Start of National Assembly Discussions on Class Action Act

Insurance Companies with Many Complaints Actively Prepare

[Asia Economy Reporter Oh Hyung-gil] As the 'Class Action Act' and the 'Commercial Act Amendment,' which expand class actions and punitive damages, are set for discussion in the National Assembly, Directors and Officers (D&O) liability insurance, which guarantees the legal responsibilities of CEOs and executives, is rapidly gaining attention.

In particular, financial companies with many customer complaints are actively preparing for potential future lawsuits by setting coverage limits as high as 100 billion KRW. As lawsuits against companies, such as class actions, become easier, the demand for D&O liability insurance is expected to increase further.

According to the financial industry on the 11th, Samsung Life Insurance paid 1.835 billion KRW in premiums last year to its affiliate Samsung Fire & Marine Insurance to subscribe to D&O liability insurance.

Samsung Fire & Marine Insurance subscribed to insurance with Hyundai Marine & Fire Insurance and KB Insurance for premiums of 950 million KRW. The coverage limit for the two companies is 100 billion KRW, the highest set amount among financial companies subscribed to D&O liability insurance.

D&O liability insurance compensates for damages and litigation costs borne by executives when shareholders or third parties file lawsuits against executives for damages due to wrongful acts that are not intentional but involve breaches of duty. It is renewed annually on a one-year basis.

It has become common in advanced countries such as the United States, where corporate lawsuits are active, but in South Korea, it began to attract attention after the 2000s following the Asian financial crisis as accountability for poor management by executives increased.

Especially last year, as the Ministry of Justice announced legislation expanding the scope of class action application and introducing punitive damages through the Class Action Act and Commercial Act amendments, there has been a trend of increasing subscription amounts or new subscriptions.

Samsung Life & Fire, 100 Billion KRW Coverage Limit 'Largest in Financial Sector'

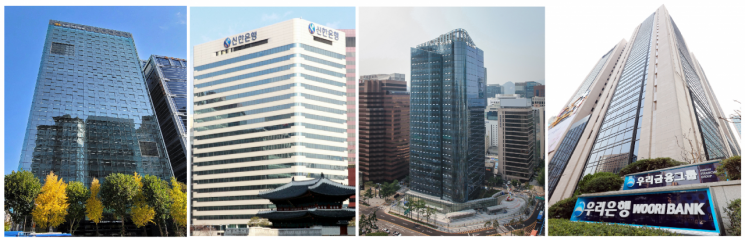

The four major domestic financial groups subscribed using a bulk enrollment method that includes all executives of subsidiaries. The coverage limit was the same for all four at 50 billion KRW.

Shinhan Financial Group and Hana Financial Group set the self-pay amount for outside directors' D&O liability insurance at 20% or more of the liability amount (up to 100 million KRW), while KB Financial subscribed to a special clause related to the Act on External Audit of Stock Companies, providing an additional 25 billion KRW coverage.

Insurance companies with relatively high complaint rates are more proactive. Hanwha Life Insurance, which has been subscribed to D&O liability insurance since 2000, paid 200 million KRW in premiums last year for a 40 billion KRW insurance policy. DB Insurance subscribed to Meritz Fire & Marine Insurance with a 70 billion KRW coverage limit, paying 560 million KRW in premiums.

Some life insurers mainly subscribe through affiliated non-life insurers. DB Life Insurance subscribed to DB Insurance with a coverage limit of 7 billion KRW (premium 82 million KRW), and Heungkuk Life Insurance subscribed to Heungkuk Fire & Marine Insurance with a coverage limit of 10 billion KRW (premium 100 million KRW).

The insurance industry expects that if damages increase due to institutional improvements in corporate lawsuits, the demand for D&O liability insurance will expand further.

According to the Korea Insurance Research Institute, general liability insurance accounted for 57.30% of liability insurance among non-life insurers in the third quarter of last year, maintaining high growth with an average annual growth rate of 11.1% from 2010 to 2019.

Professional liability insurance grew at an average annual rate of 5.1% from 2010 to 2019, while product liability insurance, which accounts for 18.5%, showed a relatively low growth rate of 4.8% annually.

In the United States, D&O liability insurance has grown significantly over the past three years. The growth rate of U.S. D&O insurance premiums was 6% in 2018, followed by sharp increases of 41.4% and 61.6% in 2019 and 2020, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)