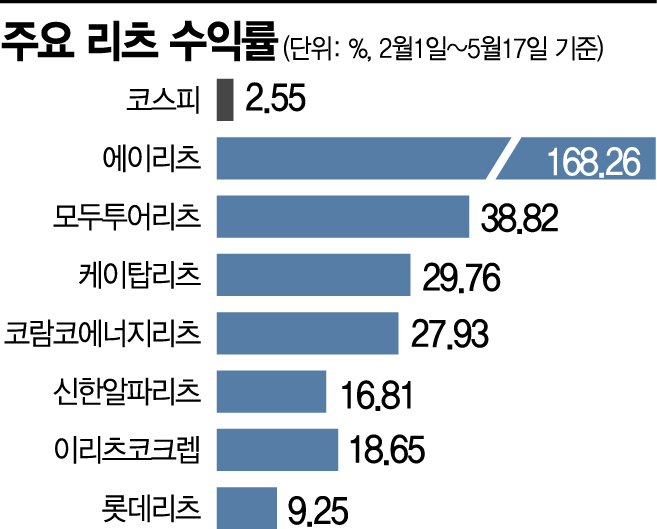

[Asia Economy Reporter Ji Yeon-jin] REITs (Real Estate Investment Trusts) are running at full speed. Following their dividend appeal, concerns over tightening due to inflation have grown this year, leading them to emerge as inflation-hedge stocks. Some REITs are recording triple-digit returns as they become themed stocks related to real estate policies ahead of next year's presidential election.

According to the Korea Exchange on the 18th, A-REITs rose 67.44% from the beginning of this month until the previous day. On the 12th, it jumped 28%, then plunged 13% the next day, but has since recorded double-digit gains consecutively. On the morning of the same day, it soared to 19,800 won, breaking its 52-week high.

This stock began to surge from last month. The rise of a judgment theory against the government's real estate policy in the Seoul mayoral by-election seems to have reflected expectations that REITs, an indirect real estate investment method, will benefit ahead of next year's presidential election. Additionally, with inflationary pressures increasing this year and concerns over tightening such as U.S. interest rate hikes, REITs have emerged as an inflation hedge, which analysts say has driven up stock prices. In fact, not only A-REITs but most listed REITs have shown an upward trend while the market remained sideways since the beginning of the year. Lee Kyung-ja, a researcher at Samsung Securities, explained, "Historically, REITs have been defensive against inflation," adding, "They compensate rental income by passing on interest rate hikes to rents, and especially global residential REITs have shown the most superior performance over the past 60 years."

The dividend appeal has also encouraged REIT investment. Except for A-REITs, K-Top REITs, and Modetour REITs, domestic REITs typically pay dividends twice a year. Most REITs have dividend yields exceeding 5%, much higher than the KOSPI dividend yield (2%). Furthermore, expectations for dividend expansion have grown with COVID-19 vaccinations. There is anticipation that stable income-generating real estate will benefit from economic normalization. In the U.S., REIT dividends were suspended last year due to the expansion of remote work during the COVID-19 pandemic. However, with major U.S. companies such as Goldman Sachs, JP Morgan Chase, and Google recently returning to office work, the possibility of asset price recovery has increased.

However, except for A-REITs, most REITs' upward momentum has somewhat weakened this month. Given the significant gains over recent months, concerns about a peak seem to be reflected. Looking at returns until the previous day this month, Modetour REITs surged 13.75%, but Lotte REITs rose 2.59%, Koramco Energy REITs 6.10%, K-Top REITs 6.34%, ESR Kendall Square REITs -1.39%, Shinhan Alpha REITs 0.86%, and iREITs Co-KREIT -0.96%, showing mixed results.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)