US Authorities Investigate Binance Exchange for Money Laundering and Tax Evasion

DarkSide Triggered by Pipeline Hacking Demands Bitcoin Payment... Investigation Complicated

Musk's Suspension of Bitcoin Payments Sparks Tesla Boycott "Market Disruption"

Domestic Existing Returns 500 Times... Serious Fraud Damage Targeting Margin Trading

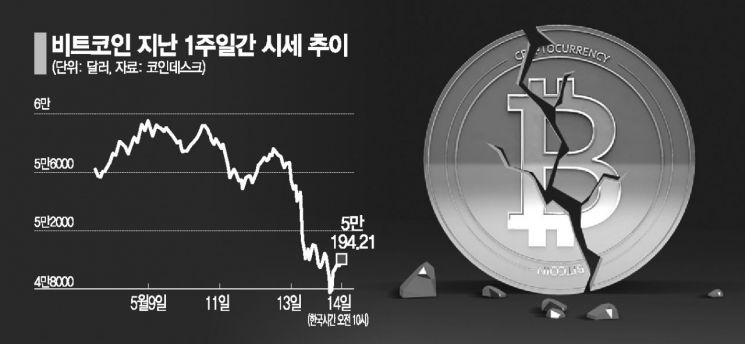

[Asia Economy Reporters Kim Suhwan and Gong Byungseon] On the 13th (local time), reports emerged that U.S. authorities are conducting investigations into money laundering and tax evasion allegations against Binance, sending shockwaves throughout the cryptocurrency industry. The market is interpreting this as a signal for new cryptocurrency regulations. Attention is focused on whether this will put a brake on reckless Bitcoin investments.

"Exploited for Money Laundering"... 'DarkSide' Also Demands Cryptocurrency

So far, U.S. authorities have criticized cryptocurrencies as tools for money laundering to conceal profits obtained from crimes such as drug trafficking. Since cryptocurrencies operate without a central controlling authority and utilize blockchain technology, which is encrypted, it is virtually impossible to trace financial transactions conducted with cryptocurrencies.

In fact, blockchain analysis firm Chainalysis announced last year that the volume of cryptocurrency-related criminal proceeds transacted on Binance overwhelmingly surpasses that of all other exchanges combined. According to the announcement, among $2.8 billion worth of illegal cryptocurrency transactions tracked by Chainalysis, 27%, or approximately $756 million, were conducted through the Binance platform.

The area around the crude oil storage facility of Colonial Pipeline, a U.S. pipeline operator [Image source=Reuters Yonhap News]

The area around the crude oil storage facility of Colonial Pipeline, a U.S. pipeline operator [Image source=Reuters Yonhap News]

DarkSide, which triggered the U.S. pipeline hacking incident, also demanded cryptocurrency as ransom payment. According to Bloomberg, Colonial Pipeline, the pipeline operator, paid nearly $5 million (about 5.67 billion KRW) in Bitcoin as demanded by DarkSide to restore the pipeline. Since Bitcoin is virtually untraceable, concerns have arisen that U.S. authorities’ investigation into DarkSide has become even more difficult.

Charlie Munger, vice chairman of Berkshire Hathaway and well-known business partner of investment guru Warren Buffett, criticized earlier this month, calling Bitcoin "a currency for kidnappers and embezzlers." Bloomberg reported, "Cryptocurrencies, which have struggled to integrate into the institutional system over the past few years, are now facing even greater regulatory pressure," adding, "The fact that untraceable cryptocurrencies can be used for crimes, as in the Colonial Pipeline incident, is an unacceptable risk for governments."

Untrustworthy Musk... Boycott Movement Also Emerges

Since Elon Musk announced that Tesla would stop accepting Bitcoin as a payment method for its cars, a boycott movement against Tesla has been spreading on social networking services (SNS). Following Musk’s decision and the subsequent decline in Bitcoin’s value, Bitcoin investors have criticized Musk for disrupting the market. Additionally, the hashtag '#Don‘t Buy Tesla' is spreading on Twitter, urging people not to purchase Tesla vehicles.

On the same day, The New York Times (NYT) reported that Musk may have sold all his Bitcoins before announcing the payment suspension. NYT called for a thorough investigation into this matter.

Musk has pointed to Dogecoin as a new cryptocurrency payment method and has started promoting Dogecoin. Through a tweet on the same day, Musk stated, "We are working with Dogecoin developers to improve payment efficiency." Immediately after this tweet was posted, Dogecoin surged by up to about 20%.

Investors Seeking Up to 500 Times Previous Returns

In South Korea, investors seeking extreme returns close to 500 times their original profits have emerged. Fraudulent activities targeting these investors have also appeared, becoming a social issue.

According to the cryptocurrency industry on the 10th, BitBuyKorea promoted itself as an exchange offering margin trading with leverage up to 500 times, but disappeared after collecting investment funds. The number of victims is estimated to be around 1,000, but the exact amount of damages has not even been tallied.

Margin trading is an investment method that allows investors to invest amounts several times greater than their deposited collateral, offering high returns but also significant risks. South Korea implicitly does not permit cryptocurrency margin trading. In 2017, the government banned initial coin offerings (ICOs), which were controversial due to fraud issues at the time, and also blocked margin trading. However, prosecutors dismissed charges related to margin trading. Although prosecutors did not disclose the reasons for dismissal, the industry speculates it was due to unclear grounds for punishment.

With regulatory blind spots confirmed and the cryptocurrency market heating up, investors chasing high returns are flocking in. In fact, content boasting huge profits or explaining how to conduct cryptocurrency margin trading can be easily found on YouTube and online communities. When YouTuber A broadcasted generating profits through margin trading on overseas exchanges, viewers left comments asking for methods and study tips on margin trading.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.