"Full-scale Growth This Year... Aiming to Grow Corporate Value to 1 Trillion Won Within 5 Years"

Localization of Gas Transport Pipeline Parts... Supplying to the World's No.1 Equipment Company

Entering the Global Semiconductor Market... Growing Expectations for a Supercycle

Asplo headquarters, a semiconductor piping parts manufacturer located in Hwaseong, Gyeonggi.

Asplo headquarters, a semiconductor piping parts manufacturer located in Hwaseong, Gyeonggi. Photo by Asplo

[Asia Economy Reporter Junhyung Lee] "This year, we have entered a full-fledged growth phase. We plan to grow 20-30% annually and develop into a company valued at 1 trillion KRW within five years."

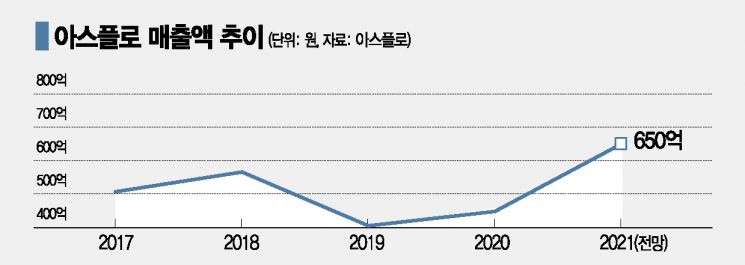

‘Asflo,’ a semiconductor piping parts manufacturer in Hwaseong, Gyeonggi Province, has experienced ups and downs in recent years due to a sluggish market, but expects clear growth starting this year. The background is that from the second half of this year, it will supply parts to Company A, the global No. 1 semiconductor equipment maker. Company A holds about a 20% market share in semiconductor equipment, purchasing semiconductor parts worth approximately 800 billion KRW annually.

It was not easy from the beginning. Large semiconductor equipment companies did not deal with small Korean parts manufacturers. The key for parts used in semiconductor processes, which must operate 24/7 without stopping, is ‘reliability’ that proves quality such as durability. If production stops due to defective parts, huge losses can occur. There was no reason to take risks and use parts from a startup before other companies did.

Kang Doohong, CEO of Asflo, explained, "To supply parts, we had to obtain reliability certification, but they wouldn’t even give us the opportunity to verify performance." He added, "So we equipped ourselves with expensive testing equipment, secured reliability data ourselves, and then knocked on the door again." The company was registered as an OEM (Original Equipment Manufacturer) supplier for Company A in 2018 and received vendor certification this year.

Localization of US and Japanese Monopolized Piping Parts... Reduced Unit Price by 40%

Asflo is the first company to localize gas transport piping parts used in semiconductor processes. Previously, these parts were monopolized by the US and Japan. Semiconductor piping requires strong corrosion resistance and cleanliness, and without advanced heat treatment technology, it was impossible to manufacture domestically. CEO Kang worked as an engineer at Samsung Electronics’ first-tier supplier in the 1990s, bringing in semiconductor piping technology from Japan. Exposure to Japanese technology gave him confidence in localization. When the company closed due to the 1998 IMF financial crisis, he started his own company.

The beginning was modest. Kang was the only R&D personnel. Capital was only 100 million KRW borrowed as venture startup funds. Awareness of localization was also negative. Kang said, "In the past, the semiconductor industry was reluctant about localization of materials, parts, and equipment (SoBuJang) because close cooperation among various companies was difficult and trust in domestic products was low."

As technologies necessary for localization were developed one by one, the government began to take interest. Two years after founding, the Ministry of Trade, Industry and Energy (then Ministry of Commerce, Industry and Energy) provided 2.3 billion KRW in technology development funds. In 2005 and 2006, Asflo was selected as a parts supplier for Samsung Electronics and SK Hynix consecutively.

The main competitive edge against strong US and Japanese parts companies was price. Asflo’s piping parts were about 30-40% cheaper than imported parts. Kang said, "Domestic companies could reduce import dependence at relatively lower costs. When we lowered prices first, overseas parts companies also reduced their prices." The Ministry of SMEs and Startups (then Small and Medium Business Administration) awarded Asflo the Industrial Medal in 2018, recognizing that "Samsung Electronics and SK Hynix achieved import substitution effects exceeding 1 trillion KRW with Asflo parts," Kang explained.

Full-Scale Entry into Global Market... Expectations for Semiconductor Supercycle

The company’s next growth phase is entry into the global semiconductor equipment market. CEO Kang sees supplying parts to Company A as a foothold for expanding sales channels. Being a certified supplier to the industry leader Company A allows active targeting of other equipment makers such as ASML in the Netherlands. Kang said, "Even if you combine the sales of domestic semiconductor equipment companies, it does not reach the sales of Company A alone; the global market is on a different scale." He added, "This year, we plan to additionally introduce reliability testing equipment, prepare data, and approach global equipment companies anew."

The semiconductor supercycle (long-term boom) this year also contributes to optimism. Asflo expanded and relocated its factory at the end of last year to meet demand. The size of R&D personnel is planned to more than double from the current 15. According to the Semiconductor Equipment and Materials International (SEMI), the semiconductor equipment market size will grow from 77.7 trillion KRW last year to 81.1 trillion KRW this year. Semiconductor equipment sales this year are expected to be about 76 trillion KRW, a 16% increase from last year’s approximately 64.9 trillion KRW.

There is also a growing new business. The company supplies parts to Samsung Biologics and Celltrion. Piping used in bio processes requires lower technical skills than semiconductor piping, so market entry was not difficult. Kang said, "Although the semiconductor piping market is still about five times larger, we cannot overlook the growth potential of the bio industry." He added, "We already have sufficient technical capabilities and are confident in our competitiveness in the bio market as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)