National Assembly Holds Discussion Forum on Amendment Bill

"Current Law Fails to Reflect Industrial Development"

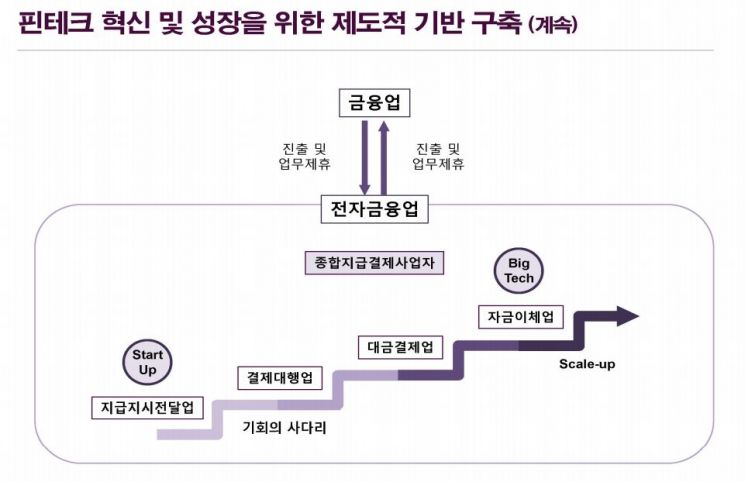

[Asia Economy Reporter Kiho Sung] Regarding the amendment to the Electronic Financial Transactions Act (EFTA) currently under discussion in the National Assembly, there have been calls for its prompt passage, describing it as a "ladder of opportunity for the phased growth of fintech startups."

Professor Junhyuk Jeong of Seoul National University School of Law attended the 'Fintech and Digital Finance Future: Electronic Financial Transactions Act Amendment National Assembly Forum' held on the 17th at the Federation of Korean Industries building in Yeouido, Seoul, where he presented on the topic of ‘Significance and Key Issues of the EFTA Amendment.’ He stated, "The current EFTA has not adequately reflected the technological changes and the development of the fintech industry over the past 15 years since its enactment."

Professor Jeong emphasized, "Since the financial crisis at the end of 1997, the Korean financial industry has undergone the most significant innovation and competition," adding, "Legal systems must be improved to harmonize the promotion of digital innovation and competition, protection of financial consumers, and stability of the financial system."

He particularly explained, "A ladder of opportunity must be created for the phased growth of fintech startups," and "An institutional foundation should be established to allow gradual growth starting with small capital, such as in the case of payment instruction transmission businesses."

Regarding future challenges in digital finance legislation, Professor Jeong pointed out the need for ▲review of the concurrent and ancillary business system under the digital financial environment ▲examination of unbundling of existing financial functions, re-bundling phenomena through partnerships with financial institutions, and the current outsourcing system ▲restructuring of the investment system by financial institutions in fintech companies as a basis for digitalization of finance and creation of a fintech startup and nurturing ecosystem ▲evaluation and response to various third-party risks and information security ▲strengthening compliance, risk assessment, and management capabilities of electronic financial business operators.

The subsequent forum was moderated by Senior Research Fellow Jung-ho Seo of the Korea Institute of Finance and featured discussions with Jung-rok Choi, Executive Director of Shuttle Bank; Jisik Kim, Director of Naver Financial; Young-seo Cho, Head of KB Management Research Institute; Taehyun Yoo, Executive Director of Shinhan Card; Junhee Lee, Lawyer at Yulchon; and Hyungjoo Lee, Head of the Financial Innovation Planning Division at the Financial Services Commission.

Ryoungjun Ryu, Chairman of the Korea Fintech Industry Association, stated, “The amendment to the Electronic Financial Transactions Act contains a policy direction that responds to the changes of the times while sowing the seeds of another innovation,” and added, “I hope this forum will help dispel unnecessary misunderstandings and open a productive space to discuss the future of finance and the lives of the people that will change due to the amendment.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)