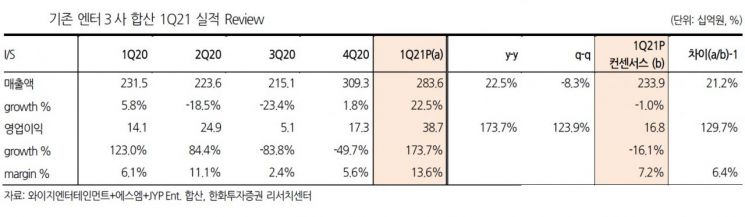

[Asia Economy Reporter Song Hwajeong] The three major existing entertainment companies?YG Entertainment, JYP Ent., and SM Entertainment?each recorded surprise earnings in the first quarter of this year, drawing increased attention to future investment points. Hanwha Investment & Securities identified the investment points for these three companies as growth in domestic and international intellectual property (IP) earnings based on fandom, expanded contribution from rookie groups, and improvements in management structure.

JYP Ent. posted sales of 32.3 billion KRW and operating profit of 13.8 billion KRW in the first quarter, exceeding the market consensus operating profit forecast of 8.3 billion KRW by 66%. Ji Inhae, a researcher at Hanwha Investment & Securities, analyzed, "Despite the absence of major activities, structural growth centered on domestic and international music sales was reflected, especially the U.S. album and music sales of Twice through Republic Records, and an increase in guarantees from the contract with Tencent Music in China last February. Additionally, the Japanese rookie group NiziU filled the performance gap in Japan after releasing their album." Accordingly, high-margin IP growth and increased revenue contribution from rookie groups significantly improved the gross profit margin (GPM) to 65%, and the operating profit margin reached 43%, marking the highest profitability ever.

SM Entertainment recorded sales of 154.3 billion KRW and operating profit of 15.3 billion KRW in the first quarter, driven by the most active activities. Operating profit significantly exceeded the consensus of 3.3 billion KRW. Researcher Ji said, "Besides the core business, the Chinese subsidiary (2.7 billion KRW) and DearU (3.2 billion KRW) posted profits, and profitability improved due to a reduction in fixed costs following the suspension of the COEX Artium business and the elimination of one-time expenses in the fourth quarter of last year."

Earlier, YG Entertainment also announced first-quarter sales of 97 billion KRW, an 84% increase compared to the same period last year, and successfully turned to operating profit of 9.5 billion KRW. YG Entertainment also recorded an earnings surprise by significantly exceeding the operating profit consensus of 5 billion KRW.

With solid performance, the outlook is positive. Researcher Ji stated, "Although the major three entertainment companies’ investment points have not been significantly damaged, the supply and demand for entertainment stocks have focused on HYBE, which is listed on the KOSPI, leading to continued stock price weakness. Despite the absence of offline performances, the strong first-quarter results were demonstrated, and if COVID-19 eases in the future, the resumption of offline performances could continue to benefit the post-COVID era. Above all, due to relatively lower concentration and lighter supply and demand, we maintain a positive view on these three companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.