[Asia Economy Reporter Joeslgina] One Store, a 'native app market' subsidiary of SK Telecom, has attracted an investment of 26 billion KRW from KT and LG Uplus. This has led to the creation of the so-called 'K-App Market,' with the three major telecom companies and leading domestic ICT companies such as Naver participating as shareholders. This decision was based on the need to nurture a native app market that can compete against foreign platforms, amid ongoing controversies over the 'app tolls' and 'power abuse' by Google and Apple, which hold overwhelming market dominance. One Store is also preparing for an initial public offering (IPO) this year.

◆All Three Telecom Companies Invest... Birth of the K-App Market

According to the three telecom companies and One Store on the 3rd, KT and LG Uplus recently invested a total of 26 billion KRW in One Store, securing a 3.8% stake. KT invested 21 billion KRW (3.1% stake), and LG Uplus invested 5 billion KRW (0.7%). As a result, One Store's shareholding structure has been reorganized to include the three telecom companies (53.9%), Naver (26.3%), and financial investors (18.6%). The previous shareholding structure was SK Telecom (52.1%), Naver (27.4%), and financial investors (19.4%).

This equity investment is expected to strengthen the business cooperation system among the three telecom companies and also establish a joint responsibility management system in the future. Lee Jaehwan, CEO of One Store, said, “With the two telecom companies that have been joint business partners for the past five years now participating as shareholders, we expect a higher level of cooperation.”

One Store, launched in 2016, is a leading domestic app market. The three telecom companies and Naver integrated their separately operated app markets?T Store, Olleh Market, U+ Store, and Naver App Store?into One Store and have continued cooperation such as membership discounts. Celebrating its 5th anniversary yesterday, One Store's monthly active users (MAU) are approximately 15.4 million, and the total number of content downloads to date is about 500 million.

◆Consensus Formed on the Need to Foster Native App Markets

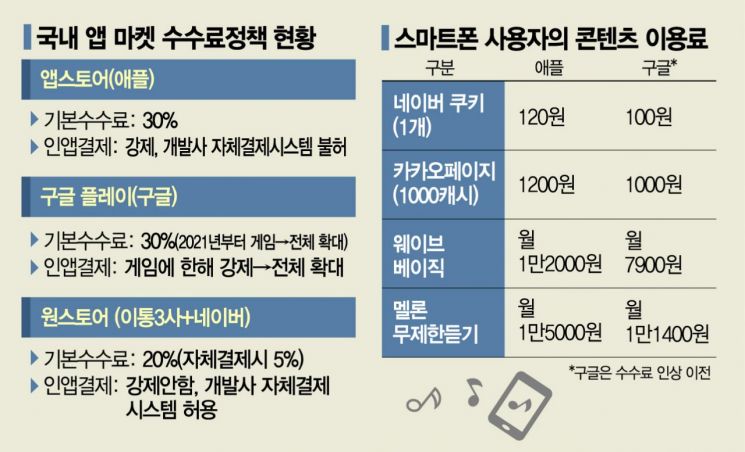

The background behind KT and LG Uplus investing in One Store was primarily a shared recognition of the urgent need to secure competitiveness for native app markets. This was due to the heated controversy over so-called 'app tolls' after Google Play declared a 30% app commission fee following Apple App Store last year.

In particular, this controversy confirmed that platform companies with dominant market positions can shake the industry ecosystem simply by changing policies, heightening the industry's sense of crisis. Since proper competition has become impossible by market power alone, there have been continuous calls for urgent policy support to nurture native app markets to prevent 'digital colonization.'

Domestic developers, unable to endure the power abuse of the app market giants, are gradually turning to One Store. While One Store's market share was in the low teens early last year, it surged significantly after the app toll controversy spread in the second half. As of the end of August last year, One Store's market share reached a record high of 18.3%. During the same period, Google Play held 71.2%, and Apple App Store 10.5%. According to the mobile index by market research firm IGAWorks, One Store's transaction growth rate in 2020 was 34.4%, nearly twice the growth rate of other global app markets.

One Store's app commission fee is currently 20%, much lower than Apple and Google's 30%. It does not force in-app payments, which are almost an industry norm. Rather, since July 2018, it has implemented a groundbreaking policy reducing the commission to 5% if developers use their own payment systems. As COVID-19 prolonged, last year it reduced commissions by 50% (from 20% to 10%) for small and medium-sized businesses. This contrasts with Google Play, the 'app market giant,' which has been criticized for commission power abuse and is facing the so-called 'Google Power Abuse Prevention Act.'

CEO Lee said, “We will accelerate our business efforts to become Korea's representative app market that coexists with the industry and provides greater benefits to users.” One Store aims for an IPO in 2021 and selected KB Securities, NH Investment & Securities, and SK Securities as IPO underwriters last September. It also succeeded in turning a profit for the first full year since its establishment last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.