"Reflation Signal"

Inflation up 1.3%, considered appropriate

Effect of reduced debt burden as currency value decreases

U.S. also allows inflation above 2%

"Concerns about Stagflation"

Domestic vaccine rollout sluggish

If only prices rise, perceived economy worsens

Some predict higher inflation than expected due to short-term concentrated quantitative easing effects

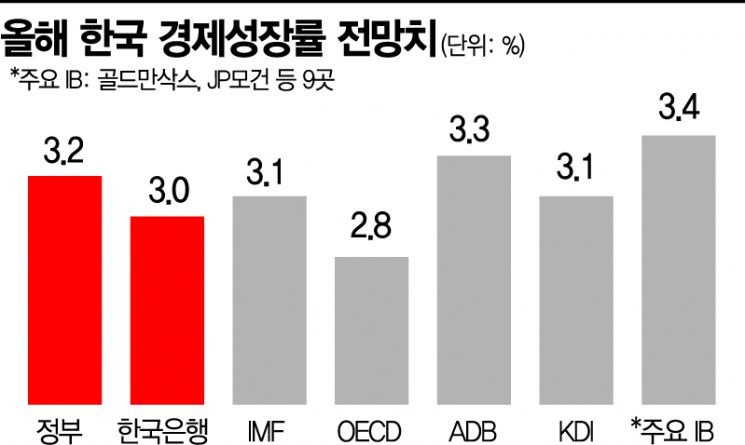

[Asia Economy Reporter Kim Eunbyeol, Sejong=Reporter Jang Sehee] The Bank of Korea’s decision to maintain this year’s growth forecast at 3.0% while raising the inflation outlook is interpreted as ‘reflation’ occurring during the economic recovery process. Although inflation remained in the 0% range for two consecutive years since 2019, the unprecedented scale of money supply expansion after the COVID-19 outbreak is now being reflected in inflation indicators with a time lag. However, considering the ongoing COVID-19 variables, concerns are also emerging that the perceived inflation burden may only increase.

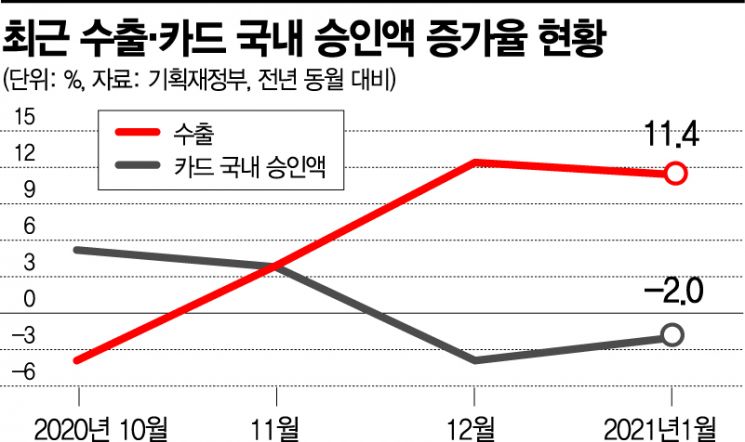

The Bank of Korea’s decision to keep the growth rate at 3.0%, reflecting that exports are showing a favorable trend but domestic demand shows no signs of recovery, is also a reason for negative views. According to the Ministry of Economy and Finance, exports in December last year and January this year grew by 12.4% and 11.4% year-on-year, respectively, but domestic card approval amounts shrank by -3.9% and -2.0%, showing signs of domestic demand contraction for two consecutive months.

"This is a Reflation Signal... Not Stagflation"

Economic experts evaluated that if inflation rises to 1.3% as the Bank of Korea forecasts, it is neither excessive nor insufficient but an appropriate level. The money injected to prevent the economic shock of COVID-19 had mainly flowed into asset markets, but now it is finally pushing up prices as well. Professor Kim Soyoung of Seoul National University’s Department of Economics said, "It takes time for liquidity to affect prices," adding, "As prices rebound, it will be crucial to see if we can break away from the low inflation trend that lasted more than 10 years after the financial crisis."

Of course, the recent price increases are partly due to reduced supply of raw materials such as agricultural and livestock products and crude oil. Although the demand side driven by economic recovery is not strongly reflected, experts say it does not mean there is no recovery expectation at all. Professor Ha Jun-kyung of Hanyang University’s Department of Economics said, "If inflation rises to around 3-5% without causing a sharp increase in interest rates, moderate inflation is actually the direction the government desires," adding, "There is also an effect of reducing debt burden." When prices rise and the value of money relatively decreases, interest burdens also decrease accordingly.

Experts welcoming the price rebound say that although oil prices surged causing inflation, it is difficult to interpret this as stagflation like the oil shock. The growth forecast is 3.0%, higher than the potential growth rate (about 2.3%, estimated by the Organisation for Economic Co-operation and Development (OECD)). Professor Kim Soyoung said, "The economy is not in recession with only prices soaring," and added, "Stagflation should broadly affect all prices, but here only some prices are rising, which is different." She also said, "Since the U.S. allows inflation rates to exceed 2%, central banks will not consider inflation a problem until the target level is reached."

‘Bad Inflation’ with Slow Economic Recovery but Rising Prices?

However, there is also a view that if the COVID-19 situation continues and economic recovery remains slow, rising prices could backfire. While advanced countries with fast vaccine rollouts are seeing quick economic rebounds, if prices rise in Korea where progress is sluggish, the economy as perceived by the public could worsen. Professor Ahn Donghyun of Seoul National University’s Department of Economics expressed concern, saying, "Even with a 3.0% growth rate, there is a base effect from last year’s -1.0%, and not much of it was generated by the private sector rather than government fiscal spending." He explained that if prices rise without improvement in the private sector economy, even if real income increases, economic agents may feel inflation more acutely.

Economists forecasting higher-than-expected inflation cite three main reasons: ▲ money was injected intensively over a much shorter period than during the financial crisis ▲ the banking system is sound, leading to increased liquidity through loans ▲ government-led wage increases causing price rises. There is also a view that escaping deflation, which has persisted since before COVID-19, is difficult. Core inflation excluding oil and agricultural products was 0.9% (as of January), still low, and money circulation is sluggish. Professor Ha Jun-kyung said, "Looking at Japan, even with zero interest rates, prices do not rise, and the worst scenario is a liquidity trap where the real economy remains depressed and money flows only into asset prices and disappears." Ultimately, the key is how to maintain the rebounding prices appropriately and efficiently circulate money in line with inflation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.