Direxion WFH and BlackRock IWFH

Bright Outlook as Remote Work Becomes Routine

[Asia Economy Reporter Park Jihwan] As COVID-19 resurges with variants like Delta, exchange-traded funds (ETFs) investing in industries related to remote work are gaining attention. With global companies such as Google postponing their planned return-to-office schedules in the second half of the year and remote work becoming normalized, there is analysis suggesting that investments can be considered from a mid- to long-term perspective. ETFs related to cloud technology, which is essential for remote work, are also expected to continue steady growth.

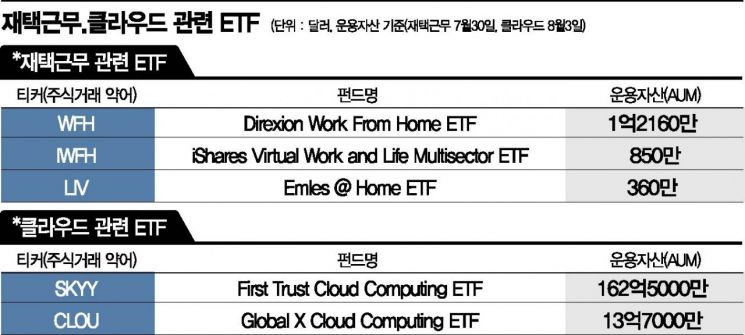

According to Hana Financial Investment on the 5th, the most popular remote work-themed ETF is Direxion's WFH, listed in the United States. Launched in June last year, this ETF primarily invests in U.S. companies (93.4%). Its current AUM (assets under management) is approximately $120 million (1.376 billion KRW). It is characterized by equally weighted holdings of the top 10 companies in fields related to remote work such as remote communication, cybersecurity, online document management, and cloud.

BlackRock's IWFH, listed in September last year, invests not only in the U.S. (62.0%) but also in companies from 41 countries including Hong Kong (11.7%) and China (5.4%). It includes network security company Cloudflare (2.9%) and streaming platform company Roku (2.8%). The total number of holdings is about 78, with individual company limits not exceeding 2%, resulting in generally balanced weights. However, because the individual company limits are not high, it is evaluated that the ETF can be significantly affected by price changes in small- and mid-cap stocks.

There are also products reflecting the trend of living centered around the home. Emles' LIV, listed in October last year, reflects not only remote work but also home training and telemedicine, the so-called homeconomy lifestyle patterns. Although software (25%) and internet companies (19%) have high proportions, leisure-related sectors such as Peloton Interactive (5.3%) for home training and Walt Disney (4.8%) stand out.

ETFs that include cloud industry stocks, essential technology for remote work, also attract attention. Representative cloud-related ETFs are First Trust's Cloud Computing (SKYY) and Mirae Asset Global Investments' Global X Cloud Computing (CLOU). As of the 4th this year, SKYY has a return of 12.4%, and CLOU has a return of 5.0%. The top holdings of SKYY include Alphabet, Google's parent company (3.87%), and Microsoft (3.85%). CLOU is also famous for having been directly involved in product development by Park Hyun-joo, Head of Global Investment Strategy (GISO) and Chairman of Mirae Asset Daewoo Hong Kong. Major holdings include cloud security company Zscaler (4.95%) and online shopping mall platform company Shopify (4.83%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)