[Asia Economy Reporter Minji Lee] Demaekan is expected to show performance growth based on the structural growth of the Japanese food delivery market.

According to Korea Investment & Securities on the 27th, first-quarter sales this year are estimated to reach 4.2 billion yen, a 132% increase compared to the same period last year. Operating losses are expected to continue at 3.2 billion yen. Bloomberg forecasts this year's sales to grow 134% year-on-year to 24.1 billion yen.

Demaekan is a leading food delivery service provider in Japan. It operates a platform connecting restaurants and consumers, collecting a portion of the amount generated from delivery and takeout orders as commission. Competitors include Uber Eats and Rakuten Delivery. So-yeon Lee, a researcher at Korea Investment & Securities, explained, "Among competitors, Demaekan has secured the largest number of affiliated restaurants (33,000) and offers outdoor delivery using GPS functionality. A key strength is that delivery personnel are store employees or affiliated staff, not individual contractors."

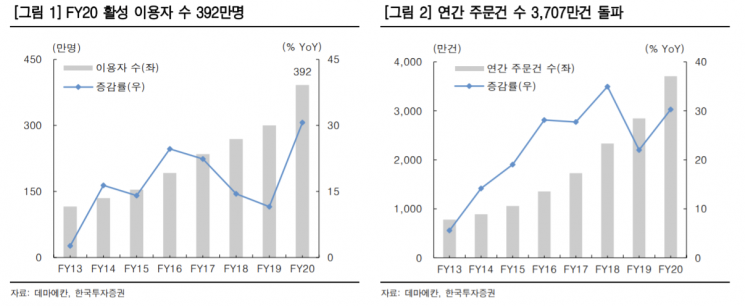

The penetration rate of online food delivery was 41% in Singapore and 36.7% in Hong Kong as of May last year, but Japan's rate remains low at 16.6%. This is due to the widespread culture of lunch boxes and convenience stores in Japan. However, structural growth in the food delivery market is occurring due to the state of emergency declarations and consumption tax rate increases caused by COVID-19. The number of users increased significantly as restaurants shortened operating hours and outdoor activities were restricted during the state of emergency.

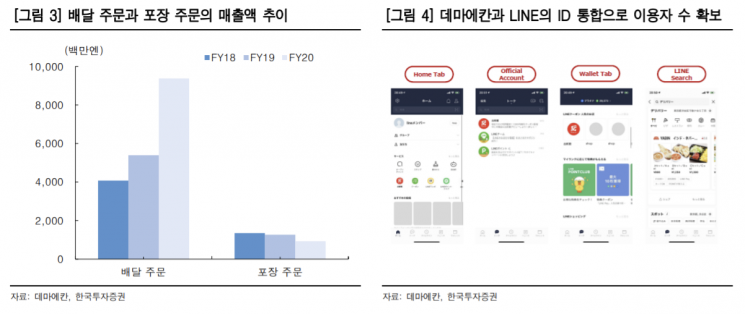

Researcher Lee stated, "During the 2019 consumption tax rate increase from 8% to 10%, the previous tax rate (8%) was maintained only for takeout and delivery to minimize tax friction. Since dining in restaurants requires paying more, there is sufficient incentive to use Demaekan."

Last year, sales reached 10.3 billion yen with an operating loss of 2.6 billion yen. Sales grew 54.6% year-on-year, but operating losses continued following the previous year. The sustained losses are estimated to be due to excessive spending on securing franchise stores and brand marketing costs.

Recently, Naver and Line became the largest shareholders, potentially securing 84 million Line users as prospective customers. Researcher Lee said, "Following collaboration with Line, we are focusing on acquiring new users by partnering with popular restaurants in a cloud kitchen format."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)