[Asia Economy Reporter Lee Seon-ae] A 'money move' phenomenon, where funds from banks' Individual Savings Accounts (ISA) and Individual Retirement Pensions (IRP) are shifting to the securities market, is becoming visible. The introduction of brokerage-type ISAs by securities firms and the declaration of zero fees for IRPs are the driving forces behind this money move.

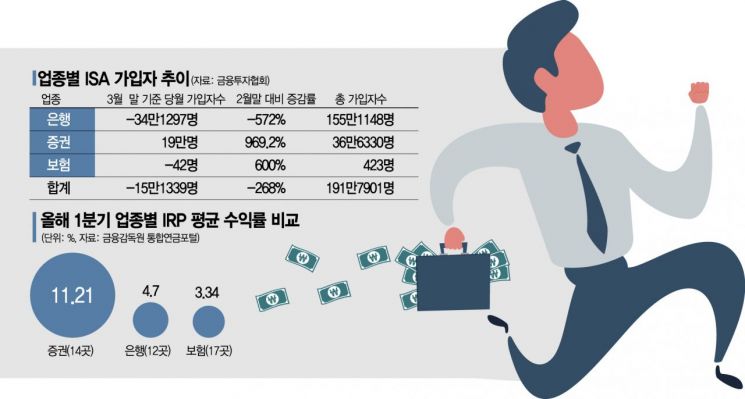

◆Popularity of Brokerage-type ISA= According to the Korea Financial Investment Association on the 27th, as of the end of March, the number of ISA subscribers at securities firms increased by 190,000 compared to the end of February, marking a 969.2% increase. The subscription amount also surged by 989.3%, from 20.9 billion KRW to 227.4 billion KRW. In contrast, during the same period, the number of ISA subscribers at banks decreased by 341,297. Compared to an increase of 72,308 at the end of February, this is a 572% decrease. The subscription amount also dropped significantly, down 92.6% from 685.7 billion KRW to 50.8 billion KRW.

This is thanks to the introduction of brokerage-type ISA products by securities firms. Brokerage-type ISAs can only be opened through securities firms licensed for discretionary trading. Unlike the existing trust-type and discretionary-type ISAs, subscribers can directly manage domestic stocks themselves, which has made them popular.

The ISA market still has a larger number of subscribers and subscription volume at banks. Banks account for 1,551,148 subscribers, which is 80% of the total 1,917,901 subscribers, and 6.7288 trillion KRW, which is 86% of the total 7.8155 trillion KRW subscription amount. Compared to securities firms, the number of subscribers is 4.2 times higher, and the subscription amount is 6.1 times higher.

However, the money move is expected to accelerate this year. An industry insider said, "Following Samsung Securities and NH Investment & Securities in February, in March, Mirae Asset Securities, Korea Investment & Securities, KB Securities, Hana Financial Investment, and Shinhan Financial Investment launched brokerage-type ISA accounts," adding, "Several securities firms plan to introduce brokerage-type ISAs by the first half of this year, expanding customers' choices."

◆Zero Fees and Higher Returns for Securities Firms' IRP= Signs of IRP funds moving from banks to securities firms are also emerging. The zero-fee declarations by securities firms have a significant impact. The signal was fired by Samsung Securities last month when it launched the 'Direct IRP,' the first IRP product in the financial industry to waive all fees for new customers. Subsequently, Mirae Asset Securities and Yuanta Securities also decided to waive all IRP fees. Shinhan Financial Investment, KB Securities, and Korea Investment & Securities have joined in.

According to the Ministry of Employment and Labor's statistics on retirement pension fund management, the size of individual IRP funds reached 34.4167 trillion KRW last year, an increase of about 35.5% compared to the previous year (25.4 trillion KRW). Although banks hold the largest share, it is notable that the share of securities firms is increasing. Securities firms' fund size increased by about 2.5 trillion KRW last year. The fund share rose from 20.0% in 2019 to 21.9% last year. Banks saw an increase of about 6.2 trillion KRW in funds, but their market share (69.3%) remained unchanged as the overall market size grew.

This appears to be influenced by returns. Securities firms allow direct purchase of Exchange-Traded Funds (ETFs) or REITs through IRPs, resulting in higher returns compared to other financial institutions.

According to the Financial Supervisory Service's Integrated Pension Portal, as of the first quarter of this year, the average IRP return for 14 domestic securities firms was 11.21%. This is significantly higher than banks (12 firms) at 4.7% and insurance companies (17 firms) at 3.34%. By company, Shin Young Securities recorded the highest return at 27.39%, followed by Korea Post Securities (13.7%), Yuanta Securities (13.41%), Korea Investment & Securities (12.49%), Mirae Asset Securities (11.37%), and Samsung Securities (11.23%). Looking at the 10-year long-term returns, Hana Financial Investment (3.18%) had the highest return, followed by Korea Investment & Securities (3.10%), IBK Pension Insurance (3.06%), Mirae Asset Securities (3.05%), and Daishin Securities (3.01%), all exceeding 3%. No banks recorded returns in the 3% range, with Shinhan Bank and Hana Bank having the highest returns at 2.54%.

The money move is expected to accelerate. An industry insider said, "Daishin Securities, Hanwha Investment & Securities, and Hyundai Motor Securities are either reviewing or have decided to participate in zero-fee policies, actively attracting customers," adding, "If the default option system, where financial firms operate retirement pension products according to the subscriber's investment profile when the subscriber does not give operation instructions, is introduced, the competitiveness of securities firms' IRPs will further increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)