Financial Hardship, Debt Investment, and Leveraged Investors

Flocking to High-Interest Secondary Financial Institutions

If Authorities Tighten Loan Regulations

Last-Minute Rush and Loan Cliff Side Effects

[Asia Economy reporters Kiho Sung and Seungseop Song] Office worker Han Seongmin (41 years old, pseudonym) recently found himself in deep 고민 while looking at apartments in the Seoul area to buy his own home. This is because from this month, the government has strengthened the Debt Service Ratio (DSR) regulation, which limits loan amounts based on repayment ability (income), causing disruptions to the originally expected funding. As a result, Mr. Park had no choice but to turn to the secondary financial sector, where the DSR limit is 60%. Mr. Park confessed, "Although the secondary financial sector causes a lot of anxiety, interest rates have recently been falling, and bank loan limits are gradually decreasing, so there is no choice."

The surge in household loans from the secondary financial sector, such as card loans and savings banks with high interest rates, is mainly attributed to financial difficulties caused by COVID-19. Low-income and low-credit individuals, who find it difficult to get money from commercial banks with high barriers, have flocked massively to the secondary financial sector. The balloon effect, where investors who engaged in debt-financed investment (debt investment) and Eolgul (pulling together all resources) due to the stock and cryptocurrency investment craze turned to the secondary financial sector after bank loans were blocked, is also interpreted as a factor that increased loans. Financial authorities are considering strengthening regulations on secondary financial sector loans to curb the rapid increase in loans, but there are concerns that regulating the ‘balloon effect’ caused by excessive regulation may lead to new side effects.

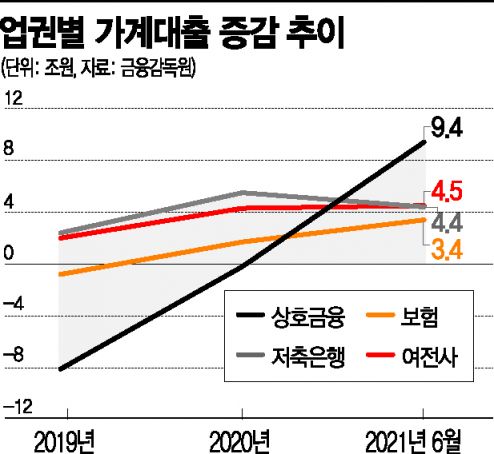

According to the Financial Supervisory Service and supervisory authorities on the 16th, household loans from mutual finance institutions increased by 9.4 trillion won in the first half of this year. This contrasts with decreases of 8.1 trillion won and 2 billion won in 2019 and 2020, respectively. Insurance companies, which have a relatively low proportion of household loans, showed a sharp increase. From a decrease of 800 billion won in 2019, it grew to 1.7 trillion won last year and 3.4 trillion won in 2021.

Savings banks and card loans are showing even more rapid growth. During the same period, savings banks, which had a net increase of 2.4 trillion won, saw a net increase of 5.5 trillion won, with 4.4 trillion won added in just the first half of this year.

There are forecasts that the increase in household loans in the secondary financial sector will not slow down immediately. This is because demand to catch the last train before regulations may increase as financial authorities have announced the application of DSR regulations limiting loan principal and interest repayments to within 40% of income.

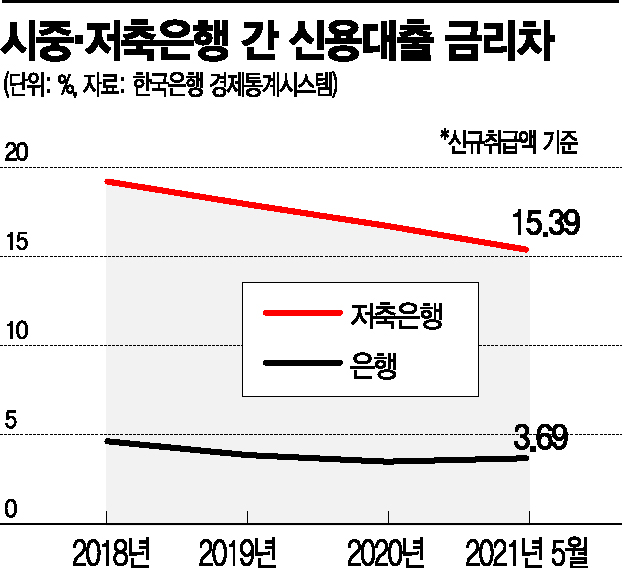

The continuous interest rate cuts by the secondary financial sector are also cited as an inducement effect. According to the Bank of Korea, the interest rate of commercial banks decreased by 0.18 percentage points from 3.87% in 2019 to 3.69% in May this year. In contrast, savings banks reduced their rates by 2.54 percentage points from 17.93% to 15.39%.

Experts expressed concerns that while the authorities’ regulations on the secondary financial sector may reduce the speed of debt accumulation, side effects such as ‘last train rush’ and ‘loan cliff’ are inevitable.

Professor Kim Taegi of Dankook University’s Department of Economics analyzed, "There are many vulnerable and difficult groups in the secondary financial sector, and there is a risk that loan execution will become more difficult due to the authorities’ regulations," adding, "If someone lacks funds, they are likely to rush to secure funds quickly before loan regulations take effect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)