Ruling Party and Government Pressure on Platform Companies Hinders Growth Potential

Consumer Burden Increases and Concerns Over Shareholder Property Rights Infringement

"Political Necessity Divides People and Companies"

Untact Medical Services Rapidly Grow... Legal Barriers Cause Domestic Market Stagnation

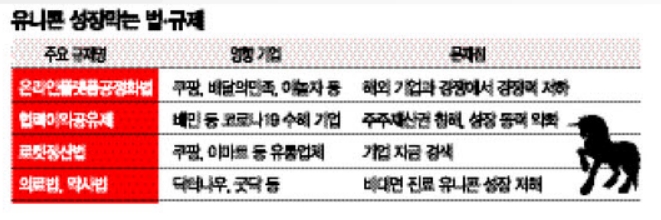

[Asia Economy Reporters Kim Bo-kyung and Bu Aeri] Platform companies that have begun to take flight are suffering under rapidly advancing regulations. There are concerns that they may lose momentum before they even build the capacity to grow into unicorns (unlisted companies valued at over 1 trillion won) due to the barrage of regulatory measures from the political sphere and the existing framework (system) of entrenched practices.

One of the representative regulations hindering domestic startups that must compete with overseas companies is the "Act on the Fairness of Online Platform Intermediated Transactions" proposed by the Fair Trade Commission. This law mandates that platform operators and tenant companies must compulsorily draft and deliver contracts. A representative from a platform startup said, "Platform companies receive investments based on their future growth potential," adding, "If various regulatory bills emerge, overseas investors will likely turn away."

◆Continued Enforcement of Laws and Systems That Strangle Companies= The Democratic Party's push for the "COVID-19 Profit Sharing System" is also a burden on business operations. Woowa Brothers, the operator of Baedal Minjok, became the first company subject to the profit-sharing system for having profited during COVID-19. On the 15th of last month, Woowa Brothers launched a win-win council with the National Franchisee Association at the National Assembly and agreed to regularly discuss key issues such as commissions and advertising fees. Interpretations abound that during this council, Woowa Brothers faced tacit pressure as agreements were reached on previously resisted matters such as providing customer information and displaying stores in order of distance.

Although the Democratic Party emphasized voluntary participation in the profit-sharing system, in reality, it is likely to become a coercive system that strangles companies. A Woowa Brothers representative said, "We have already practiced voluntary coexistence by refunding 80 billion won to tenant companies to help overcome the COVID-19 crisis, including a 50% refund on advertising fees last year," adding, "We are about to announce our performance this month, but a deficit is expected for the second consecutive year." The Federation of Korean Industries expressed caution about introducing the profit-sharing system, citing unclear profit calculation standards and potential infringement on shareholder property rights.

On the 15th of last month, at the National Assembly in Yeouido, Seoul, Lee Nak-yeon, the party leader, and participants are taking a commemorative photo at the mutual growth agreement ceremony between the Democratic Party's Euljiro Committee and Baedal Minjok - Self-Employed Business Owners.

On the 15th of last month, at the National Assembly in Yeouido, Seoul, Lee Nak-yeon, the party leader, and participants are taking a commemorative photo at the mutual growth agreement ceremony between the Democratic Party's Euljiro Committee and Baedal Minjok - Self-Employed Business Owners. [Photo by Yonhap News]

The Ministry of Employment and Labor has embarked on enacting the "Platform Worker Protection Act." It plans to recommend standard contracts to platform companies such as delivery agencies to prevent unfair trade and manage worker safety. While strengthening the responsibilities of platform companies, the act aims to legally protect platform workers, who are not employees under the Labor Standards Act, on par with regular workers. However, the labor sector opposes the special law, arguing it is not a fundamental solution, and consumers worry about potential increases in delivery fees. Additionally, the ruling party and government are also pushing for the so-called "Rocket Settlement Act," which would expedite payment deadlines to suppliers for distribution companies like Coupang and E-Mart.

A platform company representative said, "There are many issues in the platform industry that are difficult to judge by existing rules," adding, "We are stumbling along but trying to solve problems with goodwill as much as possible. It is worrisome that political necessities are dividing sides and distancing the public and companies."

◆Growth Difficult Despite Technology Due to Regulatory Barriers= Despite Korea's reputation as a medical powerhouse, it is difficult to expect unicorns in the untact (non-face-to-face) medical treatment sector. Jang Ji-ho, CEO of Doctor Now, a startup providing untact medical treatment and medicine delivery services, lamented, "If regulations do not change, there will never be an untact medical treatment unicorn even 10 years from now," adding, "Due to various regulations such as the Medical Service Act and the Pharmaceutical Affairs Act, legal risks always exist in business despite having the technology."

According to the Korea Startup Forum and others, Korea is the only country among the top 15 global GDP nations where untact medical treatment is completely prohibited. In fact, due to various regulations such as the Medical Service Act and the Pharmaceutical Affairs Act, no Korean companies participate in the global untact medical treatment market, which is worth 46 trillion won. According to a survey by Samjong KPMG, the global untact medical market has grown at an average annual rate of 14.7% since 2015 and is expected to reach $41.2 billion (approximately 46 trillion won) in 2021.

Unlike Korea, where growth is stalled by regulations, untact medical treatment businesses are rapidly expanding in other countries. Teladoc in the U.S. has grown into a global untact medical treatment company with a market capitalization of 30 trillion won, and the U.S. has about 10 unicorn and potential unicorn companies related to untact medical treatment. China and Europe each have three unicorn or potential untact medical treatment unicorns, contrasting with Korea. Naver's subsidiary Line started remote medical services in Japan instead of Korea, where regulations are stricter.

The difficulty in producing untact medical treatment unicorns in Korea stems from outdated policies and regulations. Under Article 33, Paragraph 1 of the Medical Service Act, medical treatment not conducted within a "medical institution" is not permitted. Although Article 34 includes provisions on telemedicine, it only allows it between medical professionals and does not include language permitting telemedicine between medical professionals and patients. According to Article 50 of the Pharmaceutical Affairs Act, selling pharmaceuticals outside pharmacies is also prohibited. CEO Jang emphasized, "In 10 or 20 years, there will be a situation where telemedicine must be accepted, but once overseas companies monopolize the market, there will be no way to respond," adding, "An environment must be created where Korean companies can also develop self-sustainability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)