Loan and HR Integration... AI Bank Clerks Expected to Emerge in the Second Half of the Year

[Asia Economy Reporter Kim Jin-ho] Banks are actively promoting the introduction of artificial intelligence (AI) in various fields such as loans and regular personnel appointments. This is because they have focused on the fact that AI can meet the needs of customers who prefer non-face-to-face transactions while maximizing work efficiency.

According to the financial sector on the 17th, Hana Bank recently launched a new 'AI Loan' that calculates loan limits using AI technology.

The AI Loan applies machine learning that autonomously learns data to the loan limit model jointly developed by Hana Bank and Hana Financial Convergence Technology Institute to calculate loan limits. The AI analyzes customer patterns and combines about 200 variables and multiple algorithms to assess risk.

In particular, if there is a transaction history with Hana Bank, loans of up to 50 million KRW are possible even without income documents. A Hana Bank official explained, "Loan limits and interest rates can be confirmed within 1 minute of application, and execution is possible within 3 minutes," adding, "We plan to introduce products utilizing big data in the future."

SC First Bank also recently launched a similar service. By entering only basic information such as income, customers can check the limits and interest rates for general credit loans and mid-interest loans at once. This is thanks to the use of IT-based screening techniques. It is expected to be a great help to so-called 'thin filers' (people with insufficient financial history), such as housewives with limited transaction records.

Shinhan Bank utilized AI in its regular personnel appointments in the second half of this year. They quantified over 50 factors such as performance, competence, and leadership for each individual and conducted AI-based personnel decisions using deep learning. In the future, they plan to add the concept of 'metacognition' (diagnosing current competencies and future competency needs) for promotions of young employees such as clerks and assistants to create a more sophisticated system.

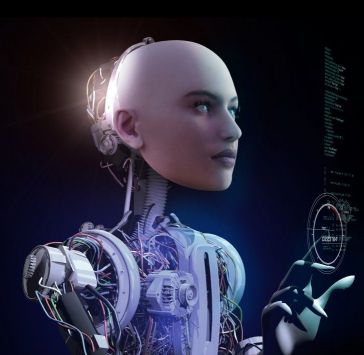

AI clerks are also expected to be commercialized soon. Kookmin Bank plans to pilot AI clerks at some branches starting in the second half of this year. Customers visiting branches will be able to receive information on interest rates and details of financial products such as savings and deposits through AI kiosks without meeting bank clerks. Depending on the results of the pilot operation, they will consider whether to expand deployment in the future.

An official from a major commercial bank said, "Interest in AI among banks is increasing in terms of the normalization of non-face-to-face services and work efficiency," and predicted, "AI is expected to be integrated into many services going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)