98.8% of Open Market Vendors Support Fair Trade Act Enactment

6 out of 10 Delivery App Vendors Say "Hard to Operate Without Using App"

SME Central Association: "Burden on Vendors Passed to Consumers... Legal Regulation Urgently Needed"

On the 2nd, a delivery worker recruitment notice was posted at a local center of a delivery agency in downtown Seoul. Due to the resurgence of the novel coronavirus disease (COVID-19), the volume of delivery orders has surged, causing ongoing difficulties in securing delivery workers. According to Baedal Minjok, the total number of orders during the week of August 24-30, when the COVID-19 spread was severe, increased by 26.5% compared to the last week of July (July 20-26). Photo by Kim Hyun-min kimhyun81@

On the 2nd, a delivery worker recruitment notice was posted at a local center of a delivery agency in downtown Seoul. Due to the resurgence of the novel coronavirus disease (COVID-19), the volume of delivery orders has surged, causing ongoing difficulties in securing delivery workers. According to Baedal Minjok, the total number of orders during the week of August 24-30, when the COVID-19 spread was severe, increased by 26.5% compared to the last week of July (July 20-26). Photo by Kim Hyun-min kimhyun81@

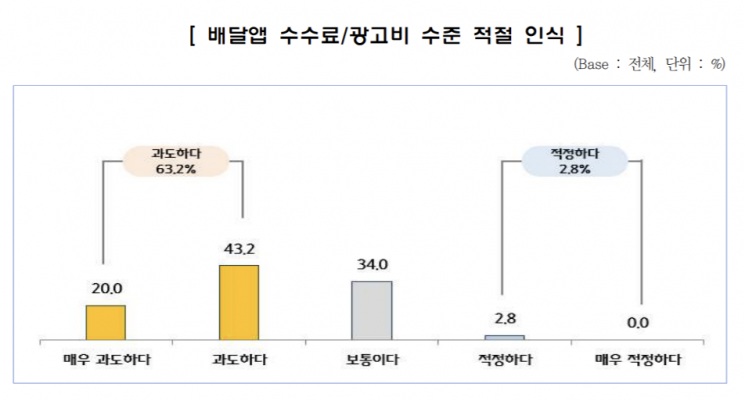

[Asia Economy Reporter Junhyung Lee] More than six out of ten delivery application vendors perceive the commissions and advertising fees paid to delivery apps as excessive.

The Korea Federation of SMEs announced the results of a survey conducted on 1,000 vendors operating on online platforms such as open markets and delivery apps on the 31st. Among vendors on delivery apps like Baedal Minjok, 63.2% responded that "the level of commissions and advertising fees is excessive." Of these, 20% said it was "very excessive." Only 2.8% responded that the commissions and advertising fees were at an appropriate level.

Perception of the appropriateness of delivery app commission fees and advertising costs.

Perception of the appropriateness of delivery app commission fees and advertising costs. Photo by Jungso-Gieop Joonganghoe

Most vendors were positive about the "Online Platform Fairness Act (Fairness Act)" proposed by the Fair Trade Commission. Among delivery app vendors, 68.4% and among open market vendors, 98.8% supported the enactment of the Fairness Act.

As reasons for supporting it, 51.2% of delivery app vendors and 39.5% of open market vendors cited "establishing a concrete basis for responding to unfair trade practices." Regarding additions or future improvements needed for the Fairness Act, both open market and delivery app vendors most frequently mentioned "establishing cost limits or guidelines."

The Fairness Act, currently being promoted by the Fair Trade Commission, is a kind of "online gap-jul relationship law." It includes provisions such as imposing fines of up to 1 billion KRW if online platform operators engage in unfair practices against vendors.

The brokerage commissions for delivery apps generally matched the publicly disclosed commission levels. According to the disclosed commissions, Yogiyo charges 12.5%, Coupang Eats charges 15% or 1,000 KRW per order, etc. Baedal Minjok had no commission fees.

However, most vendors were found to use either fixed-rate or percentage-based advertising. In particular, 87.6% of Baedal Minjok vendors used fixed-rate advertising, while 41.2% of Yogiyo vendors used percentage-based advertising. Fixed-rate advertising involves paying a fixed amount monthly, while percentage-based advertising charges a certain percentage of the order payment amount as advertising fees.

The average monthly sales commission for open market vendors was up to 12.5%. In the case of open markets, the satisfaction rate with product exposure opportunities was relatively high at 69%. On the other hand, satisfaction rates for sales commissions and advertising fees were not high, at 36.8% and 35.6%, respectively.

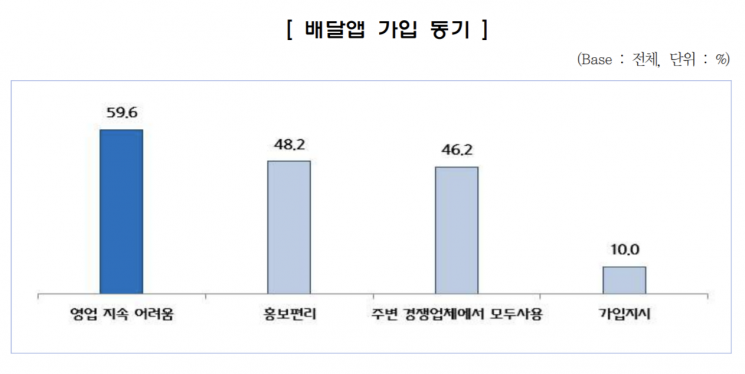

Six out of ten (59.6%) delivery app vendors responded that they joined because it would be difficult to continue business without using the app. This was followed by responses such as "convenient promotion" (48.2%), "all nearby competitors use it" (46.2%), and "franchise headquarters' instruction to join" (10%).

Among respondents, 94.8% of delivery app vendors were registered with Baedal Minjok, and 79.2% with Yogiyo. The main trading platforms were Baedal Minjok (57.6%), Yogiyo (26%), and Wemakeprice O (7%) in that order. Among open market vendors, 65% were registered with Gmarket, and 54.8% with 11st.

The average monthly sales ratio generated through online platforms steadily increased for delivery apps: 48.6% in 2018, 53.2% in 2019, and 56.6% last year. For open markets, it increased from 41.4% in 2018 to 41.6% in 2019 and 45.6% last year. The increase in online consumption due to COVID-19 appears to have influenced last year's sales.

Jumoon Gap, head of the Economic Policy Division at the Korea Federation of SMEs, said, "Online platform usage has become active due to COVID-19," adding, "Many vendors are complaining about excessive cost burdens and unfair trade practices." He stated, "The majority of small and medium-sized enterprises and small business owners operating on platforms believe that legal regulation of platform intermediary transactions is urgently needed," and emphasized, "It is necessary to ensure fairness in the transaction ecosystem through the prompt enactment of the Online Platform Fairness Act."

He added, "The burden on vendors ultimately gets passed on to consumers," and stressed, "At least a minimum guideline should be established regarding the cost burden of commissions and advertising fees for vendors on online platforms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)