[Asia Economy Reporter Lee Seon-ae] The Korea Exchange plans to implement regular changes to the KOSPI and KOSDAQ size indices (large, mid, small cap) on the 12th. As passive funds tracking the indices flow in, attention is focused on the newly included stocks in the KOSPI mid-cap and KOSDAQ large-cap categories.

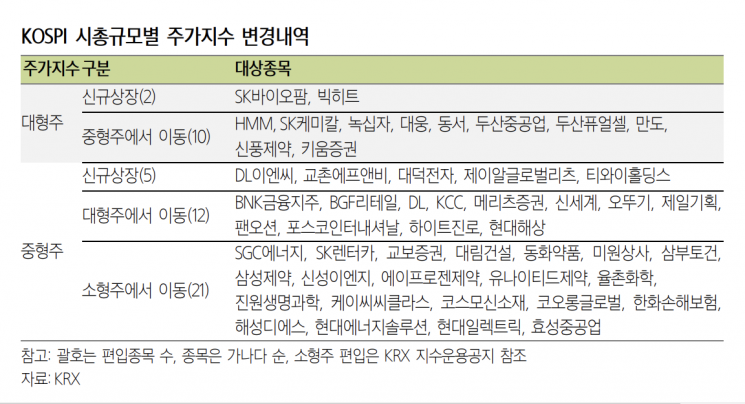

According to the Korea Exchange on the 7th, for KOSPI, 10 stocks were newly included in the large-cap category, including newly listed SK Biopharm and Big Hit, as well as Shinpoong Pharmaceutical, Kiwoom Securities, and SK Chemical, which moved from the mid-cap category.

In the mid-cap category, 5 newly listed stocks such as DL E&C and Kyochon F&B, 12 stocks moved down from large-cap including DL, Shinsegae, KCC, and Cheil Worldwide, and 21 stocks moved up from small-cap including Daelim Construction, Hyundai Electric, Kyobo Securities, and Hyosung Heavy Industries were newly included.

In the small-cap category, 6 newly listed stocks mainly REITs and 27 stocks moved down from mid-cap including SBS, Daekyo, and Kumho Industrial were newly included.

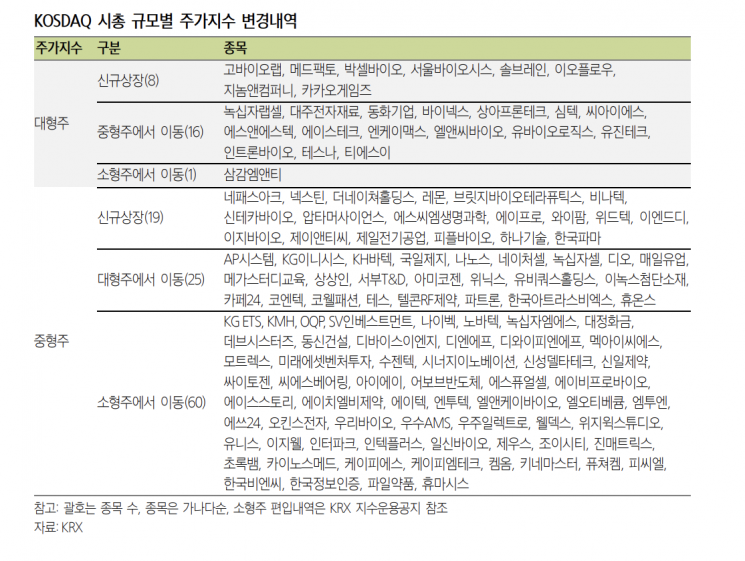

For KOSDAQ, 8 stocks including newly listed Kakao Games, Solbrain, and Vaxcell Bio were newly included in the large-cap category, along with 16 stocks moved down from mid-cap such as L&C Bio, Daewoo Electronics Materials, Simtek, and Eugene Technology, and Samkang N&T moved up from small-cap.

In the mid-cap category, 19 newly listed stocks including Lemon and Korea Pharma, 25 stocks moved down from large-cap such as Nanos, Sangsangin, Cafe24, and Cowell Fashion, and 60 stocks moved up from small-cap including Chorokbaem, Yes24, and Interpark were newly included.

In the small-cap category, 60 newly listed stocks mainly SPACs and 86 stocks moved down from mid-cap including Kangstem Biotech, Sungkwang Bend, and Pyeonghwa Precision were newly included.

The size indices classify listed stocks into large, mid, and small caps based on market capitalization. The KOSPI large-cap index includes stocks ranked 1st to 100th by market cap, the mid-cap index includes those ranked 101st to 300th, and the small-cap index includes those ranked 301st and below. The KOSDAQ large-cap index includes stocks ranked 1st to 100th, the mid-cap index includes those ranked 101st to 400th, and the small-cap index includes those ranked 401st and below.

Looking at 11 KOSPI size index changes from 2010 to 2020, stocks moving from large-cap to mid-cap tended to outperform the KOSPI (measured by returns from early February to the index change date), while stocks moving from mid-cap to large-cap tended to underperform the KOSPI. This phenomenon occurs because stocks moving from the lower ranks of the large-cap index to the upper ranks of the mid-cap index can expect buying pressure from mid- and small-cap fund inflows. Conversely, stocks moving from mid-cap to large-cap may temporarily experience weaker demand as they move to the lower ranks of the large-cap index.

Stocks moving from large-cap to mid-cap are like "the tail of the dragon" becoming "the head of the snake." According to cases from 2010 to 2020, among these stocks (large to mid), those with smaller market caps (below the top 75%) showed higher investment returns (from early February to the change date). Also, stocks moving from small-cap to mid-cap with smaller market caps (below the top 75%) outperformed the KOSPI by 5.1 percentage points during the same period. Kang Song-cheol, a researcher at Shinhan Financial Investment, advised, "It is necessary to pay attention to stocks moving to the mid-cap index until the size index change date and to those moving to the large-cap index after the change date."

KOSDAQ stock replacements also deserve attention. Jeon Gyun, a researcher at Samsung Securities, said, "From the perspective of institutional investors such as pension funds and asset management companies, KOSPI mid-cap and KOSDAQ large-cap stocks belong to the 'mid-cap investment universe' for active management, so they need to be closely watched." He emphasized, "From the institutional investor's perspective, the stocks subject to rebalancing are those upgraded from small-cap to mid-cap (KOSPI mid-cap) or moving from mid-cap to large-cap (KOSDAQ large-cap)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)