Plans to Pursue Listing Through Public REITs in the Future

[Asia Economy Reporter Minwoo Lee] KTB Asset Management has purchased logistics centers located in Vietnam, owned by logistics service specialist Logisvalley, for 120 billion KRW. They also plan to pursue a public REITs (Real Estate Investment Trusts) listing in the future.

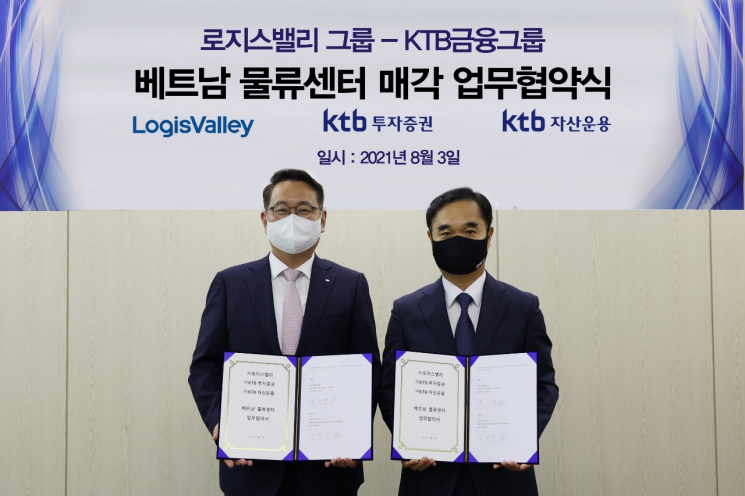

KTB Asset Management announced on the 4th that it signed a business agreement with Logisvalley on the 3rd at Logisvalley's headquarters in Seongnam, Gyeonggi Province regarding this matter.

Accordingly, KTB Asset Management will establish an overseas alternative investment fund to acquire a 70% stake in three logistics centers located in Ho Chi Minh, Hai Phong, and Bac Ninh, Vietnam, owned by Logisvalley, for approximately 120 billion KRW. The total gross floor area of these logistics centers amounts to 109,819 square meters (㎡). They are located in major cities in Vietnam where many large domestic companies have entered, and the industrial complexes are well-developed, making the business potential high. Additionally, since Logisvalley plans to lease and use these logistics centers and the lessee is a major shareholder, investment stability is also secured.

The fund will be established by the end of this year, and after asset stabilization, a public REITs listing will be pursued. Furthermore, KTB Asset Management plans to continuously acquire overseas logistics centers being developed by Logisvalley, expanding overseas investments starting with this transaction.

A KTB Asset Management official said, "The logistics industry is growing rapidly worldwide, and this growth trend is the same in Vietnam," adding, "We will achieve high investment performance through overseas quality asset investments and contribute to the entry of domestic companies into Vietnam by using the logistics centers as a forward base."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.