[Asia Economy Reporter Lee Seon-ae] This year, the initial public offering (IPO) market is expected to set a record for the highest amount of public offering funds ever. The first quarter saw an unprecedented IPO boom, and a major player is set to enter the market again in April. With many large-scale new listings still waiting in the second half of the year, an unprecedented record for public offering funds is likely to unfold this year.

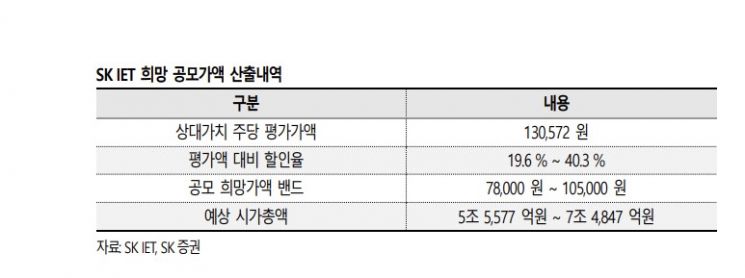

According to the financial investment industry on the 9th, the major player awaited by the April IPO market is SK IET (SK IE Technology), a subsidiary of SK Innovation engaged in the secondary battery separator business. Although aiming for a May listing, investor interest is high as the demand forecast will be conducted over two days from the 22nd to the 23rd, and the public subscription will take place from the 28th to the 29th. SK IET's desired public offering price band is 78,000 KRW to 105,000 KRW, and based on this price band, the expected corporate value is approximately 5.5577 trillion KRW to about 7.4847 trillion KRW.

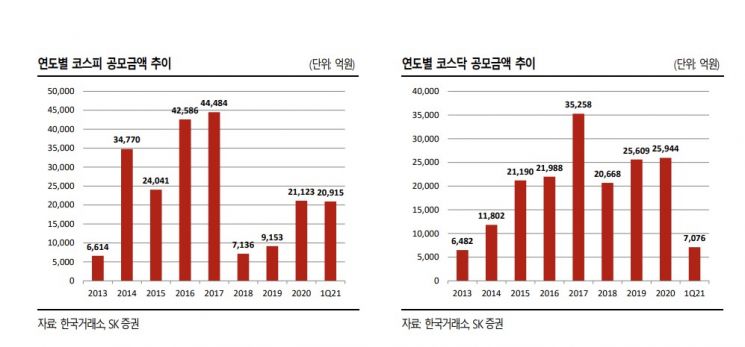

Last year, the KOSPI recorded about 2.1 trillion KRW in public offering funds annually, but this year, the amount surpassed 2 trillion KRW in the first quarter alone. Thanks to SK Bioscience (listed in March), which attracted subscription deposits of 63 trillion KRW, easily surpassing the previous record held by Kakao Games (about 59 trillion KRW).

In May, SK IET is preparing for a listing with a public offering amount estimated between 1.6 trillion KRW and 2.2 trillion KRW. Considering this, the KOSPI market is expected to achieve public offering funds in the 4 trillion KRW range in the first half of this year, approaching the level of 2017. Although the KOSDAQ recorded only about 700 billion KRW in public offering funds up to the first quarter, it is highly likely to achieve the highest level of public offering funds ever for the year. This is because companies such as Krafton, Kakao affiliates including Kakao Pay, Kakao Bank, Kakao Page, and LG Energy Solution, which was newly launched after spinning off from LG Chem, are waiting. Krafton recently submitted its preliminary review application for listing on the Korea Exchange's KOSPI market. Krafton is a company recognized for its value comparable to Nexon, NCSoft, and Netmarble with just one game, 'Battlegrounds,' which has achieved global success. There are expectations that Krafton's market capitalization could reach up to 30 trillion KRW.

Na Seung-du, a researcher at SK Securities, said, "If the current enthusiasm for public offerings continues, there is a very high possibility that this year will achieve the highest level of public offering funds ever."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.