Domestic Semiconductor Stocks Falter While US Semiconductor Stocks Rise Throughout the Holiday

US Government Announces Executive Order to Address Supply Shortages

Ripple Effects in Korea... Samsung Electronics and SK Hynix Up

"Companies with Production Facilities in the US Especially Likely to Benefit"

[Asia Economy Reporter Minwoo Lee] Semiconductor stocks, which had been sluggish since mid-last month, are showing signs of rebound. As the global shortage of semiconductors accelerates ahead of the electric vehicle era, the Biden administration has announced its intention to actively address the issue, leading to analyses that the entire industry will benefit significantly.

As of 11:16 a.m. on the 15th, Samsung Electronics' stock price rose 3.31% from the previous day to 84,300 KRW. After a downward trend since the beginning of this month, it had fallen to the 81,000 KRW range by the 10th, just before the Lunar New Year holiday, but has now rebounded. SK Hynix saw an even larger increase, rising 4.76% from the previous day to 132,000 KRW at the same time. It also appears to be recovering from the slump before the holiday.

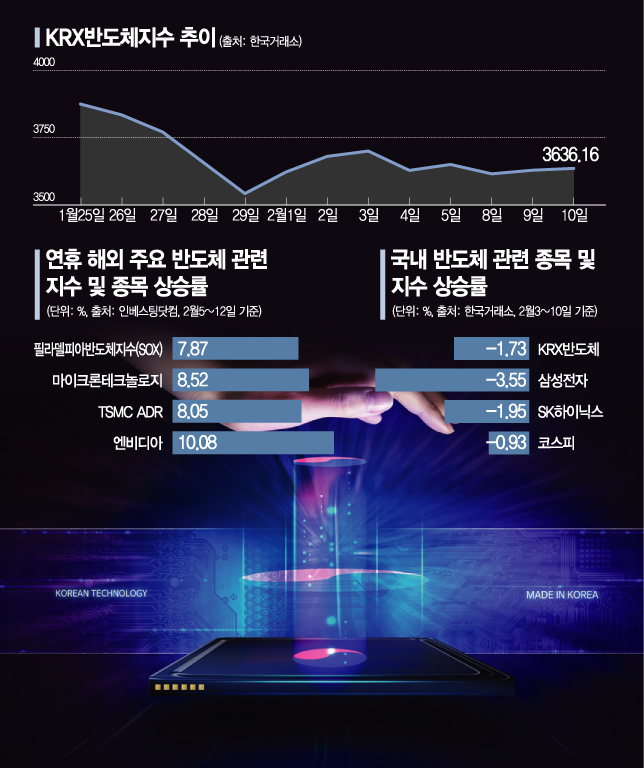

Previously, the domestic semiconductor sector continued to decline until the Lunar New Year holiday after reaching an all-time high last month. Samsung Electronics hit an intraday record high of 96,800 KRW on the 11th of last month, the highest since its stock split in 2018, before steadily declining. SK Hynix also showed a downward trend after reaching its all-time high of 140,000 KRW on the same day. During the week before the holiday (February 3?10), the two stocks fell by 3.55% and 1.95%, respectively. This decline was more than twice the 0.93% drop in the KOSPI index during the same period. As the leading semiconductor stocks faltered, the KRX Semiconductor Index also underperformed, dropping from its all-time high of 3,874.53 on January 25 to the 3,600 range, a 1.73% decrease in the week before the holiday.

While the domestic semiconductor sector was sluggish during the holiday period, overseas markets showed an upward trend. On the 12th (local time), the Philadelphia Semiconductor Index (SOX) closed at 3,219.87 on the New York Stock Exchange (NYSE), marking an all-time closing high. After surpassing the 3,100 mark for the first time on the 10th, it surged past 3,200. The one-week increase (February 5?12) was 7.87% based on closing prices. During this period, major semiconductor-related stocks also rose significantly: Micron Technology by 8.53%, TSMC ADR (Taiwan Semiconductor Manufacturing Company American Depositary Receipt) by 8.05%, and Nvidia by 10.08%. This positive momentum was influenced by the Biden administration's announcement of an executive order to address semiconductor supply shortages.

According to Bloomberg, the White House announced on the 11th (local time) that it would sign this government-wide executive order. White House spokesperson Jen Psaki stated, "The Biden administration is identifying potential bottlenecks in the supply chain" and "is actively discussing with key industry stakeholders and trade partners to address these issues."

Recently, major U.S. automakers have halted factory operations due to severe semiconductor shortages. General Motors (GM) extended production cuts at three North American plants, which began last week, at least until mid-next month, and the Bupyeong 2 plant in South Korea is operating at half capacity. This is because global semiconductor companies reduced automotive semiconductor production last year due to decreased vehicle demand caused by COVID-19, focusing instead on semiconductors for PCs and smartphones, while this year, the surge in demand for automotive semiconductors due to expanded electric vehicle production has coincided. The U.S. semiconductor industry has even sent letters to President Biden requesting support for domestic semiconductor production.

Kim Kyung-min, a researcher at Hana Financial Investment, said, "The obstacle to the domestic semiconductor sector's stock prices was the limited increase in supply," adding, "If the executive order positively impacts the resolution of supply shortages, it could also affect the domestic stock market, especially companies with semiconductor production lines in the U.S. are expected to receive relatively greater attention."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.