KIRI Hosts Public Hearing on Auto Insurance to Establish Rational Treatment Practices

Mandatory Submission of Medical Certificates for Treatments Over 3 Weeks

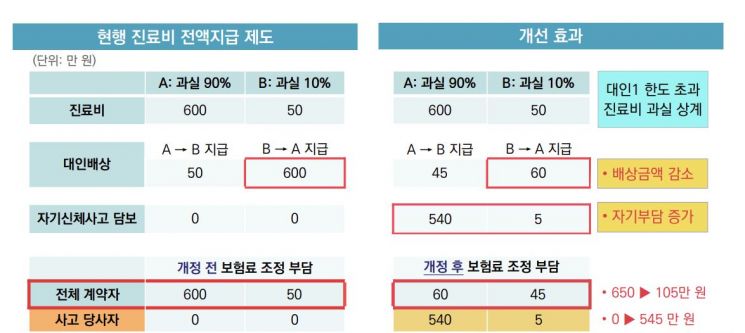

Excess Medical Expenses Beyond Bodily Injury Level 1 to Be Covered by Own Damage Insurance Proportionate to Fault

[Asia Economy Reporter Ki Ha-young] A plan is being promoted to mandate the submission of medical certificates for minor injury patients who require treatment for more than three weeks after a traffic accident. Additionally, measures reflecting fault in the burden of treatment costs exceeding the scope of liability insurance are also being considered. This is to prevent excessive medical treatment of minor injury patients, which is cited as a main cause of automobile insurance premium increases.

Jeon Yong-sik, Senior Research Fellow at the Korea Insurance Research Institute, announced the "Improvement Plan for Medical Treatment Practices for Minor Injury Patients in Automobile Insurance," which centers on these points, at the "Public Hearing on Establishing Rational Treatment Practices for Automobile Insurance" hosted by the Korea Insurance Research Institute on the 22nd.

Minor injury patients refer to those classified as injury grades 12 to 14. The medical expenses paid to minor injury patients surged from 345.5 billion KRW in 2014 to around 1 trillion KRW in 2020. The per capita medical expenses for minor injury patients also more than doubled from 330,000 KRW in 2014 to 650,000 KRW in 2019. The Financial Services Commission estimates the scale of excessive medical treatment at 540 billion KRW.

Mandatory Submission of Medical Certificates for Minor Injury Patients Treated Over 3 Weeks

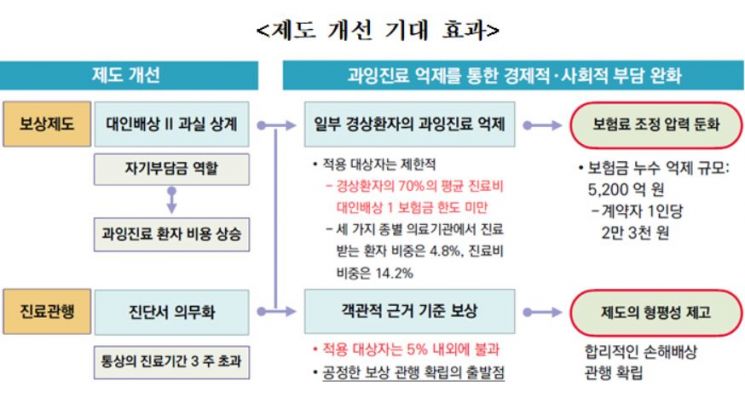

Senior Research Fellow Jeon proposed mandating the submission of medical certificates for minor injury patients who wish to receive treatment for more than three weeks to improve medical treatment practices. It is estimated that about 5% of minor injury patients receive treatment for more than three weeks. Jeon said, "Minor injury patients can receive unlimited treatment based solely on subjective pain complaints without verification of injury or recovery." He added, "Mandating medical certificate submission can curb incentives for excessive treatment among some minor injury patients."

Similar systems are already in place overseas. The UK is promoting mandatory medical certificates during settlement processes, Japan does not pay insurance benefits without a medical certificate, and Spain and Italy require medical proof of minor injuries to pay insurance benefits.

Offsetting Medical Expenses Beyond Liability Insurance Limit According to Fault Ratio

A plan was also proposed to offset medical expenses for minor injury patients exceeding the liability insurance limit (Personal Injury Compensation 1) according to the fault ratio. Medical expenses exceeding the Personal Injury Compensation 1 insurance limit would be offset in the voluntary insurance Personal Injury Compensation 2 based on fault, and any shortfall due to fault offset would be covered by the Personal Injury Protection coverage. The Personal Injury Compensation 1 limit for minor injuries graded 12 to 14 ranges from 500,000 to 1.2 million KRW. The average medical expenses for 70% of minor injury patients are below the Personal Injury Compensation 1 insurance limit.

Senior Research Fellow Jeon said, "This approach reduces compensation amounts and increases self-pay, thereby lowering the overall burden on policyholders while increasing the burden on accident parties, protecting good policyholders." He advised, "To ensure prompt treatment rights, it would be desirable to adopt a 'pay first' system followed by the insurer recovering the portion corresponding to the insured's fault afterward."

He added, "While guaranteeing sufficient treatment for good minor injury patients, we expect that improving treatment practices will curb excessive treatment among some minor injury patients, easing pressure on premium adjustments, and that mandatory medical certificates will establish objective evidence-based compensation practices."

Expected to be Implemented as Early as the Second Half of the Year

Amid rising public calls for measures to curb automobile insurance premium hikes, the Financial Services Commission announced plans to prepare measures to control medical expenses for minor injury patients. The Korea Insurance Research Institute presented this improvement plan after discussions with the Financial Services Commission. The government plans to finalize improvements to the minor injury patient compensation system after reviewing opinions gathered through public hearings and other channels.

Mandatory medical certificates for long-term treatment require amendments to the Ministry of Land, Infrastructure and Transport notifications, while reflecting fault in medical expenses exceeding the Personal Injury Compensation 1 limit can be implemented through revisions to the standard insurance terms, so implementation is expected as early as the second half of the year.

Ahn Cheol-kyung, President of the Korea Insurance Research Institute, emphasized, "The problem of excessive medical treatment for minor injury patients is a typical moral hazard caused by information asymmetry. The issue must be resolved through fundamental institutional improvements."

Kim Tae-hyun, Secretary General of the Financial Services Commission, said, "In the past, there were many seriously injured patients from vehicle-pedestrian accidents, but now most minor injury patients result from minor collisions between vehicles. To reduce the cost burden on good drivers caused by excessive treatment of some minor injury patients, a reasonable compensation plan for treatment costs for minor injury patients is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)