Demand for Overdraft Accounts Continues to Rise

FSS to Soon Consult Banks with High Loan Targets... Limit Reductions and Interest Rate Hikes Expected to Continue

[Asia Economy Reporter Wondara] Banks are consecutively lowering the limits on overdraft accounts and raising interest rates in response to the financial authorities' crackdown on 'debt investment'.

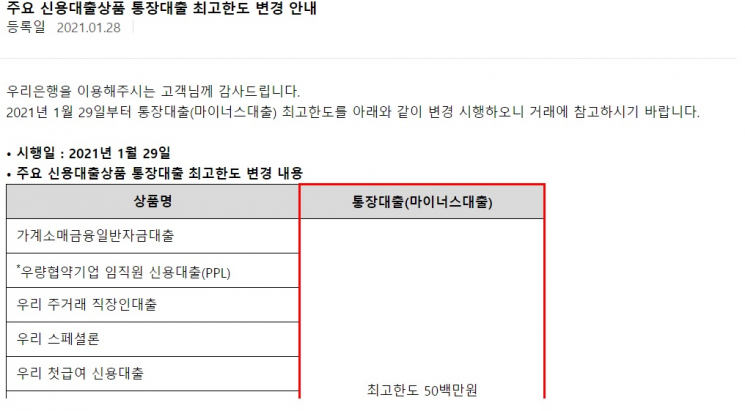

According to the financial sector on the 31st, Woori Bank significantly reduced the maximum limit of 10 overdraft loan products from 80 million to 100 million KRW to 50 million KRW on the 29th. Suhyup Bank completely stopped new overdraft loans for its 'Sh The Dream Credit Loan' product targeting office workers on the 22nd. On the same day, Kakao Bank lowered the maximum limit of overdraft loans and high-credit office worker credit loan products from 150 million KRW to 100 million KRW. Shinhan Bank also reduced the maximum limits by 50 million KRW for four credit loan products targeting office workers, including 'Elite Loan I & II' and 'Solpyeonhan Office Worker Loan S I & II', starting from the 15th.

Banks that have not lowered overdraft limits or stopped new subscriptions are raising loan interest rates. Hana Bank adjusted the product-specific discount rates applied to the Hana One Q Credit Loan (Prime) product for high-income, high-credit borrowers from the 28th, effectively raising the loan interest rate by 0.1 percentage points. K Bank raised the overdraft loan interest rate for office workers by 0.1 percentage points on the 28th, increasing the minimum interest rate to 3.0% per annum. Foreign banks are also showing changes in their loan interest rate management plans. Korea Citibank recently raised interest rates on major credit loan products by 0.01 to 0.06 percentage points.

Meanwhile, demand for overdraft accounts continues to increase. As of the 28th, the outstanding balance of credit loans at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?was 135.4099 trillion KRW, an increase of 1.7617 trillion KRW compared to the end of last year. From the 1st to the 28th of this month, a total of 43,143 new overdraft accounts were opened at the five major banks over 19 business days. While the daily number was around 1,000 at the end of last year, about 2,000 accounts have been opened daily this month.

The reduction of overdraft accounts and the increase in interest rates in the financial sector are expected to continue. On the 26th, the Financial Supervisory Service summoned deputy heads in charge of household loans from 17 commercial banks and advised them to 'reduce loan targets.' This was the second meeting following the one on the 11th. A Financial Supervisory Service official explained, "On the 11th, we received loan targets, and this meeting was to recommend banks with high loan growth targets to lower them based on our analysis." The official added, "We will soon hold separate consultations with banks that have high targets."

Meanwhile, according to the 'Weighted Average Interest Rates of Financial Institutions in December 2020' announced by the Bank of Korea on the 29th, the average household loan interest rate (based on new contracts) at banks last month was 2.79% per annum, up 0.07 percentage points from the previous month. This marks a four-month consecutive increase since the record low of 2.55% per annum in August last year. According to the Korea Federation of Banks, the average interest rate on credit loans extended to consumers with credit ratings of 1 to 2 by the five major banks?Shinhan, Kookmin, Hana, Woori, and Nonghyup?in December last year was 2.60% per annum. This is an increase of 0.33 percentage points from 2.27% per annum in August last year over about four months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)