Q4 Operating Profit Soars 134%... Donation Economy Sales Growth Confirmed

Last Year Stock Price Fell 12%... Target Prices Raised Across the Board

[Asia Economy Reporter Ji Yeon-jin] AfreecaTV delivered a 'surprise performance' in the fourth quarter of last year, prompting securities firms to raise their target stock prices one after another.

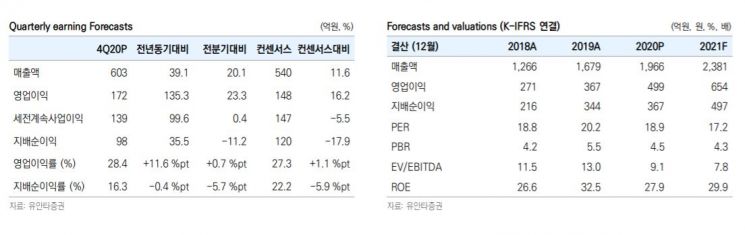

AfreecaTV's consolidated sales in the fourth quarter of last year reached 60.4 billion KRW, a 39.2% increase compared to the same period last year. Operating profit during this period surged by 134% to 17.3 billion KRW. Both sales and operating profit exceeded market expectations by 11.9% and 16.9%, respectively.

The market is focusing on AfreecaTV's platform sales (44.8 billion KRW), particularly the donation economy gift sales (42.9 billion KRW). Since COVID-19, video consumption has increased, and the growth in channels such as education and hobbies has significantly contributed to sales growth. Park Yong-hee, an analyst at IBK Investment & Securities, said, "We have reaffirmed competitiveness in the basic framework of the donation economy," adding, "Sales are expected to grow by more than 20% this year, and profit margins are also expected to rise, making it the cheapest internet company worldwide, which anticipates further stock price level-ups." The target stock price was raised to 93,000 KRW.

Lee Moon-jong, senior researcher at Shinhan Investment Corp., also said, "Concerns about platform service sales growth are limited, and advertising is entering a high-growth phase with the introduction of its own advertising solution," raising the target stock price to 95,000 KRW. Korea Investment & Securities raised its previous target price by 17.9% to 92,000 KRW, and Yuanta Securities increased it to 99,000 KRW.

Kim Dong-hee, an analyst at Meritz Securities, said, "Last year, AfreecaTV's stock price fell about 12%, showing a price trend unrelated to its solid performance," adding, "The expansion of AfreecaTV's viewer base and the popularization of creator support culture such as YouTube Super Chat indicate that the growth trend of the domestic video market remains valid. A stock price at a PER of 14.8 times presents an opportunity to buy the most undervalued video company globally."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.