Outstanding Household Loans at 5 Major Banks Increase by 9.2 Trillion KRW in April

Mortgage Loan Rates Rise for 7 Consecutive Months, Credit Loan Rates Also Up for 2 Months

Speculative Asset Investment Surges, Increasing Default Risk

[Asia Economy Reporters Sunmi Park, Seungseop Song] The massive shift of market funds from low-interest deposits to speculative high-yield, high-risk financial products is interpreted as a warning sign that household debt defaults may increase. As the base interest rate is expected to remain at the current level for some time due to the impact of COVID-19, investors seeking to avoid becoming 'lightning beggars' are expected to increase their investments in stocks, cryptocurrencies, and other assets instead of meager deposit interest.

Furthermore, since there is a time lag until the financial authorities' 'Household Loan Management Measures' take full effect in July, the enthusiasm for investing in high-yield assets is likely to continue for the time being. Experts have expressed concerns that with the effective rise in loan interest rates this year, speculative loans without proper measures could become a trigger for financial market instability. In particular, they warned that virtual assets are risky because they have no intrinsic value and are purely driven by supply and demand, making them susceptible to sudden crashes without reason.

Debt Pile Continues to Grow Despite Rising Interest Rates

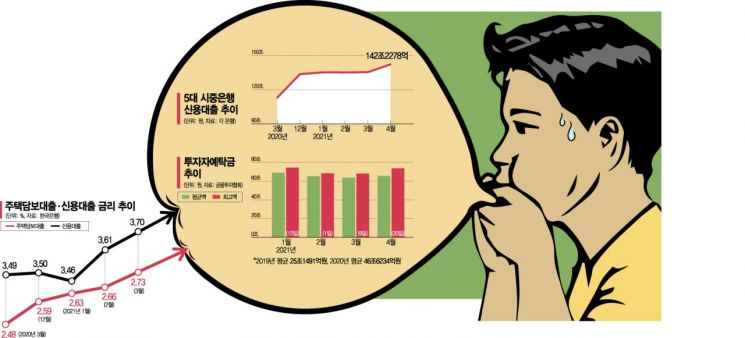

According to the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?as of the end of April, the outstanding balance of personal credit loans reached KRW 142.2278 trillion. This is an increase of KRW 6.8401 trillion compared to the end of March, marking an all-time high. This monthly increase is the largest since November last year (KRW 4.8495 trillion increase), when the banks began compiling credit loan data, breaking the record after five months. It also exceeds the monthly credit loan increase limit of KRW 2 trillion set by financial authorities by more than three times.

Due to the sharp surge in credit loans, household loans across banks are also soaring. The outstanding balance of household loans last month was KRW 690.8622 trillion, up KRW 9.2 trillion from KRW 681.6357 trillion at the end of March. The increase of over KRW 9 trillion last month is nearly three times the increases in February (KRW 3.79 trillion) and March (KRW 3.4 trillion). Although stricter real estate market regulations have slowed the growth of mortgage loans, they have had no effect in curbing household loan growth.

The problem lies in rising loan interest rates. According to the latest statistics from the Bank of Korea, the overall household loan interest rate (weighted average, based on new loans) for deposit banks in March was 2.88%, up 0.07 percentage points from 2.81% in February. The credit loan interest rate rose 0.09 percentage points from 3.61% to 3.70%, and the mortgage loan interest rate increased 0.07 percentage points from 2.66% to 2.73%, continuing an upward trend for two and seven consecutive months, respectively. The credit loan interest rate is at its highest since February last year (3.70%), and the mortgage loan interest rate is at its highest since June 2019 (2.74%).

While financial consumers are increasing household debt to cope with higher loan interest payments, the economic environment has not clearly improved due to the ongoing COVID-19 situation, and money is flowing into speculative assets, increasing the risk of defaults. Typically, defaults or delinquencies occur after a certain period following loan issuance. Loans issued during periods of rapid growth are relatively more likely to become non-performing. This is why there are concerns that the surge in household debt could threaten financial stability.

The Korea Institute of Finance stated, "As temporary measures such as maturity extensions or interest payment deferrals imposed by financial authorities due to COVID-19 normalize, latent defaults may surface," adding, "Measures that only adjust loan repayment methods or periods to ensure a soft landing may only delay defaults."

Experts Warn of Money Movement Risks Linked to Speculative Assets

Most experts analyze that the accelerating money movement phenomenon is connected to the speculative assets currently rampant in the market.

Professor Donggeun Cho, Emeritus Professor of Economics at Myongji University, said, "People are ready to withdraw money at any time to buy stocks, Bitcoin, and other virtual assets," warning, "It is dangerous that many people in their 20s and 30s are putting all their money into speculative assets." He added, "Money is flowing in even though there is no official announcement of big wins. If the price bubble of assets without intrinsic value bursts, the negative impact on the market will be significant."

Professor Sangbong Kim of Hansung University’s Department of Economics also noted, "The surge in credit loans and the reduction in deposits indicate that funds have moved to stocks or the cryptocurrency market," analyzing, "In the past, money movement was thought to flow into real estate, but given the high prices now, that is difficult to expect." He further pointed out, "Virtual assets are purely driven by supply and demand, so they are risky and could crash without reason."

There is also an assessment that an environment allowing money movement to continue is being created. Professor Taeyoon Sung of Yonsei University’s Department of Economics explained, "As interest rates are expected to rise, funds are first moving from fixed deposits to 'parking accounts,'" adding, "This reflects the psychology of waiting to put money into high-interest products after waiting for interest rates to rise further."

Although financial authorities announced 'Household Loan Management Measures' at the end of last month to curb the surge in household loans, the measures will take effect after July. Meanwhile, 'last-minute demand' to borrow before then is expected to drive continued money movement toward speculative assets for the time being.

In particular, the financial authorities plan to announce expanded financial support measures for housing ladders targeting the homeless and youth within this month. Since these measures target the 20s and 30s age group leading the money movement, concerns about side effects from loan easing have also emerged.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.