[Asia Economy Reporter Kim Hyewon] As the subscription economy market rapidly grows recently, there is a call for Korean companies to strengthen their global competitiveness through subscription business models.

According to the 'Global Subscription Economy Status and Business Strategies for Korean Companies' report released on the 14th by the Korea International Trade Association's Institute for International Trade and Commerce, the global subscription-based e-commerce market size is expected to grow from $13.2 billion in 2018 at an average annual rate of 68%, reaching $478.2 billion (approximately 529.4 trillion KRW) by 2025.

A 530 trillion KRW market by 2025... What is the Subscription Economy?

The subscription economy refers to a business model where customers pay a fixed amount regularly to receive products or services. The term 'subscription economy' was first used by Tien Tzuo, founder of the American subscription payment system company Zuora, who defined the industrial environment that transforms customers from buyers to subscribers for the purpose of generating recurring revenue.

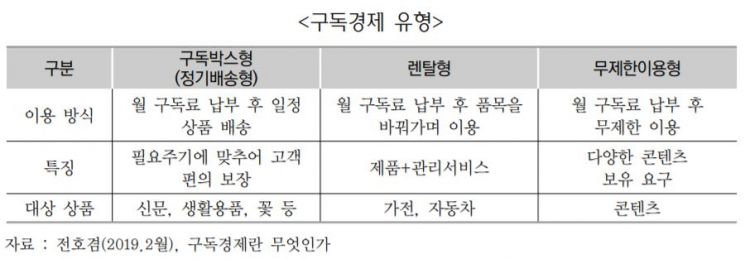

The subscription economy is characterized by providing personalized services based on customer data. Unlike traditional subscription services such as newspapers or milk, it enables on-demand consumption regardless of time and place by utilizing platforms. As consumer trends emphasizing the utility and practical value of products have emerged, subscription economy business models have begun to attract attention. While similar to the sharing economy in that customers pay for what they use, it is an expanded concept of the sharing economy because it involves memberships and allows consumers to change their choices within the membership scope at any time. Generally, it is classified into three types: regular delivery, rental, and unlimited usage.

Increasing Subscription Economy Users in Major Countries... Korea in Early Stage but Accelerating Growth

The number of Amazon Prime subscribers, a representative membership-type subscription service, increased more than twice from 5,400 in 2015 to 112 million in 2019, accounting for 65% of all Amazon customers. Japan's subscription economy market also grew from 872 billion yen (about $8 billion) in 2017 to 1.144 trillion yen (about $10.5 billion) in 2019. Particularly, the digital content sector is expected to grow the fastest at an average annual rate of 11.6%.

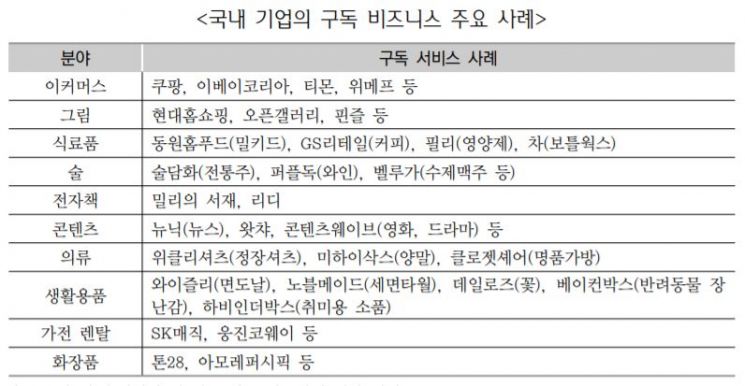

In Korea, as of last year, more than 70% of consumers have experienced subscription businesses in areas such as content, daily necessities, and cosmetics, indicating rapid expansion of the subscription economy.

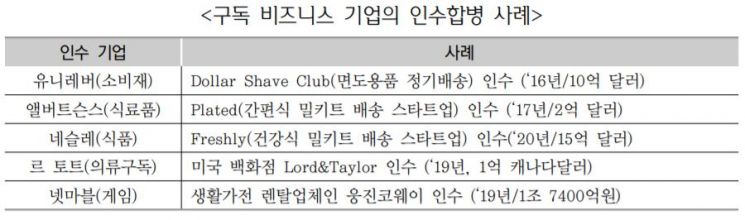

Recently, driven by consumer trends that value utility over ownership and advances in digital technologies such as cloud computing and big data, the scope of the subscription economy has expanded from daily necessities to content, software, home appliances, and automobiles. Companies are also expanding into B2B transactions by subscribing to Software as a Service (SaaS) and other services. Large corporations are actively adopting subscription businesses leveraging abundant resources, diverse distribution channels, and high brand awareness. This is because they can generate stable revenue by securing loyal customers (lock-in effect).

Companies that have adopted subscription business models are seeing faster revenue growth compared to general companies. According to the subscription economy index devised by Zuora, subscription economy companies' revenue grew at an average annual rate of 17.8% from 2012 to the second quarter of last year, six times faster than the S&P 500 companies' 3.1% growth during the same period. Especially with the rise of the contactless economy due to COVID-19, the subscription economy has emerged as a promising business model. While the S&P 500 companies' revenue decreased in the first half of last year compared to the previous year, subscription economy companies saw more than a 10% increase.

For example, Cisco launched subscription-based products combining hardware and software in 2017, moving away from its traditional hardware (communication equipment) sales, achieving success. Although its revenue growth rate was negative in 2016-2017, it recorded increases of 2.8% in 2018 and 6.3% in 2019.

Compared to advanced countries like the US and Japan, Korea's subscription economy market is in the early stages but is rapidly expanding. The diversification of subscription items, expansion of demand from individuals to companies, and changes in service providers from startups to large corporations are some of the achievements showing the spread of subscription business adoption among companies. Among the top domestic startups in terms of investment attraction, those engaged in subscription businesses are recording steady performance, drawing attention to subscription platforms even at this early stage.

Cases of Korean companies achieving overseas expansion through subscription economy models are also emerging. Home appliance rental companies for water purifiers, air purifiers, and bidets are expanding their businesses in Southeast Asia, and enterprise security software companies are achieving export success with subscription services. Mergers and acquisitions cases are also increasing.

Three Keys to Successful Subscription Economy Business Strategies

The report identifies three key elements for securing a successful subscription economy model: ▲ adoption of data-driven information and communication (IT) technologies and service advancement ▲ creation of new experiences and value ▲ appropriate pricing.

The rapid growth of the subscription economy owes much to advances in cutting-edge IT technologies and the expansion of platforms and e-commerce markets. In other words, the success of subscription economy businesses depends on collecting individual consumer purchase data, which is why companies are increasing investments to secure high-quality data.

To secure customer data, cases of building proprietary platforms or collaborating with platform companies are increasing. Home interior company Hanssem started a furniture subscription service business called 'Hanssem Mall' last year through collaboration with platform company Kakao. Subscribers can use a bed mattress for a fixed monthly fee over a set period (60 months). This is an example of collaboration with a platform company that allows existing KakaoTalk customers to obtain Hanssem product information and easily apply for subscriptions via mobile.

A business model where manufacturers establish direct relationships with customers without going through distributors (D2C - Direct to Customer) has also emerged. Nike introduced the NikePlus membership program in 2018, and Bloomberg estimated that NikePlus members spend three times more than regular consumers.

In subscription economy models, customer value influences pricing decisions. Companies entering the subscription economy must set appropriate prices considering the time required for revenue to surpass costs. Recently, more companies are offering various pricing plans, such as hybrid models combining monthly subscription fees and free services. A Chinese-style hot pot specialty restaurant offered a subscription service where customers could eat anytime and anywhere for a month by purchasing a 120 yuan prepaid membership card, but sales plummeted as cards were shared among acquaintances, leading to bankruptcy within a year?a failure case.

Shim Hyejung, senior researcher at the Korea International Trade Association, said, "Subscription business creates new added value by linking product sales and services while securing loyal customers to generate stable revenue, which is why global companies are adopting it. Korean companies should continuously strive to develop competitive subscription economy models, and the government should actively support the activation of the subscription economy ecosystem through deregulation and expanded export support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.