This Month, Lee Dal Group's New Head to Be Decided... 'Right Time' to Start Governance Restructuring

Securing Hyundai Mobis Shares and Preparing Gift Tax 'Ammunition' Upon Listing

Expected to Strengthen Future Mobility Strategy Implementation

[Asia Economy Reporter Minwoo Lee] With the listing of Hyundai Engineering, the restructuring of Hyundai Motor Group's governance, where Hyundai Mobis takes on the role of the holding company, is expected to accelerate. Through this listing, Chung Euisun, chairman of Hyundai Motor Group and the second-largest shareholder of Hyundai Engineering, will be able to secure additional shares of Hyundai Mobis, which were somewhat insufficient, while also raising the necessary funds for inheriting shares from his father, Honorary Chairman Chung Mong-koo.

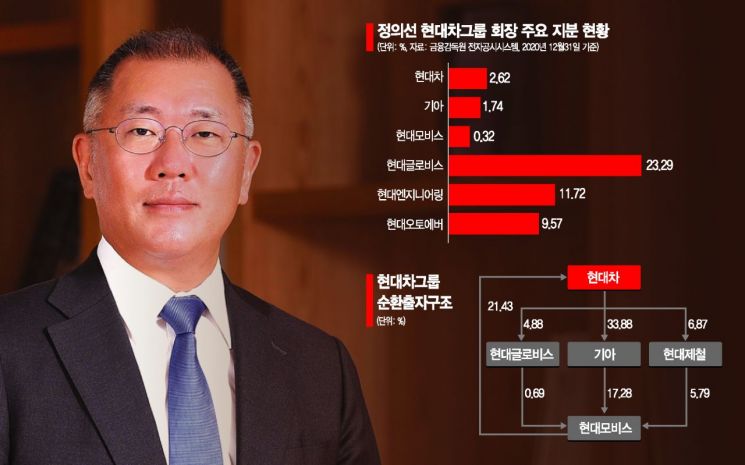

According to industry sources on the 13th, Hyundai Motor Group is expected to officially begin restructuring its governance starting with the listing of Hyundai Engineering. Currently, Hyundai Motor Group maintains a circular shareholding structure of ‘Hyundai Mobis → Hyundai Motor Company → Kia → Hyundai Mobis.’ Hyundai Mobis is the largest shareholder of Hyundai Motor Company with a 21.43% stake, Hyundai Motor Company is the largest shareholder of Kia with 33.88%, and Kia, in turn, holds a 17.28% stake in Hyundai Mobis, completing the loop. According to the Fair Trade Commission, Hyundai Motor Group is the only one among the top 30 domestic conglomerates that has not resolved this circular shareholding structure. If the change of the same person (controlling shareholder) applied to the Fair Trade Commission is announced as early as this month, Chairman Chung will succeed Honorary Chairman Chung as the new group head, making it an opportune time for governance restructuring.

◆Securing Funds for Governance Restructuring = With the listing of Hyundai Engineering, Chairman Chung is expected to secure the ‘funds’ necessary for governance restructuring. Currently, Hyundai Mobis effectively acts as the holding company within Hyundai Motor Group. However, Chairman Chung’s stake in Hyundai Mobis is only 0.32%. According to the Financial Supervisory Service’s electronic disclosure system, Chairman Chung also holds shares in Hyundai Motor Company (2.62%), Kia (1.74%), Hyundai Glovis (23.29%), and Hyundai Engineering (11.72%). In the short term, cash is needed to stably secure shares of Hyundai Mobis. Additionally, funds are required to pay gift taxes and other expenses when inheriting Honorary Chairman Chung’s 7.13% stake in Hyundai Mobis. Considering Chairman Chung’s 11.72% stake in Hyundai Engineering upon its listing, it is expected that he will be able to secure cash stably.

After securing control over Hyundai Mobis, it is anticipated that governance restructuring will be carried out in the mid-to-long term through Hyundai Glovis, in which Chairman Chung holds a large stake. Hyundai Motor Group had previously attempted to break the circular shareholding loop. In 2018, they proposed splitting Hyundai Mobis into core parts business and module & AS parts business, then merging the module & AS parts division with Hyundai Glovis. The plan was for Chairman Chung to purchase additional shares of Hyundai Mobis and reorganize the governance structure as ‘Chung Mong-koo & Chung Euisun → Hyundai Mobis → Hyundai Motor Company → Kia.’ However, this plan was voluntarily withdrawn due to attacks from the U.S. hedge fund Elliott and the market’s lukewarm response.

◆Governance Restructuring + Strengthening Future Industries= This time, a plan has been proposed to complement the past approach by splitting and listing the AS division, which accounts for over 60% of Hyundai Mobis’s total corporate value, and then merging it with Hyundai Glovis. The surviving Hyundai Mobis entity would conduct a public tender offer for Glovis, and if major shareholders such as Honorary Chairman Chung and Chairman Chung participate, the major shareholder control over Hyundai Mobis would naturally be strengthened. It is also favorable that Elliott, which had previously blocked the plan, sold all its shares in Hyundai Motor affiliates and exited early last year.

Future strengthening of the mobility business centered on electric vehicles is also expected to accelerate. With companies in which Chairman Chung holds significant stakes supporting this, there is speculation that Hyundai Engineering could even pursue businesses combining construction and mobility. By empowering Hyundai Glovis (logistics), Hyundai Engineering (construction), and Hyundai AutoEver (software), all companies where Chairman Chung holds shares, it is analyzed that Hyundai Motor Group aims to realize ‘human-centered mobility’ beyond just automobiles.

Earlier, Chairman Chung announced at the Consumer Electronics Show (CES) held in Las Vegas, USA, that the company would transform from a car-selling company into a ‘smart mobility solutions company.’ To this end, he presented concepts such as Urban Air Mobility (UAM), Purpose-Built Vehicles (PBV), and Mobility Transfer Hubs (Hub), outlining a vision to provide a foundation where future cities and people can create more value free from spatial and temporal constraints. An industry insider commented, “The companies in which Chairman Chung holds significant shares are well-suited to pursue this vision,” adding, “(This listing) could be a turning point where the grand vision for a more distant future begins to be realized.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.