Expansion of Sales Channels Using IT Technology

Prospects for Entry into China's Online Insurance Market

[Asia Economy Reporter Oh Hyung-gil] Samsung Fire & Marine Insurance's joint venture project with Tencent, a leading Chinese internet company, is progressing smoothly. The joint venture process is expected to be completed as early as the second half of this year, marking Samsung Fire's entry into the Chinese online insurance market.

According to the insurance industry on the 4th, Samsung Fire's Chinese subsidiary, 'Samsung Property Insurance,' recently held an extraordinary general meeting of shareholders and resolved to increase its capital. Last November, Samsung Fire decided to convert Samsung Property Insurance into a joint venture through equity partnerships with Chinese investors.

The investors include five companies: Tencent, Shanghai Jiayin Cultural Media Co., Ltd., Wising Technology Company, Shanghai Tian Tian Asset Management Company, and Bowei Fund, with an investment scale reaching 320 billion KRW.

After the conversion to a joint venture, Samsung Fire's shareholding will decrease from 100% to 37%, with Tencent holding 32%, Shanghai Jiayin 11.5%, Wising Technology 11.5%, Shanghai Tian Tian 4%, and Bowei Fund 4%.

Following this capital increase decision, Samsung Fire plans to submit application documents regarding shareholder changes and capital increase to Chinese regulatory authorities and obtain approval to finalize the joint venture conversion.

Samsung Fire intends to nurture its Chinese subsidiary as an online insurance business by expanding insurance sales channels utilizing Tencent's strength in IT technology. The Chinese non-life insurance market, valued at approximately 288 billion USD (about 322 trillion KRW), has grown at double-digit rates for several years, becoming the world's second-largest market.

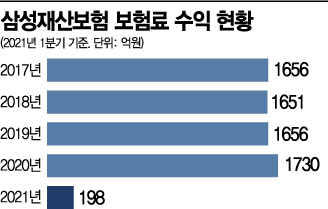

Samsung Fire's Chinese subsidiary recorded insurance premium income of 19.8 billion KRW in the first quarter of this year, including 9.8 billion KRW from automobile insurance and 2.7 billion KRW from fire insurance, a 15.3% decrease compared to the same period last year. A Samsung Fire official stated, "The procedures to obtain approval from Chinese authorities are progressing smoothly," adding, "We plan to discover digital new business opportunities in the Chinese market based on the platform and provide fast and flexible insurance services."

International credit rating agency Standard & Poor's (S&P) downgraded the long-term issuer credit rating and insurance financial strength rating of Samsung Property, Samsung Fire's Chinese subsidiary undergoing joint venture conversion, from 'A+' to 'A0' in February.

S&P stated, "Despite the dilution of Samsung Fire's shareholding, it will pursue expansion of its position in the Chinese non-life insurance market," and "Samsung Fire is expected to enter the currently growing Chinese online personal insurance market and strengthen its position in China through cooperation with joint venture partner Tencent."

It also noted, "Samsung Fire will maintain its status as the largest shareholder with a 37% stake in Samsung Property and a corresponding board representation." S&P emphasized that Samsung Property is evaluated as a strategically important subsidiary reflecting Samsung Fire's overseas business expansion strategy. Furthermore, although Samsung Property's market share is small, its strong capital base supports its 'bbb' standalone credit profile.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.