North America's First Bitcoin Inverse ETF

Market Cap and Trading Volume Below Expectations Since Launch

Will Bitcoin Investors Switch? Doubts Arise

[Asia Economy Reporter Junho Hwang] Horizons ETFs, a Canadian subsidiary of Mirae Asset Global Investments, launched North America's first Bitcoin exchange-traded fund (ETF) on the 15th, but it received a disappointing performance in its early days. This product allows investors to indirectly invest in Bitcoin by tracking an index that follows Bitcoin prices, but it seems to be shunned by investors, unrelated to the Bitcoin craze.

North America's First Bitcoin Inverse ETF, but...

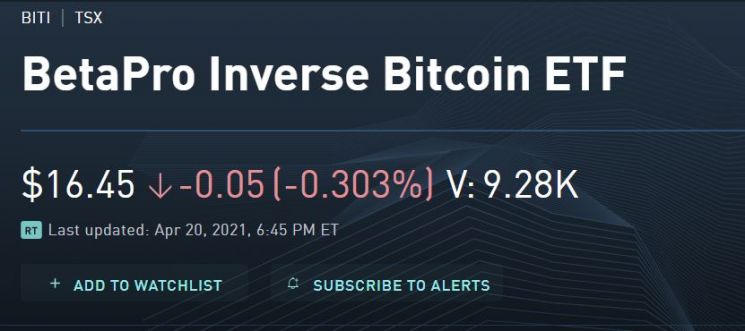

According to the Toronto Stock Exchange in Canada on the 20th (local time), the market capitalization of the Bitcoin inverse product BetaPro Inverse Bitcoin ETF (BITI) was only 4.277 million Canadian dollars (3.8 billion KRW). Although it attracted attention from major overseas media due to being the first product in North America to bet on Bitcoin's decline, it is actually being ignored by investors.

Horizons stated via email that they failed to secure institutional participation during the initial fundraising. A company official explained, "Usually, initial funds can be raised through banks, but Bitcoin is a highly volatile product, making it difficult to raise initial funds through banks."

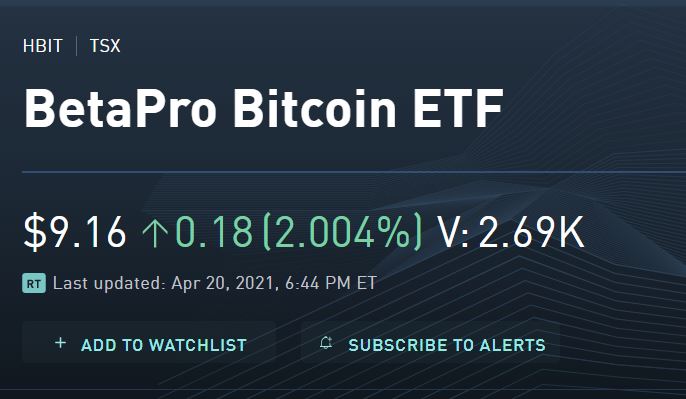

The trading volume was only 9,281 shares. Due to the low trading volume, the premium/discount rate caused by the net asset value (NAV) not being properly reflected in the closing price expanded. On the 16th, BITI rose 2.52% compared to the previous closing price following a decline in Bitcoin prices, whereas BetaPro Bitcoin ETF (HBIT), which invests in the same index in the positive direction, fell 4.01%. Both products, tracking the same index in opposite directions, were launched on the same day (the 15th), but the nearly doubled fluctuation rate made BITI's returns appear to be halved.

Horizons explained, "The closing price is based on the last traded price, so if the last trade occurs too early before market close, or during call auction periods or large block trades, there is a possibility of price distortion. We believe that as trading volume increases, prices will form closer to the NAV."

Can Bitcoin Investors Switch to ETFs?

Since the NAV is not publicly disclosed, it is difficult to know the actual value of the ETF. Horizons only posts the NAV on their website after inquiries are made through Mirae Asset.

Within the industry, there are also skeptical opinions about whether there will be any secondary effects on Bitcoin. An industry insider said, "Since the product has only recently been launched, we need to observe, but considering the high-risk, high-return nature of Bitcoin investors, it remains to be seen whether they will put money into ETFs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)