Woori Card to Introduce Overseas ATM Withdrawal Limit Starting Next Month

Shinhan, Hana, and NongHyup Cards Previously Imposed Withdrawal Limits

[Asia Economy Reporter Ki Ha-young] Card companies have been tightening limits on overseas ATM withdrawals one after another. This is to prevent the risk of illegal currency exchange transactions caused by virtual currencies, which have been identified as the main reason for the surge in cash withdrawals using overseas ATMs.

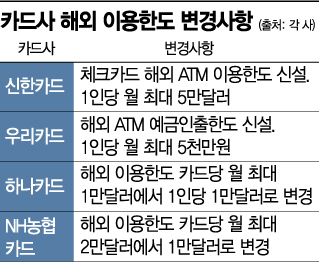

According to industry sources on the 24th, Woori Card will introduce a new overseas ATM withdrawal limit starting next month. Individuals can withdraw up to 50 million KRW per month from overseas ATMs. Currently, overseas transactions are allowed up to 20 million KRW per card per month, so holding multiple check cards made it possible to withdraw large amounts. However, with the new limit, while the overseas transaction limit per check card remains the same, the amount that can be withdrawn overseas is restricted to a maximum of 50 million KRW per person per month.

Earlier, Shinhan Card, the industry leader, also applied a new overseas ATM limit for check cards starting this month. The limit is up to 50,000 USD per person per month. Like Woori Card, the overseas transaction limit per check card is 20,000 USD, but the amount that can be withdrawn overseas is capped at 50,000 USD per person per month.

Hana Card and NH Nonghyup Card have also reduced their overseas withdrawal limits this year. Hana Card strengthened the overseas ATM withdrawal limit for check cards from 10,000 USD per card per month to 10,000 USD per user per month starting late April. NH Nonghyup Card lowered the withdrawal limit from 20,000 USD to 10,000 USD per check card per month.

KB Kookmin Card and Lotte Card have been operating overseas ATM usage limits based on users for some time. They explained that they have been managing with a relatively low limit of 20 million KRW per person per month. Samsung Card allows withdrawals up to 30 million KRW per card per month but is considering additional restrictions.

The reason card companies are strengthening overseas ATM withdrawal limits is interpreted as the increase in overseas ATM withdrawals amid the COVID-19 pandemic, which has blocked air routes. The industry sees the price difference between domestic and international virtual currencies as the main cause. It is reported that illegal foreign exchange transactions, known as "hwanchigi," aiming to profit from the so-called "Kimchi premium," have increased, with movements to purchase virtual currencies overseas.

An industry official explained, "As overseas ATM cash withdrawals have surged recently, card companies are strengthening regulations from a risk management perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)