Sojugseong Special Committee COVID Crisis Forum... "Securing 9.4 Trillion Won by Applying 5% VAT Rate"

On January 7th, during the ongoing COVID-19 pandemic, a dumpling specialty store in Tongin Market, Jongno-gu, Seoul. The atmosphere is quiet with no customers visiting. Photo by Mun Ho-nam munonam@

On January 7th, during the ongoing COVID-19 pandemic, a dumpling specialty store in Tongin Market, Jongno-gu, Seoul. The atmosphere is quiet with no customers visiting. Photo by Mun Ho-nam munonam@

[Sejong=Asia Economy Reporter Moon Chaeseok] There has been a claim that, in compensating for losses due to the prolonged COVID-19 pandemic, funding should be raised through a social solidarity tax rather than large-scale deficit bonds. The argument is that resources should be secured by increasing taxes mainly on those who were relatively less affected by COVID-19.

On the 3rd, Kim Yuchan, President of the Korea Institute of Public Finance, stated at the discussion hosted by the Special Committee on Income-Led Growth titled "One Year of the COVID Crisis: Impact on Employment, Income, and Finance and Future Tasks," that "it is desirable to avoid overburdening the government bond issuance market."

President Kim pointed out, "Although increasing the scale of government bond issuance in a low-interest-rate environment results in relatively low interest burdens, issuing a large volume of bonds at a specific point in time could temporarily cause interest rate hikes in the capital market."

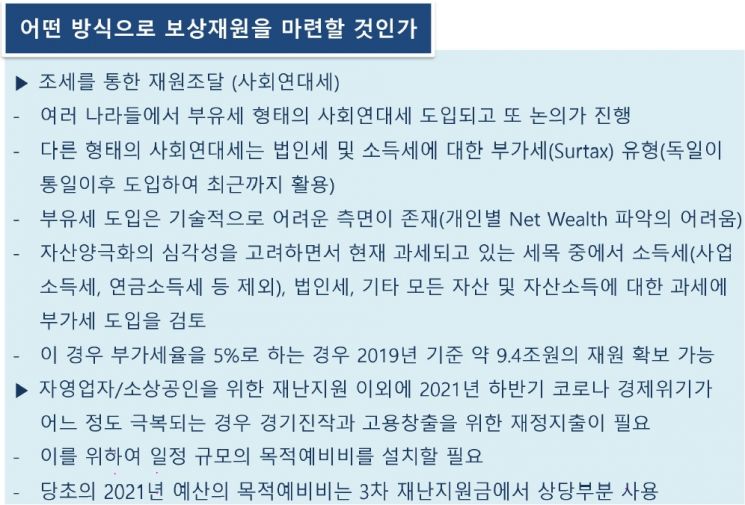

He emphasized that the social solidarity tax differs from a wealth tax. While it is difficult to assess individual net wealth for a wealth tax, the social solidarity tax can be collected in the form of a value-added tax (VAT). He explained, "Considering the severity of asset polarization, it is necessary to consider introducing VAT on income tax (excluding business income tax and pension income tax), corporate tax, and all other asset incomes among the current tax items. In this case, setting the VAT rate at 5% could secure approximately 9.4 trillion won in resources based on 2019 data."

He added, "If this idea is implemented, it could be seen as a tax increase," and clarified, "This is not a proposal for immediate implementation but a policy worth considering when implementing a loss compensation system in the future."

Professor Jung Se-eun of Chungnam National University also said, "(Although government bond issuance is the main funding method for expanding fiscal expenditure,) temporary tax increases would be more effective if added, and it is desirable to include progressivity in income tax and corporate tax."

Kim Taewan, Director of the Inclusive Welfare Promotion Team at the Korea Institute for Health and Social Affairs, called for strengthening the weakened income base. Director Kim stated, "In 2021, with confirmed cases increasing and it taking time for vaccines and treatments to show effects, the government must take strong measures to reinforce the weakened income base." He added, "We should consider providing disaster relief funds to all citizens because it can positively impact reducing polarization, increasing national income through boosting consumption by all citizens, and economic growth."

Jo Daeyup, Chair of the Policy Planning Committee, said in his congratulatory remarks, "Income-led growth is the last line of defense against transaction disruptions and livelihood crises caused by the COVID-19 pandemic," and added, "It should be recognized as a direction for national governance leading the civilizational transition in the post-COVID era."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)