LG Electronics Tops Global Home Appliance Sales in 1Q, Surpassing Whirlpool

1Q Sales Gap Exceeds 700 Billion KRW for the First Time

Expectations Rise for First Annual No.1 Year

Despite Semiconductor Supply Crisis, "Proactive Response, No Issues"

[Asia Economy Reporters Su-yeon Woo and Hyun-jin Jung] LG Electronics recorded its best-ever quarterly performance in the first quarter of this year, surpassing Whirlpool to become the world's number one home appliance company. Despite the global semiconductor shortage, LG Electronics proactively addressed component supply issues and plans to widen the gap with Whirlpool.

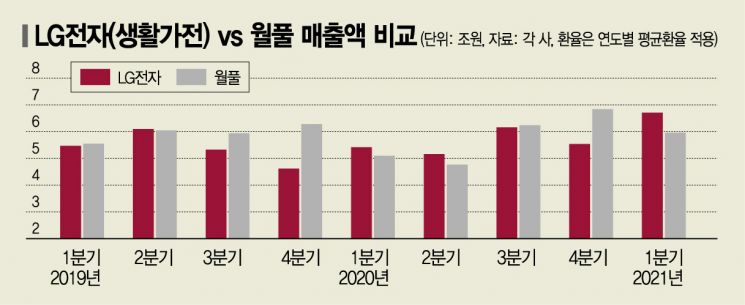

According to industry sources on the 30th, LG Electronics' Home Appliance & Air Solution (H&A) division posted sales of 6.71 trillion KRW in the first quarter, extending its lead over Whirlpool, which recorded 5.96 trillion KRW, by more than 700 billion KRW. This is the first time LG Electronics has led Whirlpool by over 700 billion KRW in quarterly sales.

While LG Electronics has outperformed Whirlpool in operating profit since 2017, it had previously conceded the top spot in annual sales volume to Whirlpool. Although LG Electronics led in the first and second quarters last year, Whirlpool's strong performance in the fourth quarter prevented LG from overtaking it in annual sales.

However, this time, with a sales gap exceeding 700 billion KRW in just the first quarter, expectations are rising that LG Electronics could surpass Whirlpool in annual sales and claim the top position in the global home appliance market. Whirlpool, which has focused on a 'low-margin, high-volume' strategy with mid-range models, has led in sales volume until now. But LG Electronics' strategy emphasizing new appliances such as dryers, stylers, dishwashers, and premium products appears to be working, suggesting that this year could be the inaugural year for LG to become the global leader in home appliance sales.

During the earnings conference call held the previous day, LG Electronics projected significant profit growth in the second quarter compared to the same period last year, driven by strong sales of home appliances and TVs as well as increased revenue from the automotive components business. This outlook seems to be underpinned by confidence in their proactive semiconductor supply management.

The global semiconductor shortage has recently caused production disruptions across manufacturing sectors, including automobiles, TVs, smartphones, and home appliances. In particular, the surge in TV sales due to increased 'stay-at-home demand' during COVID-19 has led to a shortage of the key component DDI (Display Driver IC), while the shortage of automotive semiconductors has made factory shutdowns at major automakers more visible.

In the conference call, LG Electronics IR officer Sang-bo Shim stated, "Since the home appliance business uses general-purpose chips, there has not yet been a significant impact on sales related to semiconductor supply." He added, "We have secured adequate inventory of DDI chips used in TVs and are in close consultation with suppliers, so there is no major concern regarding semiconductor supply shortages for TVs."

Regarding the concentrated shortage of automotive semiconductors, Shim acknowledged that some production disruptions might occur with certain clients starting in the second quarter, but emphasized that LG Electronics' Vehicle Component Solutions (VS) division's plan to return to profitability in the second half of this year remains unaffected. Shim said, "We anticipate risks with some clients from the second quarter due to automaker production disruptions and expect increased costs from dual sourcing of parts, but through efficient supply chain management, achieving the goal of returning to profitability this year appears feasible."

Thanks to the strong performance in home appliances and automotive components, LG Electronics' full-year consolidated earnings consensus has expanded to 69.58 trillion KRW in sales and 4.11 trillion KRW in operating profit. From the second quarter onward, the mobile business division, which is scheduled to be discontinued, will no longer affect earnings, accelerating the improvement in performance.

Kyung-tak Noh, a researcher at Eugene Investment & Securities, said, "In the second quarter, we expect increased sales of seasonal appliances such as air conditioners and new growth appliances, strong performance of premium products like OLED TVs, and growth in the automotive components segment," adding, "Operating profit is expected to exceed 1 trillion KRW for the second consecutive quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)