[Asia Economy Reporter Lee Seon-ae] The securities industry's outlook on DL E&C's stock price is generally positive. Despite high profits, the current stock price is extremely undervalued, and the dominant assessment is that there is sufficient potential for growth from a long-term perspective.

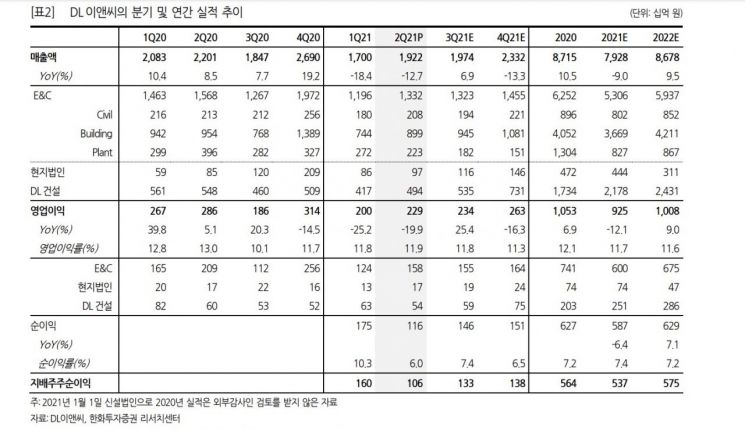

According to DL E&C on the 1st, the consolidated sales for the second quarter of this year are expected to be KRW 1.9223 trillion, with an operating profit of KRW 229 billion. The operating profit margin is 11.9%. Sales are in line with the target (KRW 1.9 trillion). Initially, DL E&C set an annual sales target of KRW 7.8 trillion and an operating profit target of KRW 830 billion along with the company split this year. The operating profit exceeds the target (KRW 190 billion) by 20.5%. DL E&C stated, "From the second half of the year, as construction at newly started sites accelerates, the growth in sales and operating profit will become more pronounced."

Although sales and operating profit decreased compared to the same period last year, the securities industry expects profits to improve as the year progresses. Korea Investment & Securities maintained a buy rating and a target price of KRW 210,000. Kang Kyung-tae, a researcher at Korea Investment & Securities, said, "The second half of the year is when housing supply and actual housing sales both turn to an upward trend, and this trend is expected to continue in 2022. The remaining supply of 12,000 housing units compared to the target is achievable," adding, "The scale of new plant and civil engineering projects to be bid on in the second half exceeds KRW 4 trillion, and as newly ordered projects begin construction, sales in the plant and civil engineering sectors are expected to normalize in 2022."

Meritz Securities maintained a buy rating and a target price of KRW 180,000 for DL E&C, forecasting gradual stock price increases despite low growth rates, considering the company's annual cash flow generation capability. Park Hyung-ryeol, a researcher at Meritz Securities, explained, "As of the end of the second quarter, cash and cash equivalents increased by KRW 396 billion compared to the end of last year, reaching KRW 2.2328 trillion, due to the payment of remaining balances from residents moving into Acro Forest in Seoul in the first half and the receipt of advance payments at some civil engineering project sites," adding, "The debt ratio improved by 1.7 percentage points compared to the beginning of the year, maintaining 10%, and net cash increased by KRW 257.9 billion to KRW 1.266 trillion, maintaining a stable financial structure."

He continued, "While a conservative order acquisition strategy has slowed external growth, profitability is expected to continue to exceed the industry average," and "Considering the high proportion of the developer business with high profitability, further improvements in profitability in the housing sector are possible."

On a separate basis, DL E&C's housing sector orders in the first half amounted to KRW 1.4945 trillion, a 28.2% decrease compared to the same period last year. However, considering projects planned for order recognition this year, a total of KRW 4 trillion in housing orders have been secured by the end of the first half. The order composition by sector consists of 40% developer, 23% urban maintenance, and 37% general contracting.

Song Yu-rim, a researcher at Hanwha Investment & Securities, maintained a buy rating and a target price of KRW 200,000, stating, "The target price was calculated by applying a target multiple of 0.9 times to the 12-month expected book value per share (BPS). The stock price is only about 0.71 times the 12-month forward price-to-book ratio (PBR) and 5.0 times the price-to-earnings ratio (PER)," adding, "Compared to competitors, relatively low housing order backlog and number of pre-sale units are disappointing factors, but the absolutely low valuation relative to the absolutely high operating profit is definitely an eye-catching aspect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.