SK, Kakao Affiliates Expected to Go Public Within the Year

High Proportion of IPOs in Growth Industries

Higher Lock-Up Shareholding Ratio Increases Stock Price Volatility

On the first day of Big Hit Entertainment's KOSPI listing on the 15th, a listing ceremony was held in the lobby on the first floor of the Korea Exchange in Yeouido, Seoul. (From left) Park Ji-won, Big Hit Entertainment HQ CEO; Yoon Seok-jun, Big Hit Entertainment Global CEO; Bang Si-hyuk, Chairman of Big Hit Entertainment; Jung Ji-won, Chairman of the Korea Exchange; Lim Jae-jun, Head of the Korea Exchange Securities Market Division / 2020.10.15. Photo by Joint Press Corps

On the first day of Big Hit Entertainment's KOSPI listing on the 15th, a listing ceremony was held in the lobby on the first floor of the Korea Exchange in Yeouido, Seoul. (From left) Park Ji-won, Big Hit Entertainment HQ CEO; Yoon Seok-jun, Big Hit Entertainment Global CEO; Bang Si-hyuk, Chairman of Big Hit Entertainment; Jung Ji-won, Chairman of the Korea Exchange; Lim Jae-jun, Head of the Korea Exchange Securities Market Division / 2020.10.15. Photo by Joint Press Corps

[Asia Economy Reporter Minji Lee] There is a forecast that the strong performance of the IPO market will continue due to the consecutive listings of large-cap stocks. However, some opinions caution that stocks with a high proportion of shares locked under mandatory lock-up agreements may experience increased price volatility after listing, so investors should be careful.

Large-cap Stock Listing Rally... Growing Interest in Growth Stocks

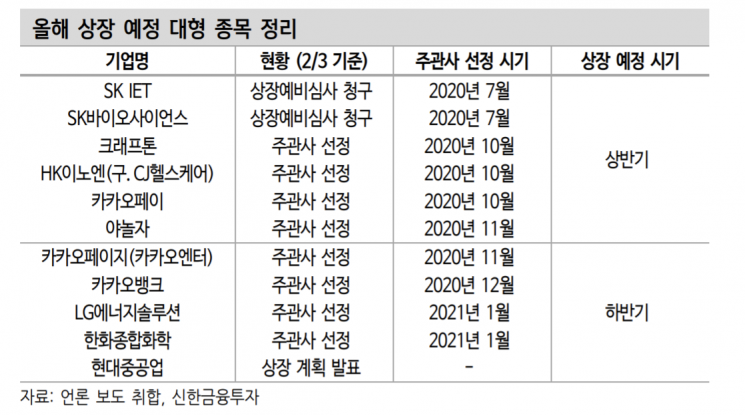

According to the financial investment industry and Shinhan Financial Investment on the 7th, SK Bioscience and SK IET filed for preliminary review for listing in December last year and are expected to be listed as early as the first or second quarter. Large-cap stocks such as Kakao affiliates including Kakao Pay, Kakao Bank, and Kakao Page, as well as Krafton and LG Energy Solution, have also selected underwriters at the end of last year and are pushing for listings within this year.

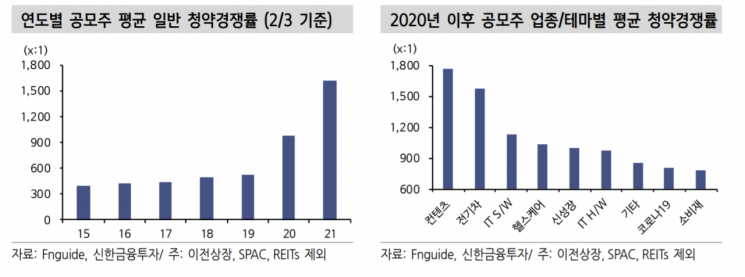

By industry, listings have increased mainly among companies with high growth potential such as bio, electric vehicles, content, and AI, riding the wave of the 4th Industrial Revolution and post-COVID trends. Comparing the number of newly listed stocks by industry theme since last year, more than five stocks each have been listed within a year not only in IT, hardware, and bio sectors, which had already increased their market share before COVID-19, but also in COVID-19 related stocks, new growth industries, media, and content sectors such as entertainment and gaming.

With IPOs mainly focused on growth stocks that have attracted increased investor interest, subscription popularity has also risen significantly. Early this year, NBT, which operates the mobile advertising platform ‘Cash Slide,’ recorded an all-time high subscription competition rate of 4,398 to 1. Researcher Dami Kim of Shinhan Financial Investment said, “If liquidity conditions similar to last year continue this year, interest in growth stocks in the IPO market will persist.”

"Be Cautious When Investing in Stocks with High Lock-up Shares"

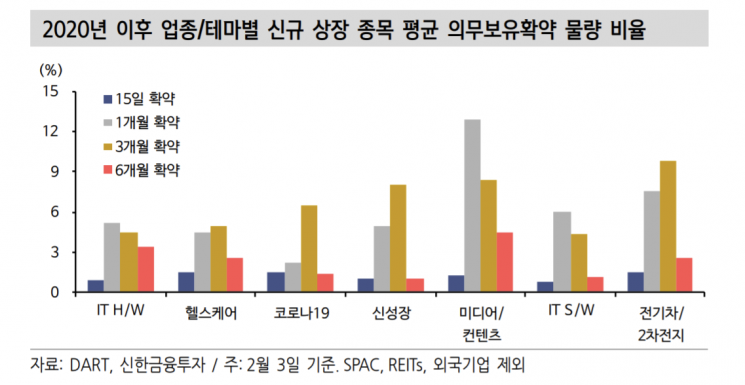

Investors should be cautious when investing in IPO stocks with a high proportion of mandatory lock-up holdings. Some stocks that recorded high subscription competition rates last year saw their opening price on the first day of listing formed at about twice the IPO price and even hit the upper limit price, known as ‘ttasang’ (listing price plus upper limit). However, as the lock-up shares were released, the stock prices showed high volatility. Stocks with a high proportion of institutional lock-up shares and many shares under mandatory lock-up agreements tend to have fewer sell orders immediately after listing, guaranteeing initial returns, but volatility in returns inevitably increases when the lock-up shares are released.

Looking at the average mandatory lock-up ratio by industry, the content sector had about 27%, roughly twice the average of other sectors (14.7%). Researcher Dami Kim stated, “These sectors showed an average return exceeding 64.6% compared to the IPO price immediately after listing, but returns between 1 to 3 months after listing tended to be relatively weak or volatile due to overhang (large volume of shares waiting to be sold) or valuation issues.”

This year, as financial authorities expand the general subscription quota and introduce a method of allocating more than half of the subscription shares equally, individual investors are expected to have more opportunities to participate, concentrating liquidity in IPOs. However, for IPO stocks with high competition rates and a high proportion of shares locked under mandatory lock-up agreements, it is necessary to consider the company’s fundamentals and the timing of lock-up release when approaching after listing. Researcher Kim said, “Attention should be paid to stocks with solid fundamentals and valid themes or industry momentum after 1 to 3 months post-listing, when most short-term overhang burdens are resolved.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)