Coupang and eBay's Rapid Growth Drives E-commerce Transactions to 161 Trillion Won Last Year

Department Store Sales Fell 16% Last Year but Rose Over 30% This Year

Home Shopping TV Broadcast Sales Plummet for Third Year... Transmission Fees Also a Burden

[Asia Economy Reporter Jo In-kyung] One year and four months after the outbreak of COVID-19, the three major distribution channels?e-commerce, department stores, and TV home shopping?are undergoing a major transformation. E-commerce, fueled by the non-face-to-face trend, has experienced rapid growth and is continuing its steep growth trajectory this year with new growth engines centered on mobile platforms such as live broadcasts. Department stores are seeing a V-shaped rebound as pent-up consumption over nearly a year has exploded into revenge buying, leading to a sharp increase in sales of luxury goods and more. On the other hand, TV home shopping, which once sold well just by broadcasting, has been unable to escape a decline for several years despite the non-face-to-face era.

Distribution Channel Black Hole: E-commerce

The e-commerce market is building an impregnable fortress among mainstream channels through the COVID-19 period. In particular, it continues to soar by absorbing consumers who have moved away from TV home shopping, department stores, and large discount stores.

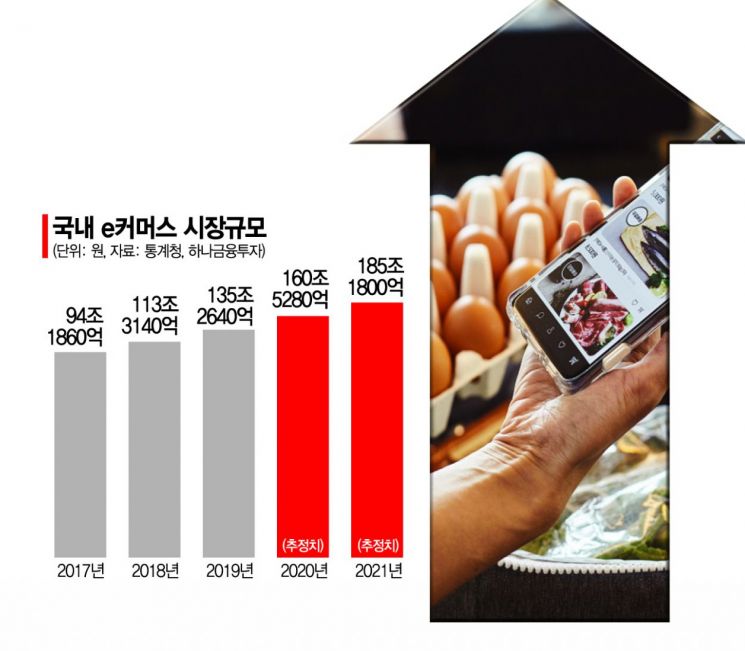

According to Statistics Korea, last year, the domestic online shopping transaction amount was estimated at 161 trillion KRW, an 18.7% increase from 135.264 trillion KRW in 2019. E-commerce companies such as Coupang and eBay Korea have grown rapidly, and large retail conglomerates like major discount stores are strengthening logistics and delivery systems to improve their online channel and speed-focused business models. The domestic e-commerce market is expected to grow rapidly to 185 trillion KRW this year.

The live commerce market, the mobile version of TV home shopping, is also expanding its presence. Especially with IT companies like Naver and Kakao joining the live commerce market, the so-called 'digitalization of consumption' is progressing rapidly. The live commerce market, which was worth 400 billion KRW last year, is expected to grow to 2.8 trillion KRW this year.

Department Stores Confirm V-shaped Rebound

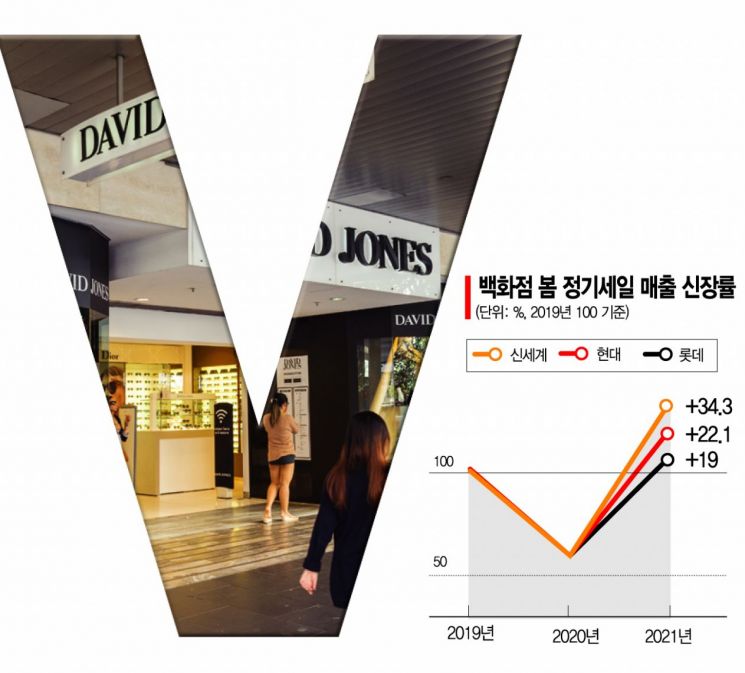

Department stores are also smiling broadly. Last weekend, department stores that concluded their first regular sale of the year saw sales increase compared to before COVID-19. Last spring’s regular sale saw sales drop by up to 16% year-on-year due to COVID-19, but this year sales increased by more than 30% compared to 2019. This is the result of the full-scale sales of luxury and fashion products.

A department store official said, "Last year, consumers flocked to the e-commerce market, including online shopping, and traditional offline channels like department stores experienced the worst period in history. This year, as customers have started going out again, we expect even more people to visit after COVID-19."

Major domestic department stores expect this strong performance to continue through May, the month of family celebrations with high consumption on gifts and dining out, as long as there are no variables such as a sharp increase in confirmed cases or stricter social distancing measures. A retail industry official said, "We believe consumer sentiment is still in the recovery phase. As vaccination expands and expectations for the end of COVID-19 rise, we anticipate unlimited competition among distribution channels with comprehensive sales growth both online and offline, centered on travel and dining out."

TV Home Shopping Declines for Third Consecutive Year

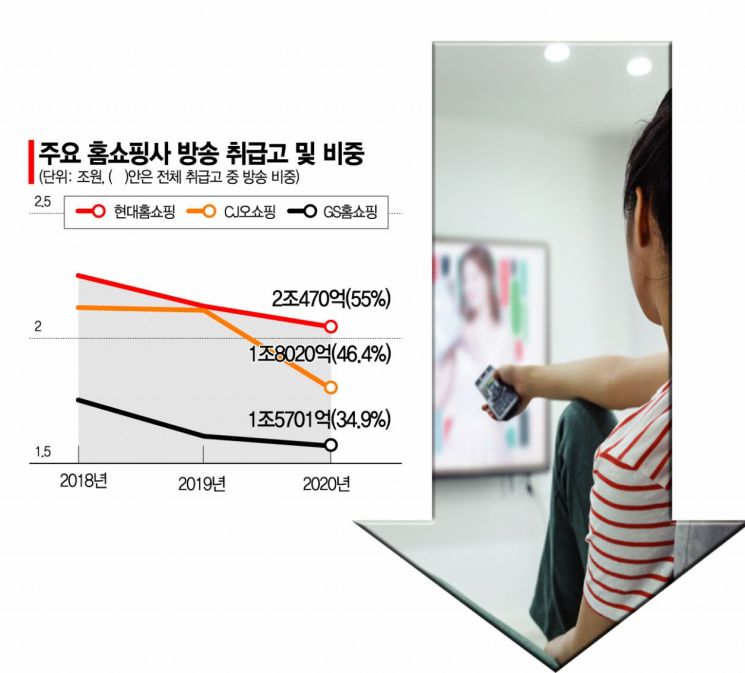

According to the home shopping industry, TV home shopping (broadcast) transaction volume has been sharply declining for three years. For example, CJ O Shopping’s broadcast transaction volume dropped 14.7% from 2.1123 trillion KRW in 2019 to 1.802 trillion KRW last year. GS Home Shopping’s broadcast transaction volume decreased by more than 10% over three years from 2018 to 2020, and Hyundai Home Shopping recorded 2.047 trillion KRW in broadcast transaction volume last year, down nearly 100 billion KRW year-on-year.

The sales structure of home shopping companies is also changing. According to the Korea TV Home Shopping Association, the share of broadcast transaction volume among the seven domestic home shopping companies fell from 50.8% in 2016 to 48.9% in 2017, then continued to decline to 47.0% in 2018 and 46.3% in 2019. Instead, the share of digital sales such as mobile apps and live commerce has increased significantly.

The outlook is not good. TV viewing time continues to decrease, reducing customers, while transmission fees are increasing. Of the 3 trillion KRW in broadcast sales from the seven home shopping companies, 1.55 trillion KRW is paid as fees to pay-TV operators. Considering that about half of sales go to fees and various broadcasting-related regulations, there are complaints that the broadcasting business license may have to be surrendered in a few years.

Hwang Ki-seop, director of the Korea TV Home Shopping Association, explained, "Despite the growing influence of online and mobile markets and the decreasing number of TV home shopping viewers, the home shopping industry, which can only operate by securing favorable channels, is inevitably at the mercy of pay-TV operators. A significant portion of home shopping companies’ profits is transferred as transmission fees, which inevitably get passed on to partner companies or consumers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.