[Asia Economy Reporter Minji Lee] Caterpillar, the global No.1 construction machinery company, is expected to continue strong performance based on improving demand in the North American region. On the 2nd, Caterpillar closed at $228.11, up 0.26% from the previous trading day as of the 30th. Since the beginning of this year, Caterpillar's stock price has risen about 25%.

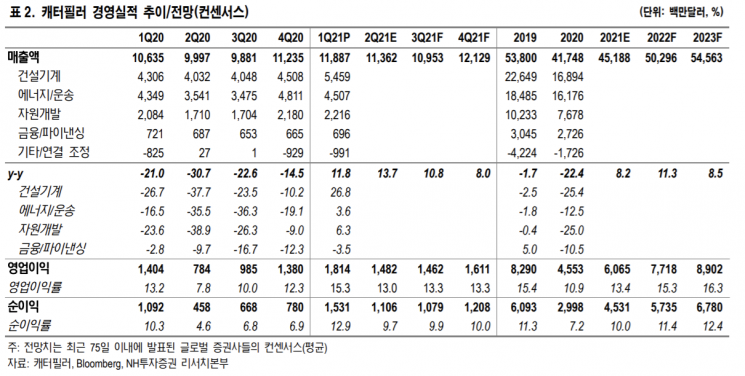

Caterpillar reported Q1 results with revenue of $11.9 billion and operating profit of $1.8 billion, up 11.8% and 29.2% respectively compared to the same period last year. Revenue and operating profit exceeded market expectations by 13.4% and 27.4%, respectively. KB Securities analyst Yoo Dong An said, "The high growth of the Chinese construction machinery market significantly increased sales in the Asia-Pacific region, contributing to the earnings growth," adding, "The increase in construction equipment demand led to dollar inventory expansion and sales volume growth, and cost reduction efforts lowered manufacturing costs, which positively impacted Q1 results."

By business segment, construction machinery grew 27% to $5.5 billion compared to the same period last year, while energy & transportation improved by 4% to $4.5 billion, and resource development by 6%. By region, the Asia-Pacific region recorded $3 billion in sales, growing 31%. The strong growth in Asia-Pacific driven by Chinese infrastructure investment momentum is expected to continue through Q2. Europe and Africa increased 13% to $2.7 billion, and Latin America rose 24% to $1.1 billion during the same period. North America remained flat at $4.9 billion year-over-year. Since North America was severely affected by COVID-19, it is expected to rebound relatively late. NH Investment & Securities analyst Yoon Yoo Dong explained, "Signs of recovery were detected in North America during Q1, and growth is expected to be strongest in Q2," adding, "Emerging markets, except for some areas like India, have entered a turnaround."

Caterpillar did not provide a separate earnings forecast for this year, citing ongoing uncertainties due to COVID-19. However, the company stated that strong performance could continue with economic recovery driven by increased COVID-19 vaccination rates and rising suburban housing demand. Furthermore, considering that U.S. President Biden announced a $2.2 trillion infrastructure investment plan on the 1st, demand recovery in advanced markets centered on the U.S. is expected to become more prominent in the second half of the year.

With the recovery of advanced markets, domestic excavator companies are also expected to benefit. Analyst Yoon Yoo Dong said, "The strength of the Chinese market is prolonging, and the recovery of advanced markets is faster than expected, so the earnings outlook for domestic companies is also positive," adding, "Doosan Bobcat, which generates more than 70% of its sales in North America, and Jinseong T.E.C., which counts such companies as clients, will benefit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)