[Asia Economy Reporter Jeong Hyeon-jin] American semiconductor company Micron and Taiwan’s TSMC, the number one foundry (semiconductor contract manufacturing) company, are strengthening their cooperative relationships with Japan, as they chase after memory semiconductor giants Samsung Electronics and SK Hynix.

As the United States, Japan, and Taiwan work together to check China while fostering their own semiconductor industries, they are deepening their close ties surrounding semiconductors. Semiconductor companies in each country appear to be leveraging this as an opportunity for business expansion and technological development.

With the global semiconductor shortage drawing daily attention to the industry, the strengthening cooperation among the U.S., Japan, and Taiwan is attracting attention for its potential impact on the domestic semiconductor industry, including Samsung Electronics and SK Hynix.

US Micron "Strengthening Cooperation with Japan"

According to Japan’s Nihon Keizai Shimbun on the 12th, Sanjay Mehrotra, CEO of Micron, recently stated in an interview with the media, "We want to help strengthen Japan’s semiconductor ecosystem," expressing his intention to cooperate with the Japanese government’s supply chain strengthening efforts through expanded factory investments and partnerships with equipment and materials companies in Japan.

CEO Mehrotra showed a willingness to collaborate with Japanese companies for technology development. He revealed that Micron is currently producing 10nm-class 4th generation (1α) DRAM. He said that Japan’s Hiroshima factory and others will play a central role in the commercialization of next-generation 1β (5th generation) products, emphasizing "Japan’s significant role." This is interpreted as a plan to develop technology through collaboration with Japan’s highly advanced materials, parts, and equipment companies.

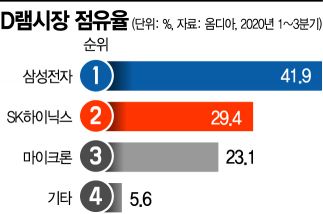

Micron is a key competitor in the memory semiconductor market led by domestic semiconductor companies. It ranks third in the DRAM market after Samsung Electronics and SK Hynix, and fifth in the NAND flash market. Recently, there have been concerns that Micron might acquire Japan’s Kioxia, the second-largest NAND flash company, which could threaten domestic companies. In this context, Micron has extended a hand toward Japan, which is seeking cooperation with overseas semiconductor companies.

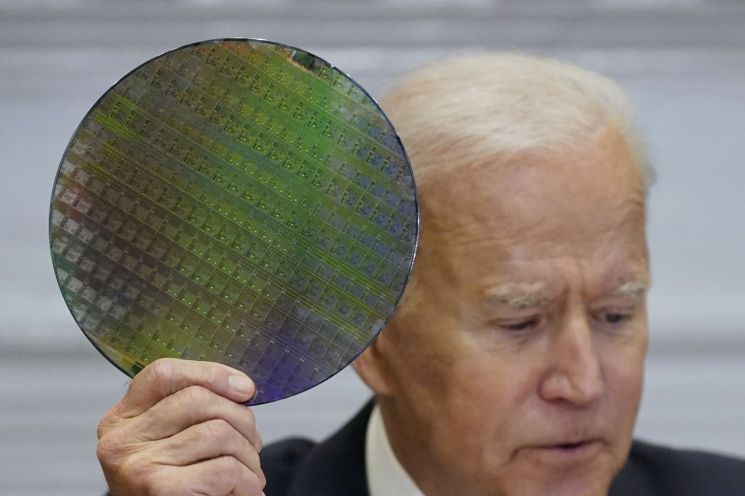

This cooperation comes at a time when the U.S. is actively working to build semiconductor supply chains. The Biden administration is focusing on establishing semiconductor alliances with friendly countries such as Japan and Taiwan. CEO Mehrotra said, "The semiconductor industry forms the foundation of the global economy and security, and the U.S. government recognizes our company as a strong example of cooperation between the U.S. and Japan." He emphasized that Micron has invested about $7 billion in Japan over three years through August this year, "the largest scale among foreign companies during the same period."

TSMC to Build Factory in Japan Following R&D Center

Taiwan’s TSMC is also taking advantage of this opportunity. Earlier this year, TSMC announced plans to build a large semiconductor factory in Arizona, U.S., further strengthening its relationship with the U.S. Recently, reports emerged that TSMC is discussing plans with the Japanese government to build a foundry production line in Kumamoto Prefecture. This follows the announcement in February to establish an R&D base in Tsukuba City, Ibaraki Prefecture, and now includes plans to build a production line. Semiconductors produced at this factory are expected to be supplied to Japan’s Sony and other major automobile manufacturers.

Nihon Keizai Shimbun reported, "As economic security gains importance amid U.S.-China confrontation, countries are competing to attract TSMC production facilities," adding, "The Japanese government is moving quickly to attract TSMC’s factory as a key card to revive its noticeably lagging semiconductor industry."

The domestic semiconductor industry is closely monitoring this situation, as there is a high possibility of having to choose sides amid the semiconductor hegemony struggle between the U.S. and China. The Chinese government may pressure companies like Samsung Electronics and SK Hynix, which have announced large-scale investments in the U.S. However, some speculate that since China’s semiconductor self-reliance is realistically difficult amid the U.S.’s expanding supply chains, this could present an opportunity for domestic companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)