- The Blade of Real Estate Regulations Focuses on the Housing Market... Balloon Effect on Income-Generating Real Estate 'Ttokttok'

- Wealthy Investors Prefer Commercial Real Estate Over Housing... O/T and Lifestyle Lodging Facilities Popular

As the government continues to announce strong real estate regulations, a sense of crisis is spreading in the housing market, while interest in income-generating real estate such as officetels, residential hotel facilities, and life offices is growing. This is because the sharp edge of real estate regulations is mainly aimed at the housing market.

In fact, as the scope of regulated areas rapidly expands beyond the entire metropolitan area to include metropolitan cities and major provincial cities (such as Cheonan in Chungnam and Jeonju in Jeonbuk), the housing market is being pressured on all fronts.

With the strengthening of real estate-related tax burdens, speculative demand has been fundamentally blocked from entering the housing market. In August last year, the acquisition tax rate for multi-homeowners soared from 1%~3% to a maximum of 12%. From June this year, the capital gains tax surcharge rate for multi-homeowners was significantly increased from ‘basic tax rate + 10~20%p’ to ‘basic tax rate + 20~30%p’. Also, the tax rate for houses held for less than two years and cooperative members’ move-in rights increased from 40% to up to 70%.

Loan qualification requirements within regulated areas have become even stricter. Starting this month, when obtaining a mortgage loan for houses exceeding 600 million KRW in regulated areas, a DSR (Debt Service Ratio) of 40% per individual is applied.

As the government strengthens real estate regulations mainly focused on housing, income-generating real estate is enjoying a balloon effect and experiencing an unexpected boom.

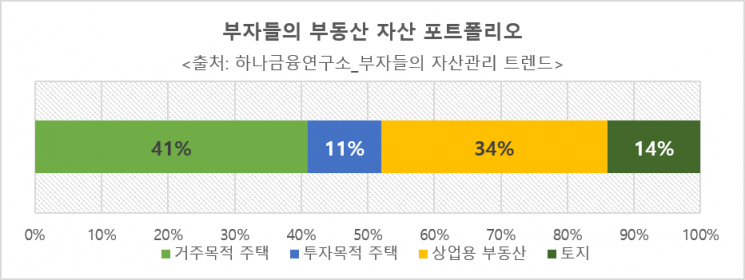

The investment behavior of wealthy individuals is also gradually changing. According to the ‘2021 Wealthy Individuals’ Asset Management Trends’ published this year by Hana Financial Research Institute, wealthy individuals considered houses more as residences than investments. Last year, houses accounted for 52% of the real estate assets of wealthy individuals. However, when classified by the purpose of holding houses, ‘residence (41%)’ was about four times higher than ‘investment (11%)’. As investment products, they mainly held ‘commercial real estate (34%)’ and also owned a significant amount of ‘land (14%)’.

The officetel market is also entering its second heyday. According to the ‘Officetel Market Trends’ released on the 26th by KB Financial Group Management Research Institute, the nationwide officetel sales volume in the first quarter of this year increased by a whopping 47% compared to the same period last year. Also, in June this year, the ‘KB Officetel Price Index’ recorded 117.9, which is 17.9% higher than the baseline of January 2019 (100).

Recently, the popularity of ‘residential hotel facilities’ has reached its peak in the real estate market. The ‘LCT The Residence (moved in November 2019)’ 177㎡ Type E unit located in Haeundae-gu, Busan, was traded for 4.35 billion KRW (33rd floor) in February. The sale price at the time of supply in 2016 was 2.46 billion KRW. This means it has nearly doubled in about five years.

Also, the ‘Byeollae Station I’Park Suite (moved in February 2021)’ 83.31㎡ unit in Byeollae New Town, Namyangju, Gyeonggi Province, was sold for 829.1 million KRW (22nd floor) in May. This unit’s price has roughly doubled compared to the supply price (479.1 million KRW, 2017) in about four years.

Construction companies are also launching income-generating real estate products in line with this trend.

HDC Hyundai Development Company plans to launch sales in August for the high-end life office ‘Godeok I’Park Dearban’ being built in Ilwon, Gangdong-gu, Seoul. It will be constructed with six basement floors and 21 above-ground floors, with a total floor area of approximately 301,337㎡. This place will be designed as a new-concept complex cultural space consisting of sales facilities, sports facilities, cultural and assembly facilities, and neighborhood living facilities. A total of 597 office units with exclusive areas ranging from 37 to 158㎡ will be sold. Located in Godeok Biz Valley, the center of eastern Seoul, it is expected to have a premium view overlooking the Han River and Godeoksan Mountain. Notably, it has been confirmed as the first large-scale IKEA store in Seoul (scheduled for 2024), along with various shopping and cultural facilities such as E-Mart, multiplex cinemas, kids’ gyms, and electronics shops. Accessibility to Gangnam is excellent via Gangil IC and Olympic-daero, and it is convenient to use the Metropolitan Area 1st Ring Expressway and Seoul-Yangyang Expressway. The Seoul-Sejong Expressway is under construction next to the project site, and the extension of Subway Line 9 connecting Gangdong, Hanam, and Namyangju, with the planned Samteo Park Station, is also scheduled.

Lotte Construction will launch sales in August for the residential hotel facility ‘Lotte Castle Le West’ in the Magok Special Planning Zone, Gangseo-gu, Seoul. The complex consists of five buildings with six basement floors and 15 above-ground floors, totaling 876 units with exclusive areas ranging from 49 to 111㎡, and includes sales and office facilities. Magok Station on Subway Line 5 and Magoknaru Station, a transfer station for Line 9 and the Airport Railroad, are connected by an underground public pedestrian passage, making access easy. Numerous large corporations such as Lotte, LG, Kolon, and Nexen, as well as many small and medium-sized enterprises, are located nearby, providing abundant demand.

Hyundai Engineering will open a sales promotion center on July 30 and begin full-scale sales for the high-end residential hotel facility ‘Hillstate Cheongju Central’ being built in Cheongju, Chungbuk. It is a high-end residential hotel facility with 162 units ranging from 165 to 198㎡ across 8 to 49 floors above ground, with 160 units ranging from 165 to 187㎡ available in this supply. The complex will be transformed into a high-end mixed cultural space equipped with a bus terminal, residential hotel facilities, sales facilities, and cultural and assembly facilities. The complex shopping mall will include Hyundai City Outlet with enhanced F&B functions, Megabox with Cheongju’s first MX theater, and various rest and cultural spaces, creating a convenient shopping, cultural, and leisure lifestyle shopping mall.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.