Customers Aged 18 to 38 Eligible for Membership Registration

[Asia Economy Reporter Park Sun-mi] You can practice split-account financial management with just one KB MyFit account without having to open multiple bank accounts. As of the 10th of last month, KB MyFit accounts recorded approximately 311,000 new sign-ups and a balance of about 397 billion KRW, gaining popularity.

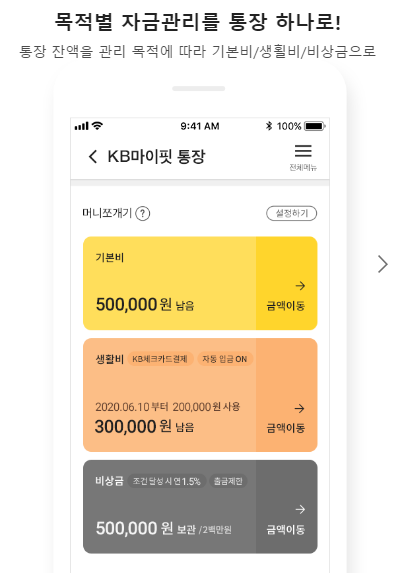

KB MyFit, a deposit and withdrawal account available to customers aged 18 to 38, features the core function of "splitting" one account into basic expenses, living expenses, and emergency funds according to management purposes.

This new concept service, described as "another account within an account," allows users to easily activate or deactivate the living expenses and emergency funds functions via on/off buttons on the bank’s dedicated applications, KB Star Banking or Liiv. The living expenses function lets users set a monthly spending limit and use the KB Check Card accordingly, enabling planned consumption.

Additionally, the amount separated as emergency funds offers an annual interest rate of 1.5% up to a limit of 2 million KRW when performance conditions are met, allowing users to earn interest while having the flexibility to withdraw funds as needed. The amount transfer button makes it easy to move balances between basic expenses, living expenses, and emergency funds, enhancing convenience in budget management.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)