Samsung Electronics IM Division Q2 Operating Profit 3.2 Trillion Won

Expecting Performance Improvement in Second Half with New Foldable Phones

[Asia Economy Reporter Eunmo Koo] Samsung Electronics' Mobile (IM) Division posted an operating profit in the 32 trillion KRW range in the second quarter of this year. Although operating profit decreased by more than 1 trillion KRW compared to the previous quarter due to a decline in new product effects and production disruptions caused by COVID-19, it is evaluated as a solid performance. In the third quarter, performance improvement is expected with the launch of new products such as the next-generation foldable smartphone ‘Galaxy Z’ series.

Samsung Phones Hold Strong Performance in Q2 Off-Season... Operating Profit Maintains 30 Trillion KRW Level

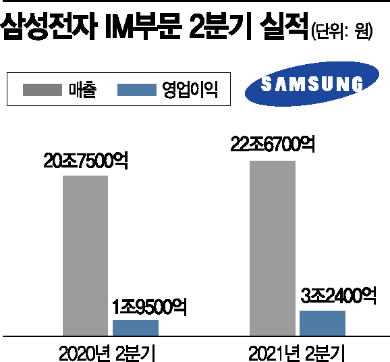

Samsung Electronics announced on the 29th of last month that its IM division recorded sales of 22.67 trillion KRW and operating profit of 3.24 trillion KRW in the second quarter of this year (consolidated basis). Compared to the second quarter of last year (sales of 20.75 trillion KRW, operating profit of 1.95 trillion KRW), these figures represent increases of 9.3% and 66.2%, respectively. However, compared to the previous quarter, sales and operating profit decreased by 22% and 26%, respectively.

During the conference call held after the earnings announcement, it was revealed that wireless product shipments in Q2 reached 60 million phones and 8 million tablets. The average selling price (ASP), including tablets, was $233 (approximately 270,000 KRW), and the smartphone ratio among phones was explained to be in the mid-90% range.

The mobile market in Q2 was characterized by a seasonal off-season and market contraction compared to Q1 due to the resurgence of COVID-19. Smartphone sales decreased by more than 20% compared to the previous quarter due to reduced demand in countries such as India, and production disruptions at the Vietnam factory caused smartphone shipments to drop from 76 million units in Q1 to about 60 million units in Q2. Additionally, supply shortages of application processors (AP) for some models also had an impact.

However, it was stated that the production disruption issue would not last long. Kim Sung-gu, Executive Director of Samsung Electronics' Wireless Business Division, said during the conference call, “The Vietnam factory was affected by production stoppages at partner companies due to COVID-19 lockdowns, including injection molding,” but added, “We are diversifying supply to India and Korea and securing additional suppliers to minimize the impact, and we expect to return to normal operations by July.”

Despite reduced sales volume, profitability was considered favorable due to efficient supply adjustments. Although manufacturing faced difficulties due to worsening COVID-19 situations in India and Vietnam and sales of low-priced products decreased, sales focused on high-end models, and marketing costs were reduced.

The expansion of sales of mid-range models such as the Galaxy A series was also viewed positively. Samsung Electronics focused on expanding the lineup of mid-to-low-end models such as the Galaxy A series in Q2. Models like the ‘Galaxy A52’ and ‘Galaxy A72’ were launched in various countries, and recently, budget models such as the ‘Galaxy M32’ have been introduced in India and other markets.

“Foldable Phones Becoming Mainstream” Performance Improvement Expected with New Products in Second Half

In the third quarter, with the effect of new products such as foldable smartphones awaiting release, the proportion of high-end phone sales is expected to increase again, leading to improvements in both sales and operating profit compared to the second quarter. Samsung Electronics plans to unveil a large number of new products including the next-generation foldable phones ‘Galaxy Z Fold3’ and ‘Galaxy Z Flip3’, the smartwatch ‘Galaxy Watch4’, and wireless earphones ‘Galaxy Buds2’ at the Galaxy Unpacked event on the 11th of next month.

These products are expected to be priced about 20% lower than their predecessors, raising expectations for the full-scale expansion of the foldable phone market. Since the Galaxy Note series will not be released this year, these foldable phone lineups will serve as Samsung Electronics' main models in the second half.

Executive Director Kim said during the conference call, “In the second half, we will focus on making foldable phones mainstream and expanding sales,” adding, “For new models, we have enhanced product completeness and innovation tailored to customer characteristics and will provide differentiated user experiences suited to the foldable form factor.” He continued, “In addition to product competitiveness, we will actively promote flagship marketing and expand in-store displays,” and added, “Through this, we expect to significantly increase sales volume to achieve economies of scale and secure profitability through optimized product design.”

Furthermore, mid-to-low-end smartphones will expand 5G adoption even to entry-level products to actively respond to diverse regional demands, and through the expanded Galaxy ecosystem including tablets, PCs, and wearables, convenient connected experiences will be provided to enhance product competitiveness and expand sales. Samsung Electronics stated, “Galaxy ecosystem products are expected to significantly increase their share of division performance compared to last year,” and added, “With the wearable market experiencing high growth, following strong performance in the first half, we plan to introduce innovative new products in the second half to achieve higher growth rates than before.”

Kim Un-ho, a researcher at IBK Investment & Securities, also forecasted, “In the third quarter, mobile overseas client volumes will ramp up, and with new product launches such as foldable phones, average selling prices are expected to improve, so both sales and operating profit are expected to improve compared to the second quarter.”

Samsung Smartphones Hold 18% Market Share in Q2... World's No.1 in Shipments

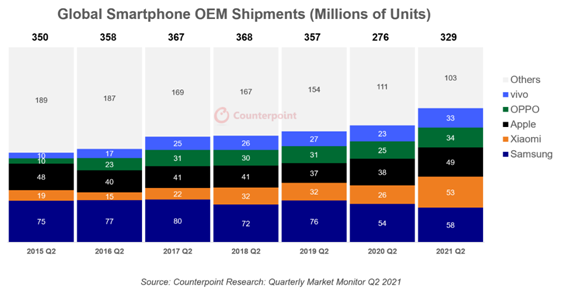

Samsung Electronics ranked first in global smartphone shipments in the second quarter of this year, following the first quarter. According to market research firm Counterpoint Research, Samsung maintained the top spot with an 18% share of global smartphone shipments in Q2. However, Samsung's Q2 shipment share (18%) was slightly down from 21.7% in Q1. Samsung shipped 57.9 million units in Q2.

Xiaomi, which recorded the best performance in China, Southeast Asia, and Europe, ranked second with 53 million units. Xiaomi increased global shipments by combining premium strategies and low-priced line sales in India, which was hit by COVID-19. Especially, its market share in mid-price markets such as Southeast Asia and Europe increased. Apple’s shipments decreased by 12% compared to the previous quarter, recording 49 million units, dropping one rank from second place in Q1 to third. China’s Oppo (34 million units) and Vivo (33 million units) followed.

Counterpoint Research explained that although the smartphone market in Q2 shrank by 7% compared to the previous quarter due to semiconductor shortages and the spread of COVID-19, sales grew by 35% year-on-year to $113 billion (approximately 129.57 trillion KRW). Counterpoint Research attributed this to “delayed launch of the iPhone 12 series creating pent-up demand, and strong sales of the iPhone Pro Max in countries like Europe and the US increasing sales volume,” and added, “Xiaomi, Oppo, and Vivo also increased shipments and sales due to Huawei’s absence and rising 5G demand.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)