Obomyeong NHN Payco Director

Transforming from Gaming to Comprehensive IT Company

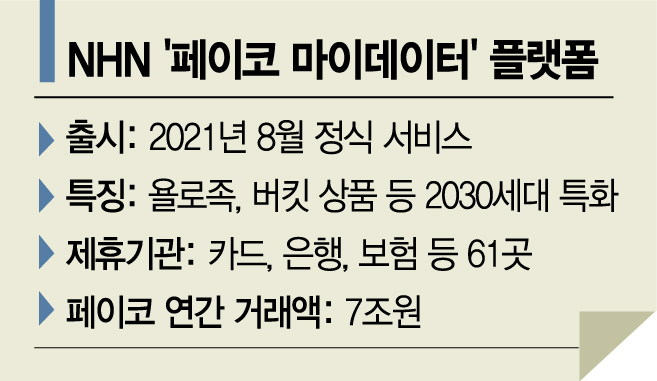

[Asia Economy Reporter Buaeri] NHN, originally a gaming company, is transforming into a comprehensive IT company by expanding its simple payment service ‘Payco’. NHN Payco officially entered the 20 trillion won-scale MyData market last month after receiving the full license for ‘MyData’ from the Financial Services Commission.

Oh Bomyeong, director overseeing MyData services at NHN Payco, explained in an interview with Asia Economy on the 23rd, "MyData is a concept where users can gather their financial data in one place." Users can consolidate their scattered financial information from banks, insurance companies, and more to utilize it collectively. Businesses can implement various services based on financial data.

NHN Payco, which has been conducting a pilot project for ‘Payco MyData’ since November 2019, is preparing for the official launch of the service on August 16. Director Oh stated, "With the ability to check loans, insurance, securities, and more, the ‘asset management service in the palm of your hand’ will be realized." Currently, Payco has the largest number of financial partner institutions in the industry, including 61 card companies, banks, and insurance firms.

NHN Payco has targeted the 2030 generation as the main customer base for its MyData business. The strategy is to dominate the market by offering services specialized for this group. He said, "The 2030 generation accounts for 75% of Payco’s customers." NHN Payco recommends financial products tailored to the 2030 generation, such as ‘YOLO (You Only Live Once) products’, and provides asset management services.

NHN Payco focused on the fact that the 2030 generation faces limitations in experiencing financial services and accessing products in traditional financial sectors due to a lack of financial history. Director Oh added, "Many in the 2030 generation are not well-versed in finance," and "We will approach them with products that have small investment amounts and are easy to understand."

The MyData business is expected to become NHN’s new growth engine. He said, "Gaming is the foundation of NHN, but due to its fluctuations, securing a stable business model is necessary," and added, "Payco is expanding services from mobile payment to consumption and finance." Last year, NHN achieved its best-ever performance with sales of 1.6814 trillion won and operating profit of 102.5 billion won, thanks to the success of the Payco business. Payco’s annual transaction volume reaches 7 trillion won, and the cumulative number of subscribers is around 10 million. Since it connects financial institutions and earns fees, it can generate steady revenue.

Securing competitiveness in the ‘Techfin war’ against IT companies like Naver and Kakao is a challenge for NHN. Director Oh emphasized, "Payco was not started as a portal or messenger but was born as a mobile wallet, making it the safest service to link finance," and added, "It will become the financial friend of the 2030 generation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)