Accumulated Loss of 420 Billion Won Over 3 Years and 3 Months

Net Loss of 79.4 Billion Won in Q1 This Year Alone

Short-term Loan Repayment Burden Also Weighs

Passenger Demand Recovery Expected but Proactive Capital Raising Needed

When will low-cost carriers (LCCs) be able to take flight again? Recently, LCC stock prices have been fluctuating. This reflects expectations that overseas travel demand will revive as the number of domestic COVID-19 vaccine recipients surpasses 10 million. However, domestic LCCs have suffered devastating declines in performance and financial conditions due to COVID-19. Some LCCs face the risk of complete capital erosion. Large-scale capital injections are inevitable for them to take off again. It is also difficult to guarantee that air travel demand will recover to previous levels. Changes in the competitive landscape within the industry are also being sensed due to Korean Air’s acquisition of Asiana Airlines and the sale of Eastar Jet. In these challenging circumstances, when and how high can LCCs fly again? We examine the current management status of Jeju Air and T’way Air and forecast their recovery prospects.

[Asia Economy Reporter Lim Jeong-su] As the number of COVID-19 vaccine recipients rapidly increases, expectations for performance improvement at Jeju Air, a leading domestic LCC, are growing. It is anticipated that travel demand will explode in the fourth quarter of this year when domestic vaccinations are nearly complete and overseas travel restrictions are eased.

However, they cannot simply wait for passenger demand to recover following regulatory easing. The financial condition has severely deteriorated due to accumulated performance declines while enduring the COVID-19 crisis. Due to consecutive losses, they have already fallen into a partial capital erosion state, and complete capital erosion within the year cannot be ruled out. Therefore, there are calls for a large-scale paid-in capital increase involving major shareholders such as AK Holdings.

Expectations for ‘Demand Recovery’ Amid Three Years of Devastating Performance

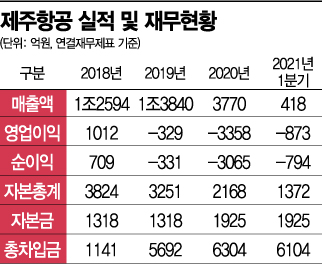

Like other LCCs, Jeju Air has posted devastating results for three consecutive years due to COVID-19. After recording an operating loss of 32.9 billion KRW in 2019 due to large-scale aircraft investments and increased depreciation expenses, it posted a loss of 344.3 billion KRW in 2020. The deficit widened to 87.3 billion KRW in the first quarter of this year alone, making a large-scale loss inevitable this year as well.

This is the result of a sharp drop in sales as passenger demand disappeared after COVID-19. Sales, which had surged to 1.384 trillion KRW in 2019 due to explosive air travel demand, fell to 377 billion KRW last year, a quarter of the previous amount, and showed a poor 41.8 billion KRW in the first quarter of this year. This is a significant decrease compared to 229.2 billion KRW in the same period last year.

The increased cost burden from large-scale investments just before the crisis is also cited as a cause for the widening losses. At the end of 2018, Jeju Air signed its largest aircraft order contract since its establishment. The order size reached as much as 5 trillion KRW, and it is known that several hundred billion KRW were paid as deposits or advance payments. Although the order contract was postponed due to COVID-19, the depreciation burden increased significantly.

Depreciation expenses, which were around 25.2 billion KRW in 2017 and 36.2 billion KRW in 2018, surged to 169.5 billion KRW in 2019 and 174.5 billion KRW in 2020. In the first quarter of this year, 32.1 billion KRW, equivalent to 77% of sales, was recorded as depreciation expenses.

Concerns Over Complete Capital Erosion... Large-Scale Paid-In Capital Increase Needed

Concerns over complete capital erosion are growing due to worsening profitability. Jeju Air has recorded cumulative net losses of approximately 420 billion KRW over the past three years and three months due to performance deterioration caused by COVID-19. Following a net loss of 306.5 billion KRW last year, it posted a net loss of 79.4 billion KRW in the first quarter of this year alone.

Due to consecutive losses, shareholders’ equity, which exceeded 380 billion KRW in 2018, has plunged to 137.2 billion KRW despite a paid-in capital increase. It is in a partial capital erosion state where shareholders’ equity is below the paid-in capital of 192.5 billion KRW. If net losses continue this year, the possibility of complete capital erosion cannot be ruled out.

The burden of debt repayment is also increasing. Due to large-scale aircraft investments decided just before COVID-19, borrowings increased from 114.1 billion KRW in 2018 to 569.2 billion KRW in 2019, and further to 630.4 billion KRW last year.

As performance deteriorated and credit ratings declined, the burden of short-term debt repayment also increased. Short-term borrowings and current portion of long-term debt that must be repaid or refinanced within one year amount to nearly 290 billion KRW, exceeding 40% of total borrowings. Having recorded losses for several years, the company’s ability to repay on its own has significantly weakened.

Therefore, there are calls for a large-scale paid-in capital increase to normalize management. An investment banking industry official stated, "The financial condition has deteriorated extremely, so large-scale capital procurement is necessary to achieve management normalization in conjunction with the recovery of passenger demand."

Researcher Eom Kyung-ah of Shin Young Securities said, "With the merger of Korean Air and Asiana Airlines, if the LCCs under these large corporations form an alliance, Jeju Air’s position as the number one LCC could be threatened," adding, "Changes in the competitive landscape among LCCs could also act as a variable in the recovery of management conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.