Bank of Korea 'Overseas Economic Focus'

[Asia Economy Reporter Kim Eun-byeol] Green bond issuance and financial support for green companies are gaining momentum due to the Chinese government's proactive commitment. The scale of green bond issuance, which had slowed down last year due to COVID-19, surged by more than 400% in the first quarter.

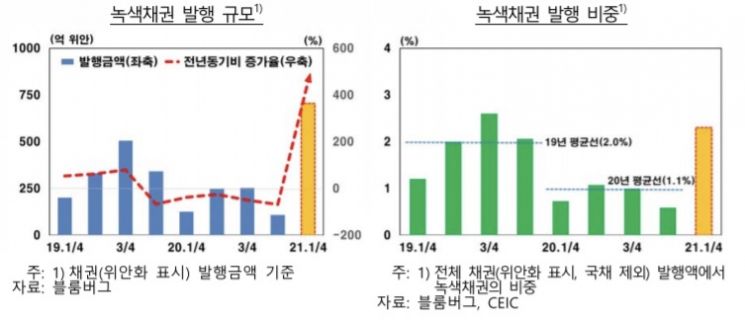

According to the 'Overseas Economic Focus' released by the Bank of Korea on the 4th, the issuance of green bonds (bonds issued to secure investment funds for eco-friendly projects such as solar and wind power) in the Chinese bond market increased by 443.1% year-on-year in the first quarter.

Last year, due to the impact of COVID-19, the amount of green bonds issued in China decreased, with an annual issuance amount of 74.55 billion yuan. This was a 46.7% decrease compared to 2019, and the market share based on issuance amount also dropped from 2.0% to 1.1%. However, this year, green bond issuance has increased mainly by policy banks and state-owned power companies, recovering to pre-COVID-19 levels. Representative examples include the China Development Bank, State Power Investment Corporation (a state-owned power company), and the Yangtze Three Gorges Group (which operates and manages the Three Gorges Dam).

The Bank of Korea explained, "The recent increase in green bond issuance in China reflects the Chinese government's long-term commitment to expanding the green economy."

Amid President Xi Jinping's declaration to achieve carbon neutrality by 2060, this year's Two Sessions set a goal to increase the share of eco-friendly energy from 15% to 20% by 2025.

Goldman Sachs also forecasted, "With various financial support policies being promoted to back eco-friendly policies, there will be significant changes in green finance, including green bonds."

The Chinese Central Financial and Economic Affairs Commission selected green finance development as a core policy task during the 14.5 Five-Year Plan period, and the People's Bank of China announced policies last month to strengthen financial support such as preferential interest rates for carbon reduction companies and funding support for eco-friendly projects.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)