[Asia Economy Reporter Minji Lee] There are opinions that PayPal will gain an advantage in the future financial services industry with the launch of its cryptocurrency payment service.

According to industry sources on the 10th, PayPal launched 'Checkout with Crypto,' a simple payment service using cryptocurrency, for its U.S. members. Customers can purchase goods with virtual currency at millions of global online merchants, and the company plans to expand the number of merchants to about 30 million in the future. Bitcoin, Ethereum, Bitcoin Cash, and Litecoin are available currencies with no additional fees. PayPal converts virtual currency into regular currency and pays the merchants, allowing merchants to process payments without significant risk.

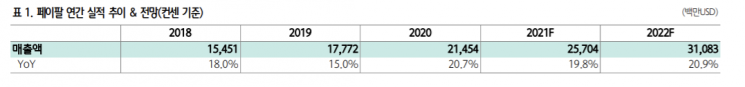

The primary effect of launching the cryptocurrency service is the influx of new members and an increase in active users. Last year, the net new members reached 75 million, more than double the previous average. This year's forecast is 50 million, higher than market expectations, reflecting anticipation for innovative and diverse new services. At the end of last year, daily active users increased by 30% year-on-year due to a surge in app visits following the launch of new services such as cryptocurrency trading. The payment amount per active user increased by 12%.

Jaeyim Kim, a researcher at Hana Financial Investment, said, "It is encouraging that all activity metrics have reached an inflection point and turned around," adding, "In the short term, the cryptocurrency payment service will contribute to accelerating the growth rate of average revenue per user (ARPU)."

In the mid to long term, it is judged that PayPal has built a foundation to become a leader in the future financial services industry by enhancing technological competitiveness and system capabilities in payment and financial services. The issuance of digital currencies by central banks worldwide is not a distant future story, and to respond to these changes, payment network operators such as Visa and MasterCard have recently started pilot programs applying cryptocurrency as a payment method.

PayPal is the most advanced in utilizing cryptocurrency as a payment method, and it appears to have a significant competitive edge, especially by leveraging its 30 million merchant members. Researcher Kim said, "Considering that business capabilities using digital currency will be the most important competitive advantage, PayPal seems to be the most advanced."

Concerns exist that cryptocurrency price fluctuations could affect stock prices. However, cryptocurrency price volatility is expected to rather increase member activity indices and not directly impact PayPal's performance. Researcher Kim stated, "PayPal's market growth potential will further improve amid changes in payment and financial services," adding, "The impact of volatility related to cryptocurrency will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)