Increase in Securities Account Fraud... 587 Cases Reported in January

Verify Directly When Family Members Are Impersonated and Refuse Installation of Malicious Apps

[Asia Economy Reporter Kwangho Lee] Recently, voice phishing scams demanding personal credit information such as ID cards and card numbers have been rampant, requiring financial consumers to exercise caution.

The Financial Supervisory Service (FSS) announced on the 5th that consumer alerts have been issued due to an increase in cases where scammers impersonate family members or acquaintances to directly or indirectly steal personal information and fraudulently obtain funds.

In the past, messenger phishing involved impersonating family members to induce victims to directly transfer funds to another person's account. However, recently, methods have increased where scammers directly request resident registration cards, bank accounts, or induce the installation of malicious apps or TeamViewer to remotely control victims' phones.

The number of messenger phishing cases increased to 1,717 in November last year, 1,727 in December, and 1,988 in January.

Scammers used stolen ID card photos to open new mobile phone lines under the victim's name and opened non-face-to-face bank accounts. They then transferred new loan funds or balances from other financial institutions to these accounts, withdrew the money, and disappeared.

Recently, damages through securities company accounts have also surged. The number of cases was 117 in November last year, increasing to 266 in December and 587 in January.

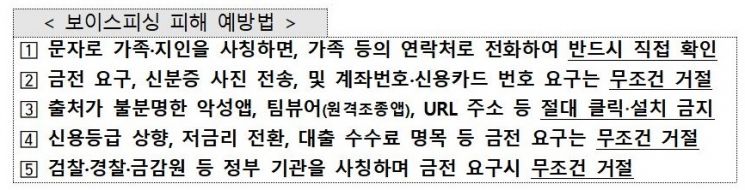

To prevent this, if someone requests personal information via text message impersonating a family member, you must call the family member's contact number to verify directly.

Even if someone asks you to add an unknown number on KakaoTalk, claiming it is difficult to talk due to phone damage or malfunction, you should refuse unconditionally.

Also, never install apps from unknown sources. Installing such apps can lead to complete leakage of personal information. If you have already installed such an app, scan it with a mobile antivirus app and delete it, or back up your data and reset your phone. Seeking help from a phone service center is also recommended.

If you have been victimized, you can call the financial institution’s call center or the FSS call center to request a freeze on the relevant account and apply for damage relief.

An FSS official urged, "If you receive false payment or delivery text messages during holidays, do not click on URLs included in the messages or call the numbers; delete them immediately."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)