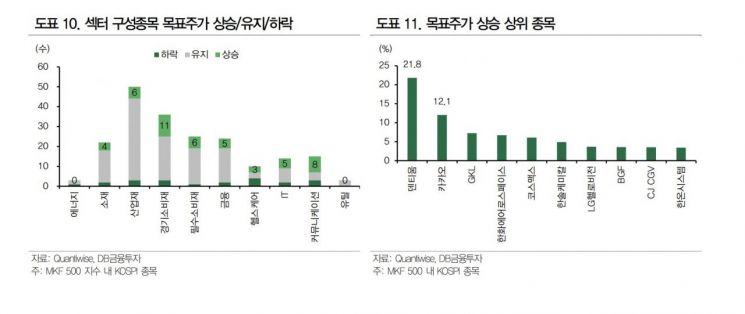

The top stocks with rising target prices were Dentium, Kakao, GKL, Hanwha Aerospace, Cosmax, Hansol Chemical, LG HelloVision, BGF, CJ CGV, and Hanon Systems.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)