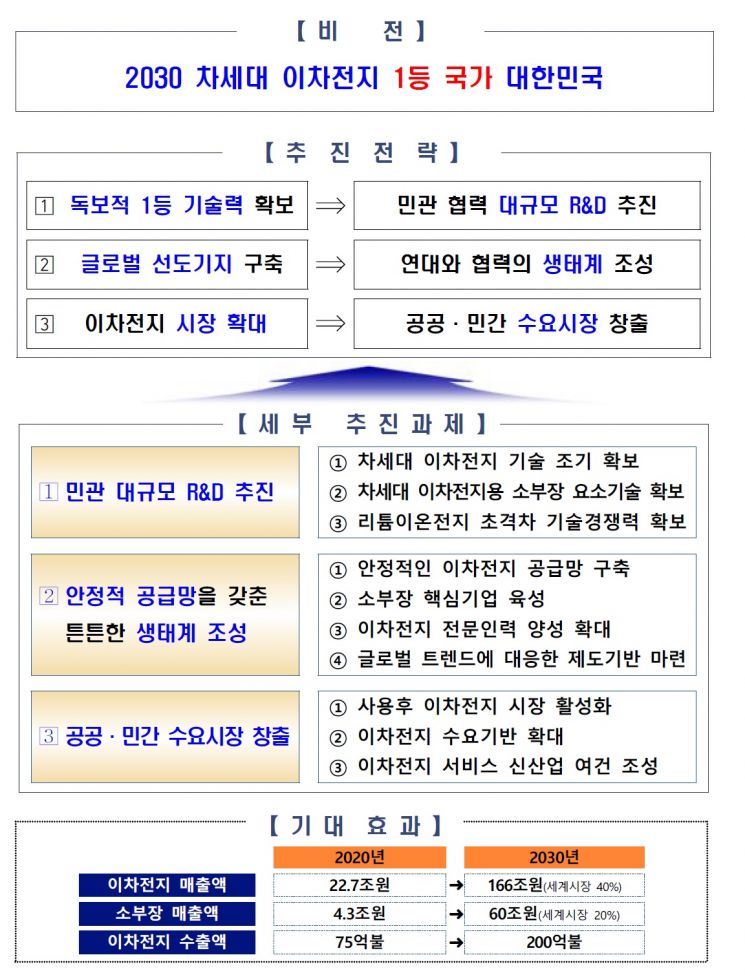

'2030 Secondary Battery Industry Development Strategy'

In Response to the Full-Scale Global Competition in Secondary Batteries

40 Trillion Won Private Investment by 2030 and Comprehensive Government Support

[Sejong=Asia Economy Reporter Joo Sang-don] The government's establishment and announcement of the '2030 Secondary Battery Industry Development Strategy' on the 8th is based on the judgment that the next five years are crucial to lead the secondary battery market, where global competition has begun in earnest. To this end, the government plans to attract more than 40 trillion won in private investment by 2030 and actively support research and development (R&D), taxation, and finance.

On this day, the government announced the K-Battery development strategy containing these details at the LG Energy Solution Ochang Plant 2 site.

Secondary batteries are expected to see rapid growth in the global market due to increasing demand from various countries as a key means of sustainable growth amid the global trend toward eco-friendliness. The global market research firm IHS Markit has forecasted that by 2025, secondary batteries will grow into a market larger than memory semiconductors. SNE Research projects that the global secondary battery market size will grow eightfold over ten years, from $46.1 billion in 2020 to $351.7 billion in 2030, driven by the expansion of electric vehicle adoption. In particular, electric vehicle batteries (EVB) are expected to grow tenfold over the next decade.

The current lithium-ion secondary battery market was first commercialized by Japan in 1991, forming the market. Since the mid-2000s, with the growth of the mobile industry, Korea has led the global market for small secondary batteries. In the 2010s, as the electric vehicle industry grew, Korea and Japan, targeting the global market, and China, with its large domestic market, have been competing in the mid-to-large secondary battery segment. As of last year, Korea held a 44.1% share of the global secondary battery market, China 33.2%, and Japan 17.4%, with these three countries occupying 95% of the market.

The global market is expected to expand with increasing secondary battery demand, and as more market participants enter, competition is likely to intensify and broaden, including in next-generation secondary battery technologies. Especially with the full-scale expansion of electric vehicle adoption, competition among secondary battery companies to secure market share is intensifying, and governments worldwide are strengthening efforts to attract and secure regional supply chains. Along with accelerated competition to secure leading technologies, there is also increasing demand to reduce carbon emissions throughout the entire lifecycle of secondary batteries, from production to disposal.

In Korea's case, small secondary batteries have ranked first globally for ten consecutive years, and mid-to-large batteries are competing for the top position. Domestic and overseas production capacity increased about fourfold from 58 GWh in 2016 to 217 GWh in 2020, and exports of lithium-ion and lead-acid batteries have increased for five consecutive years, from $4.97 billion in 2016 to $7.46 billion in 2020.

However, the high dependence on overseas materials, parts, and raw materials is pointed out as a limitation. As of 2019, the overseas dependence rate for the four major materials?cathode materials, anode materials, separators, and electrolytes?ranged from 47.2% to 80.8%, which is high.

◆Large-scale R&D to Secure No.1 Technology in Next-Generation Secondary Batteries= With global competition in secondary batteries fully underway, the government judges that securing a super-gap technology is paramount to leading the market in the future.

First, the government will promote large-scale R&D support for next-generation battery manufacturing technology and core materials-parts-equipment (SoBuJang) element technology development. Starting with lithium-sulfur batteries, which have the advantage of light weight in 2025, followed by all-solid-state batteries (2027) and lithium-metal batteries (2028), a preliminary feasibility study will be conducted for commercial technology development worth a total of 306.6 billion won.

For next-generation element technologies, development will be promoted based on demand-supply company linkage and industry-academia-research cooperation, and a 'Next-Generation Battery Park' will be established to comprehensively support next-generation battery research, performance, and safety evaluation.

◆Creating a Cooperative Ecosystem to Build a Global Leading Base= The government will also foster an ecosystem to establish a global leading base for advanced technology development and first product commercialization supporting global market entry domestically. To secure a stable supply chain, government-to-government cooperation will be strengthened, and raw material mineral procurement will be promoted through active public-private cooperation, while recycling materials sufficient to meet domestic demand will be secured within Korea.

To support the growth and technology acquisition of core SoBuJang companies in secondary batteries, Korea's first specialized secondary battery SoBuJang complex will be developed as a key growth hub. Support will be provided for securing core technologies of SoBuJang companies, such as demand-company-linked technology development, and an 80 billion won public-private joint R&D innovation fund will be established to support R&D for SMEs and startups. Secondary batteries will be designated as a national strategic technology to expand tax support, and financial support will be strengthened through incentives under the revised Return Law and the establishment of the K-Battery preferential support program.

To cultivate professional manpower, the government plans to train 1,100+ annual secondary battery personnel, including expanding the training of master's and doctoral-level design and advanced analysis experts. Starting in 2023, to address the shortage of field experts, a 'Secondary Battery Manufacturing and Process Workforce Training Platform' providing on-site experience will also be established.

◆Creating Various Demand Markets to Expand the Secondary Battery Market= The strategy also includes measures to expand the scope of the secondary battery industry by creating new demand markets. To revitalize the used secondary battery market, four regional collection centers will be established nationwide, and standards for transportation and storage of used secondary batteries will be set. By 2024, a 'Comprehensive Information Management System' will be built to manage the entire process of used secondary batteries, from collection, transport, storage, performance evaluation to private sales.

The government will also expand secondary battery demand using the public market. Over the next five years until 2025, a 2.2 GWh public energy storage system (ESS) market will be created, and by 2030, 388 government vessels will be converted to eco-friendly ships such as electric and hybrid vessels, considering size and navigation characteristics.

Additionally, the government will promote the establishment of an 'Electric Vehicle Parts Data Platform' and the creation of new industries utilizing data, introduce secondary battery rental and replacement services, and pursue secondary battery standardization to discover and foster secondary battery-related service industries.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)