Strengthening Oversight on Spreading False Information Causing Anxiety and Unilateral Contracts Using Monopoly Power

China Also Focuses on Price Stability Amid Inflation Concerns... Asset Price Increases Like Real Estate Pose Greater Problems

[Asia Economy Beijing=Special Correspondent Jo Young-shin] As international raw material prices such as iron ore showed abnormal signs, the Chinese leadership directly intervened to stabilize the situation. Judging that the rise in international raw material prices could affect domestic inflation, they decided to further strengthen management and supervision of speculative demand.

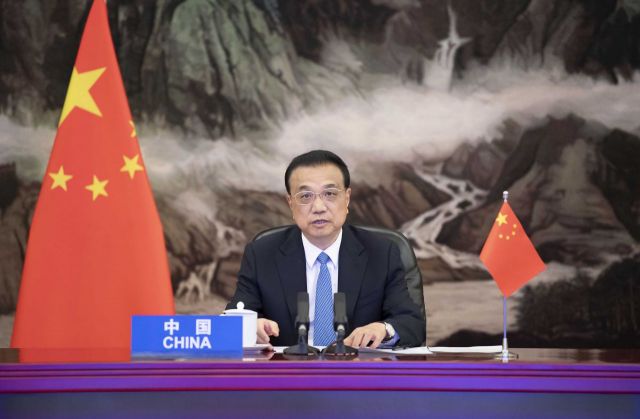

According to state-run Xinhua News Agency and People's Daily on the 20th, Chinese Premier Li Keqiang held a State Council meeting the previous day and requested active measures against speculative demand for raw materials that could impact domestic inflation.

Premier Li particularly ordered strict investigations into artificial price adjustments through hoarding, unilateral contract signing using monopoly status, and the spread of false information that stirs anxiety, and instructed that offenders be publicly punished upon detection.

Li also asked for the establishment of reasonable plans regarding currency policies such as the yuan exchange rate. Accordingly, the possibility of tolerating yuan appreciation for the time being has increased. Since June last year, the yuan has been on a downward trend, fluctuating around 6.4 yuan per dollar. Along with this, the Chinese State Council decided to expand financial support such as tax benefits for small and medium-sized enterprises (SMEs), as the rise in raw material prices is likely to lead to increased production costs for SMEs.

Earlier, Chinese customs authorities applied a '0%' import tariff on some steel products and raw materials on the 1st to protect the steel industry, which directly affects industrial production, and to curb inflation. On the other hand, export tariffs on ferrosilicon, ferrochrome, and high-purity pig iron were raised up to 25%.

This move by the Chinese State Council is seen as a preemptive measure stemming from inflation concerns. Last month, China's Consumer Price Index (CPI) rose only 0.9% year-on-year, but the Producer Price Index (PPI) increased by 6.8%. This is the highest since October 2017, directly influenced by rising international raw material prices. Since PPI affecting CPI could hamper China's economic growth, it is widely analyzed that Premier Li personally intervened.

On the other hand, there are opinions that non-productive sectors such as Chinese real estate prices are more likely to cause inflation. Chinese economic media Caixin analyzed that asset prices represented by housing prices are rising faster than prices of goods or services, and prices of high-end consumer goods are increasing much faster than low-priced consumer goods, suggesting that China may face internal structural inflation risks.

Xu Wei, a researcher at the State Council Development Research Center, stated, "The recent rise in China's PPI is of a different nature than during the 2008 global financial crisis," and analyzed, "It is influenced by demand and supply mismatches during the global economic recovery after the pandemic, acceleration of digitalization, promotion of global low-carbon policies, and asset price increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.