CEO Family Identified as 'Papyong Yoon Clan'

Net Loss Increased by 109.3% to 5.8 Billion KRW

No Dividend Missed Since 1998

The election to choose the next president is just one year away. Speculative funds betting on leading presidential candidates are rapidly increasing in the domestic stock market. Theme stocks related to top-ranking figures in the '2022 presidential candidate approval ratings,' such as Lee Nak-yeon, a member of the Democratic Party of Korea, Lee Jae-myung, Governor of Gyeonggi Province, and former Prosecutor General Yoon Seok-youl, are surging. As former Prosecutor General Yoon's approval ratings rise sharply, the stock price volatility of listed companies managed by his university alumni in executive positions has also increased. Asia Economy aims to examine the business performance and financial stability of political theme stocks.

[Asia Economy Reporter Jang Hyo-won] Seongbo Chemical, a crop protection product manufacturer, is a high-dividend stock. Since 1998, when its business reports became available, it has never missed a dividend payment in 23 years. Despite a declining performance trend and recording losses in the past two years, it decided to pay dividends with a dividend yield in the 3% range last year. This is analyzed to be due to the high ownership stake of the founding family.

However, recently, the ownership stake of the founding family has somewhat decreased. This is because some shares were sold after the stock price surged as it was grouped as a 'Yoon Seok-youl theme stock.'

Losses Continued for Two Consecutive Years

According to the Financial Supervisory Service's electronic disclosure on the 22nd, the largest shareholder and CEO of Seongbo Chemical is Mr. Yoon Jeong-seon. He has been with the company for 12 years and 10 months and holds a total of 6,772,990 shares (33.83%). Mr. Yoon inherited the shares and has been managing the company since 2007 after the passing of his father, Yoon Jae-cheon, President of Seongbo Chemical.

Mr. Yoon is the eldest granddaughter of Yoon Jang-seop, the last merchant of Kaesong and a famous cash king of the 1980s, who is the honorary chairman of the Seongbo Group. He is also the nephew of Yoon Jae-dong, Chairman of Seongbo Chemical, and Yoon Kyung-rip, Chairman of Yuhwa Securities. Mr. Yoon holds 0.01% of Yuhwa Securities' shares, and both Chairman Yoon Kyung-rip and Yuhwa Securities hold 0.32% and 2.81% of Seongbo Chemical's shares, respectively.

Seongbo Chemical's CEO family is known as the 'Papyong Yoon clan,' and the company has been grouped as a theme stock related to former Prosecutor General Yoon. However, it is not known whether former Prosecutor General Yoon and the Seongbo Chemical founding family have close interactions.

According to the Papyong Yoon clan association, while the association sends newsletters to former Prosecutor General Yoon, he does not actively participate in clan activities. It is also unknown whether the Seongbo Chemical family participates in the clan association activities. In such uncertain circumstances, the stock price fluctuated simply because they share the same surname.

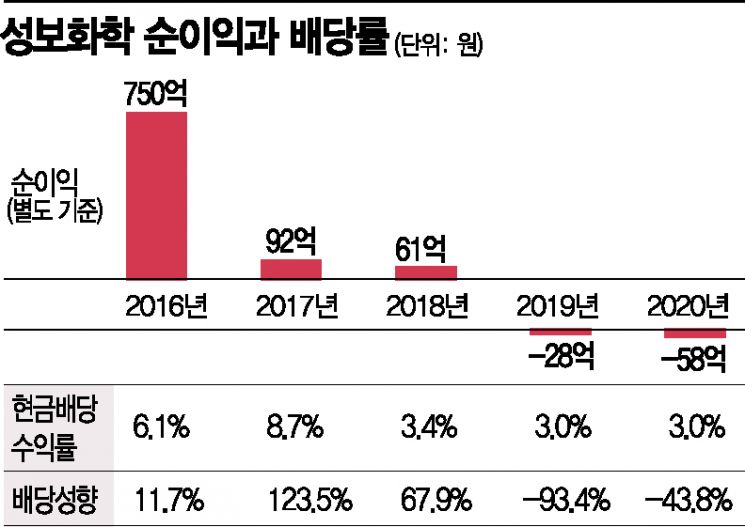

From a corporate perspective, Seongbo Chemical's performance has been declining annually and turned to losses starting in 2019.

Seongbo Chemical produces and sells crop protection products such as insecticides, fungicides, and herbicides. The sales composition is highest for herbicides at 36.1%, followed by fungicides (31.9%) and insecticides (22.9%).

Seongbo Chemical's separate financial statements show that last year's sales increased by 23.7% year-on-year to 51.7 billion KRW. Operating losses decreased by 14.7% to 3.7 billion KRW compared to the previous year, while net losses expanded by 109.3% to 5.8 billion KRW.

The increase in net loss was due to a 3.5 billion KRW impairment loss on tangible assets. This relates to the powdered products among the crop protection products manufactured by Seongbo Chemical. Since farmers recently prefer not to use powdered products, the company anticipated a decline in sales of related products and preemptively impaired the powder manufacturing equipment. This is a non-cash loss.

Consistent Dividends... Sold Shares as Stock Price Rose

Although performance has been sluggish over the past two years, dividends have been consistently paid. On the 9th, Seongbo Chemical resolved to pay a dividend of 135 KRW per share for last year's settlement. The dividend yield is 3.0%, and the total dividend amount is about 2.6 billion KRW. Despite recording net losses, retained earnings of about 82 billion KRW were accumulated, enabling the dividend payment. The same dividend amount was paid in 2019 as well.

Seongbo Chemical has been paying high dividends annually. Although the dividend yield recently hovered around 3%, it was 8.7% in 2017 and 6.1% in 2016.

The high dividend is analyzed to be due to the high ownership stake of the founding family. As of the end of last year, the largest shareholder and related parties held about 73.51% of shares. Of the total dividend of 2.6 billion KRW, about 2 billion KRW is received by the founding family.

Currently, the founding family's ownership has decreased to the 60% range. On the 10th, when the stock price rose as a 'Yoon Seok-youl theme,' about 1.16 million shares were sold on the market at around 6,000 KRW per share.

A Seongbo Chemical official said, "Seongbo Chemical has paid dividends every year so far, but it has not been decided whether dividends will continue in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.